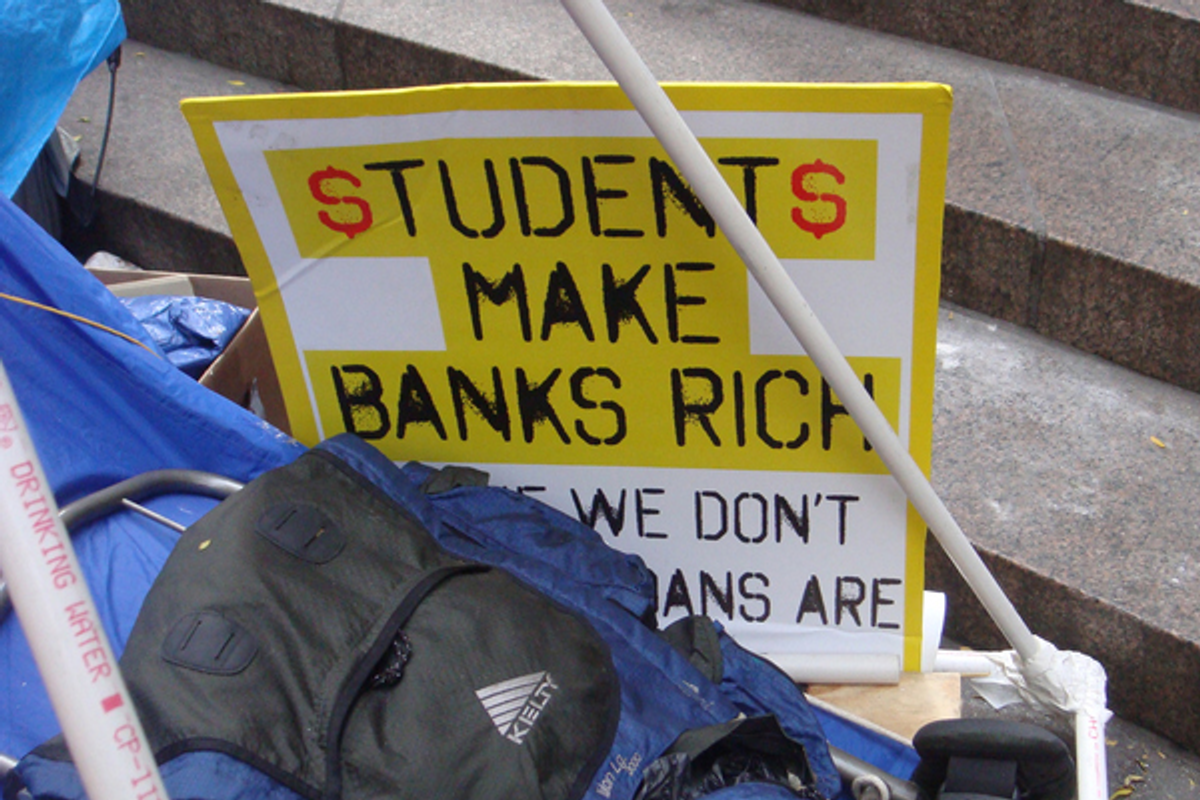

Underneath the now-iconic red sculpture at Liberty Plaza, now cleared of tents and ringed by barricades plastic-cuffed together, several “students” stood draped in fake chains over their caps and gowns, brandishing debt bills instead of diplomas.

They might have been performing, as part of a press conference unveiling a national student debt refusal pledge, but the dramatization of what happens upon graduation to many of America's students was spot-on. Despite a few moves by the Obama administration in past years and even recent months to lessen the burden of student loans, many graduates are still saddled with more debt than they can conceivably pay back and have little hope of finding a good job in the current economy.

They might have been performing, as part of a press conference unveiling a national student debt refusal pledge, but the dramatization of what happens upon graduation to many of America's students was spot-on. Despite a few moves by the Obama administration in past years and even recent months to lessen the burden of student loans, many graduates are still saddled with more debt than they can conceivably pay back and have little hope of finding a good job in the current economy.

