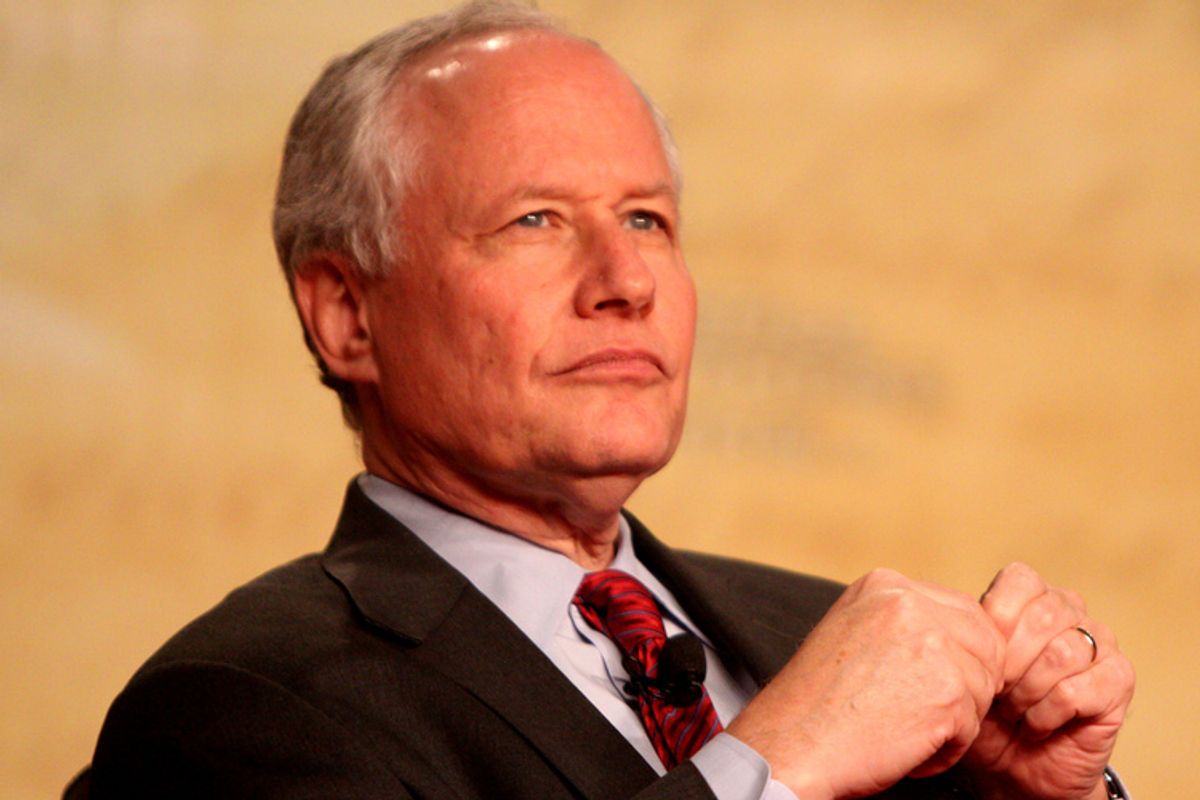

The biggest news on Sunday was Bill Kristol’s declaration on “Fox News Sunday” that Republicans should give in on President Obama’s demand that tax rates go up on income over $250,000 as part of any fiscal “cliff” deal.

“It won’t kill the country if we raise taxes a little bit on millionaires,” he said. “It really won’t, I don’t think. I don’t really understand why Republicans don’t take Obama’s offer.”

As Alex Seitz-Wald explained yesterday, this is a potentially huge development. For more than two decades now, the Republican Party has been absolutely, unanimously opposed to income tax hikes. This might just be Kristol speaking for Kristol and no one else, but if his words signal – or trigger – an actual shift within the party, the policy consequences will be serious. It could also set off an intraparty civil war.

To understand why, you need to understand the roots of the GOP’s intransigence on taxes. Believe it or not, it was fairly routine for Republicans to sign off on tax increases (or not to object to high rates already in place) until relatively recently. When Dwight Eisenhower was president, for instance, the top marginal rate was 90 percent, and at 70 percent through the Nixon and Ford years. It wasn’t until Ronald Reagan embraced the then-emerging supply-side school of thought that Republicans really declared war on taxes, with Reagan signing sweeping cuts into law in 1981. But even then, he and his party retained some flexibility, and over the rest of his tenure Reagan backed a number of tax increases.