Monday saw protests against tuition hikes on either end of the country; at New York's Baruch College of the City University of New York, the Board of Trustees voted for another tuition hike and according to reports, a student kicked off the day's actions by burning his Sallie Mae student loan bill. University of Californis, Davis, responding to the brutal pepper-spraying of students last week, also kept its focus on economic issues, chanting, "No cuts, no fees, education must be free," and reportedly shutting down the financial aid building.

The talk of debt refusal or debt strikes, as I reported just recently, has ratcheted up along with the momentum of the Occupy Wall Street movement, as the occupiers made the connection between Wall Street bankers and student debt -- right down to the bailouts, as student lenders received a bailout of their own from the federal government, which handed over billions in taxpayer dollars to the banks and lenders in exchange for loans that could no longer be sold on the secondary market.

Recent grads with mountains of debt know that without their tax dollars, these big lenders wouldn't continue to exist. They want their loans forgiven or at least written down, and they think the lenders should pay. The principles laid out on the OccupyStudentDebtCampaign site call for free tuition at public universities, an end to interest on student loans, and for private and for-profit institutions to open their books so that students know how their money is being spent.

As of 2010, the government directly lends up to $31,000 to students for their undergraduate years. Yet that total isn't even a year's tuition at many schools, let alone enough to cover living expenses and textbooks for four full years. As the economic crisis continues to stifle the economy and strangle state budgets, even public universities are seeing tuition hikes — the students pepper-sprayed at U.C. Davis were protesting a proposed hike in their tuition a full 81 percent in four years. So many students turn to private lenders to fill the gap between what the government will provide and what they realistically need to pay for school. Though those private lenders no longer get direct government subsidies, many of them still have billions on the books in federally subsidized debt, and even the private loans (often at variable interest rates, vulnerable to hikes when borrowers can least afford them) still have protections unlike almost any other type of debt, as student loans cannot be discharged in bankruptcy.

Jon Walker at FireDogLake described the now-defunct federally subsidized private lending system thus:

"The Federal Family Education Loan Program (FFEL) was a classic lemon socialism program. It provided a nearly total government guarantee for 'private' student loans. If the loans did well, the large financial companies got the profit, if they didn’t preform, the government socialized the loses. These broken incentives spurred risky behavior from the companies."

“Student loans are among the most lucrative you can make because the borrower has no protections and the creditor is afforded extraordinary powers,” noted Andrew Ross, New York University professor and labor expert, at the student debt press conference. Ross spoke, too, of the need for professors to work in solidarity with the students on this issue since their salaries are paid through the debt of their students.

“Our public universities, once the democratic gold standard worldwide, are increasingly and ruinously dependent on debt financing from the people they are supposed to serve,” he said.

So just who are the lenders profiting from the massive student debt load?

You already know some of the names: JPMorgan Chase, U.S Bank, Citi, Bank of America. Others are non-bank student lenders. What all of them have in common, though, is that their practices are shrouded in secrecy. A recent release from the Consumer Financial Protection Bureau, the brainchild of now-Senate candidate Elizabeth Warren, called for an investigation into the industry:

"It has been operating in the shadows for too long," Raj Date, the Treasury Department adviser who is running the Consumer Financial Protection Bureau, said in a release. "Shedding light on this industry will benefit students, lenders, and the market as a whole."

Here, we take a look at five of the lenders raking in the cash off the backs of the U.S.'s students.

1. Sallie Mae

The SLM Corp., better known as Sallie Mae (and originally called the Student Loan Marketing Association), is the largest student lender in the United States. It was created in 1972 as a government-sponsored enterprise, but fully privatized in 2004. It also services loans provided by the federal government, and holds, services and collects loans made under the now-discontinued Federal Family Education Loan Program (FFELP), the federally subsidized private lending program that was recently replaced with direct federal loans. These loans were, up until the end of the program, Sallie Mae's main source of income.

And just like in the mortgage market, Sallie Mae has been accused of making “subprime” loans to borrowers who will be attending for-profit or trade schools that have low graduation rates, making the loans a bad risk. Stephen Burd at the New America Foundation's Higher Ed Watch wrote in 2008, “Still, Sallie Mae won't overtly admit fault and poor management. Instead, the company and its promoters on Wall Street have been testing another explanation for its difficulties. An analyst with CreditSights Inc., in New York, recently tried it out when he told Bloomberg.com that the loan giant had been 'blind-sided' by the rising default and delinquency rates on the subprime private loans it had made to low-income and working-class students attending trade school of dubious quality.”

The last year that the FFELP existed, Sallie Mae held a frightening $154.1 billion in FFELP loans.

Like all of the student lenders, in 2008, Sallie Mae got what amounted to a sizable government bailout from the Ensuring Continued Access to Student Loans Act (ECASLA), which the Campaign for America's Future described in a report as one that “allowed lenders like Sallie Mae to sell loans back to the Department of Education through a number of loan-purchase programs.” On the strength of that government bailout, the company's profits surged to $324 million.

The CEO of Sallie Mae, Albert Lord, according to CAP “has reaped more than $225 million from the student loan business over the course of his career. In 2008, even as profits declined, Lord received $4.7 million in total compensation. He has used a portion of the proceeds to build himself a private golf course.”

Sallie Mae has spent millions lobbying against student loan reform, including lobbying the nonpartisan Congressional Budget Office, which made recommendations on the cost savings of the government's switch to direct lending. Over the last three campaign cycles (2012, 2010 and 2008) Sallie Mae's PAC has spent $1,583,557, favoring Democrats in '08 and '10 but so far this year favoring the GOP.

In 2010, when Citigroup decided to get out of the student loan business, Sallie Mae paid $1.2 billion for the rights to collect payments and service $28 billion in federally backed loans.

2. Wells Fargo

Wachovia and Wells Fargo were the third- and fourth-largest originators of federally subsidized private loans under FFELP in 2009, with $5.54 billion and $5.14 billion, respectively. After their merger, the resultant behemoth is the country's second-largest private student lender.

As we reported recently at AlterNet, Wells Fargo reported profits of $12.36 billion in 2010, and is No. 23 on the Fortune 500, just above Procter & Gamble. Headquartered in California, the bank has $1.26 trillion in assets and $93 billion in revenues. And, of course, it got $25 billion in TARP funds from the government and borrowed another $300 billion through the Federal Reserve during the financial crisis, which it helped create — Wells Fargo is the country's largest consumer lender and is the only one of the nation's big banks that offers payday advance loans, which it calls “Direct Deposit Advance” and has direct financial connections to six of the top seven payday lenders.

The company has faced allegations of racial bias in its mortgage lending processes, though there's no information about similar allegations of its student lending. Salon reported:

“Wells Fargo has a history of targeting vulnerable communities for risky financial products. At the height of the subprime lending mania in 2006, the bank was more likely to loan subprime mortgages to Latinos and African-Americans than whites, according to a September 2009 report by the Center for American Progress, a process known as “reverse red-lining.” For financially stable borrowers, the targeting was even starker: Middle-class blacks were four times more likely than middle-class whites to get a dangerous mortgage. Middle-class Latinos were nearly three times more likely.”

Wells Fargo is now offering a new fixed-rate private student loan, which would allow borrowers to lock in one rate for the life of their loan; however, the rates can be high — up to 14 percent for those attending community colleges or trade schools, or in other words, for lower-income borrowers.

In Minnesota recently, a group of Occupy-affiliated activists “mic-checked” Wells Fargo CEO John Stumpf, calling him out for his bank's foreclosure and student debt policies.

3. Discover

After buying the remains of Citi's Student Loan Corp., Discover Financial Services became the third-largest provider of private student loans. Best known for the Discover Card, of course, the company's website proclaims:

“The company operates the Discover card, America's cash rewards pioneer, and offers personal and student loans, online savings products, certificates of deposit and money market accounts through its Discover Bank subsidiary.”