The real turning point came 22 years ago, when George H.W. Bush found himself in an impossible situation. For most of his career, he’d embodied the GOP’s old attitude toward taxes, ridiculing Reagan’s supply-side theories as “voodoo economics” in the ’80 GOP primaries. But when he landed on Reagan’s ticket that fall, Bush changed his tune, then spent the next eight years as vice president trying to convince the increasingly conservative GOP base that he was a true believer. The “read my lips” anti-tax pledge in Bush’s 1988 convention acceptance speech was an assurance to this base.

But the country was facing massive deficits, the result of Reagan’s tax cuts and heavy defense spending, and President Bush quickly recognized the impracticality of his tax posture. So in 1990 he and the GOP’s top congressional leaders – Senate Minority Leader Bob Dole and House Minority Leader Bob Michel, neither a supply-sider at heart – cut a deal with Democrats that included a tax hike. Their assumption was that most Republicans on the Hill would go along; that’s how it had worked in the past, after all. Instead, the second-ranking House Republican, a bombastic Georgian named Newt Gingrich, decried the deal as a sellout of conservative principles and launched a rebellion. Other House conservatives rallied to Gingrich’s side, and so did what was just then becoming a powerful shaper of mass conservative opinion: talk radio.

The immediate result was to deliver Bush a humiliating defeat when the deal came to the House floor. The White House then gave more ground to Democrats and a recrafted version cleared both chambers a few weeks later. So Bush got his tax hike. But he did so with the vast majority of House Republicans, and about half of Senate Republicans, voting against him. Within the party, the episode radically enhanced Gingrich’s standing; within a few years, he nudged Michel aside to become the top House Republican. It also demonstrated the growing power of conservative talk radio to mobilize the GOP grass roots.

What’s more, the positive effect of Bush’s tax deal on the deficit wasn’t immediately apparent, with the early ‘90s recession sapping revenue. This freed Gingrich and his allies to claim it as proof that raising taxes hurts the economy and exacerbates deficits. When Bill Clinton took office in 1993 and proposed a tax hike on the wealthy to combat holdover Reagan-Bush deficits, not a single Republican in the House or Senate went along with him. They united in unanimous and often-overheated opposition, insisting that Clinton’s plan would crash the economy and explode the deficit.

By a two-vote margin in the House and with Al Gore’s tie-breaking vote in the Senate, Democrats managed to pass the Clinton budget anyway, and none of the doomsday GOP prophecies came to pass. In the first year after enactment, unemployment fell by a point and the deficit shrank. And by the end of the decade, joblessness was under 4 percent and the country was running surpluses. A booming economy combined with the revenue windfall yielded by the Bush and Clinton tax hikes had the national debt on course for total elimination.

Republicans never really grappled with this, though, choosing instead to revise history and claim that the election of a Republican Congress in 1994 and the enactment of a capital gains tax cut in 1997 were the reasons for the strong economy and shrinking deficits of the ‘90s. Thus have they held fast to their staunch anti-tax absolutism for the last 22 years. Grover Norquist, the premier enforcer of anti-tax orthodoxy within the party, never tires of pointing out that no Republican on Capitol Hill has voted for a tax increase since 1990.

You can see, then, the potential for the current fiscal standoff to get ugly for the GOP. If other influential voices and elected Republicans join Kristol in giving in on Obama’s tax hike insistence, it would almost invite a rebellion. The clout and relevance of conservative leaders like Norquist would depend on making those who cave pay a political price. Other conservatives looking to enhance their prominence in the party would have an opportunity to prove their “purity” by fighting the party establishment’s unconscionable deal with Obama. And what would be better for a media personality like Limbaugh than to rally his listeners against a sellout of conservatism?

Again, Kristol may only be speaking for himself here. And if there’s going to be major GOP movement on this front, it probably won’t come until much closer to Dec. 31. If they give in on taxes, Republicans will have to make their base believe they held out as long as they could. But even that might not be enough to prevent another GOP civil war on taxes.

Shares