According to Canadian Business magazine, of Discover's $52.51 billion in total loans (as of May 31, 2011) $4.57 billion was student loans, up from $820 million the previous year — which reflects the buyout of Citi's loans.

Harit Talwar, the company's vice president for US Cards, said of student lending at a conference in May, "We really like this business. In the U.S., as you know, education costs are increasing much faster than income. And therefore, students need funding for tuition fees."

Discover's PAC has spent $2,221,136 over the last three election cycles on candidates, mostly to Republicans.

4. NelNet

Based in Lincoln, Neb., NelNet was founded in 1978 as the UNIPAC Loan Service Corp. and renamed NelNet in 1996. It reported net income of $165.5 million for three quarters of 2011, and has net student loan assets of $24.6 billion. Its press release states:

“In September 2009, Nelnet began servicing student loans for the Department of Education (Department) under a contract that will increase the company's fee-based revenue as the servicing volume increases. At September 30, 2011, the company was servicing $44.6 billion of loans for 3 million borrowers on behalf of the Department, compared with $21.8 billion of loans for 2.5 million borrowers on September 30, 2010. Revenue from this contract increased to $12.8 million for the third quarter of 2011, up from $8.7 million for the same period a year ago.”

That's $12.8 million in a quarter for servicing federal loans.

The lender has been riddled with controversy; in 2006, Inside Higher Ed reported that NelNet had overcharged the government about a billion dollars. (They settled in 2010 for $55 million to resolve a whistle-blower lawsuit — which also targeted Sallie Mae.) And Higher Ed Watch reported in 2007, in a piece called “NelNet's Friend with Benefits”:

“Amidst revelations this spring of industry wide kickbacks, improper inducements, and gifts from student loan providers to colleges and universities, Nelnet quickly shut down a Nebraska investigation into its activities by agreeing to provide $1 million to the state in support of a national financial aid awareness campaign.

….

As we reported two weeks ago, seeking higher office in Nebraska with Nelnet's support can be a lucrative endeavor. Democratic Sen. Ben Nelson received almost $65,000 in the 2005-2006 election cycle alone from Nelnet and Union Bank executives and officials. This June, Nelson co-sponsored an amendment that would have sent $4 billion in financial aid earmarked for students instead to for-profit student loan companies like Nelnet. Nelson's amendment lost 61-36.”

NelNet's PAC has spent $398,731 on campaign donations since 2008, and it's spent $2,780,000 on lobbying since 2007; its lobbyists have included Clark Lytle Gelduldig & Cranford, the firm recently outed by Chris Hayes on MSNBC as doing opposition research on the Occupy Wall Street movement.

JPMorgan Chase

JPMorgan this year became the country's largest bank by asset size, surpassing the troubled Bank of America, and its private student loan division came into shape when it purchased Collegiate Funding Services in 2006, creating Chase Student Loans.

In 2009, Chase held $11.1 billion in FFELP loans, not a huge amount when you consider its $2.29 trillion in current assets. Still, the giant has been accused of some shady lending practices.

Back in 2007, NPR reported:

“The House Education and Labor Committee says it has evidence that JPMorgan Chase paid five student aid officials to do work for the bank while they were still on their school's payroll. JPMorgan Chase confirmed it did pay school officials to do work related to student loans, but the bank says it doesn't do that kind of thing anymore.

The company says it has also stopped throwing lavish parties for university officials, like the $70,000 cruise in New York Harbor that student aid officers enjoyed in 2005.”

JPMorgan Chase spends lavishly on campaigns and lobbying as well, dropping $5.8 million in just the last year on lobbyists and having given $109,750 to Mitt Romney, $79,150 to Virginia Sen. Mark Warner, $55,750 to Tennessee Sen. Bob Corker, and $37,439 to Barack Obama.

And just recently, the bank was pushed to reinstate a deferment program for active duty military servicepeople, after NBC News reported on a family that “received a letter alerting them the bank decided to end the program and would no longer allow active-duty troops to delay paying their student loans, even if they were away at war.”

Shares