Most of us agree that development that provides employment and tax revenue is good for cities. Some even argue that the need for jobs outweighs aesthetic, lifestyle, or climate concerns—in fact, this argument comes up any time Walmart proposes a new megastore near a small town. But a clear-eyed look at the spatial economics of land, jobs, and tax regimes should cause anyone to reject the anything-and-anywhere-goes development model. To explain, let me offer the story of an obsessive number cruncher who found his own urban laboratory quite by chance.

Joseph Minicozzi, a young architect raised in upstate New York, was on a cross-country motorcycle ride in 2001 when he got sidetracked in the Appalachian Mountains. He met a beautiful woman in a North Carolina roadside bar and was smitten by both that woman and the languid beauty of the Blue Ridge region. Now they share a bungalow with two dogs in the mountain town of Asheville.

Asheville is, in many ways, a typical midsize American city, which is to say that its downtown was virtually abandoned in the second half of the twentieth century. Dozens of elegant old structures were boarded up or encased in aluminum siding as highways and liberal development policies sucked people and commercial life into dispersal. The process continued until 1991, when Julian Price, the heir to a family insurance and broadcasting fortune, decided to pour everything he had into nursing that old downtown back to life. His company, Public Interest Projects, bought and renovated old buildings, leased street-front space out to small businesses, and rented or sold the lofts above to a new wave of residential pioneers. They coached, coddled, and sometimes bankrolled entrepreneurs who began to enliven the streets. First came a vegetarian restaurant, then a bookstore, a furniture store, and the now-legendary nightclub, the Orange Peel.

When Price died in 2001, the downtown was starting to show signs of life, but his successor, Pat Whelan, and his new recruit, Minicozzi, still had to battle the civic skeptics. Some city officials saw such little value in downtown land that they planned to plunk down a prison right in the middle of a terrain that was perfect for mixed-use redevelopment. The developers realized that if they wanted the city officials to support their vision, they needed to educate them—and that meant offering them hard numbers on the tax and job benefits of revitalizing downtown. The numbers they produced sparked a eureka moment among the city’s accountants because they insisted on taking a spatial systems approach, similar to the way farmers look at land they want to put into production. The question was simple: What is the production yield for every acre of land? On a farm, the answer might be in pounds of tomatoes. In the city, it’s about tax revenues and jobs.

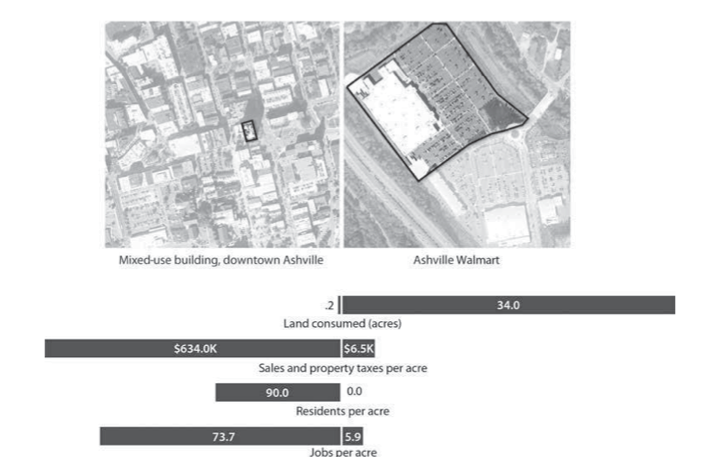

To explain, Minicozzi offered me his classic urban accounting smackdown, using two competing properties: On the one side is a downtown building his firm rescued—a six-story steel-framed 1923 classic once owned by JCPenney and converted into shops, offices, and condos. On the other side is a Walmart on the edge of town. The old Penney’s building sits on less than a quarter of an acre, while the Walmart and its parking lots occupy thirty-four acres. Adding up the property and sales tax paid on each piece of land, Minicozzi found that the Walmart contributed only $50,800 to the city in retail and property taxes for each acre it used, but the JCPenney building contributed a whopping $330,000 per acre in property tax alone. In other words, the city got more than seven times the return for every acre on downtown investments than it did when it broke new ground out on the city limits.

When Minicozzi looked at job density, the difference was even more vivid: the small businesses that occupied the old Penney’s building employed fourteen people, which doesn’t seem like many until you realize that this is actually seventy-four jobs per acre, compared with the fewer than six jobs per acre created on a sprawling Walmart site. (This is particularly dire given that on top of reducing jobs density in its host cities, Walmart depresses average wages as well.)

Minicozzi has since found the same spatial conditions in cities all over the United States. Even low-rise, mixed-use buildings of two or three stories—the kind you see on an old-style, small-town main street—bring in ten times the revenue per acre as that of an average big-box development. What’s stunning is that, thanks to the relationship between energy and distance, large-footprint sprawl development patterns can actually cost cities more to service than they give back in taxes. The result? Growth that produces deficits that simply cannot be overcome with new growth revenue.

In Sarasota County, Florida, for example, Minicozzi found that it would take about three times as long for the county to recoup the land and infrastructure costs involved in developing housing in a sprawl pattern as compared with downtown. If all went well, the county’s return on investment for sprawl housing would still be barely 4 percent.

“Cities and counties have essentially been taking tax revenues from downtowns and using them to subsidize development and services in sprawl,” Minicozzi told me. “This is like a farmer going out and dumping all his fertilizer on the weeds rather than on the tomatoes.”

The productive richness of the new Asheville approach becomes even clearer when you consider the geographic path taken by dollars spent at local businesses. Money spent at small and local businesses tends to stay in a community, producing more local jobs, while money spent at big national chains tends to get sucked out of the local economy. Local businesses tend to use local accountants, printers, lawyers, and advertisers, and their owners spend more of their profits in town. National retailers, on the other hand, tend to send such work back to regional or national hubs, and their profits to distant shareholders. Every $100 spent at a local business produces at least a third more local economic benefit and more than a third more local jobs. The arrival of a Walmart in any community has been shown to produce a blast radius of lower wages and higher poverty.

Price, Whelan, and Minicozzi helped convince the city of Asheville to fertilize that rich downtown soil. The city changed its zoning policies, allowing flexible uses for downtown buildings. It invested in livelier streetscapes and public events. It stopped forcing developers to build parking garages, which brought down the cost of both housing and business. It built its own user-pay garages, so the cost of parking was borne by the people who used it rather than by everyone else. All of this helped make it worthwhile for developers to risk their investment on restoring old buildings, producing new jobs and tax density for the city.

Retail sales in the resurgent downtown have exploded since 1991. So has the taxable value of downtown properties, which cost a fraction to service than sprawl lands. The reborn downtown has become the greatest supplier of tax revenue and affordable housing in the county—partly because it relieves people of the burden of commuting, and partly because it mixes high-end lofts with modest apartments. All of this, while growing what one local newspaper emotionally described as, “a downtown that—after decades of doubt and neglect—is once again the heart and soul of Asheville.”

By investing in downtowns rather than dispersal, cities can boost jobs and local tax revenues while spending less on far-flung infrastructure and services. In Asheville, North Carolina, Public Interest Projects found that a six- story mixed-use building produced more than thirteen times the tax revenue and twelve times the jobs per acre of land than the Walmart on the edge of town. (Walmart retail tax based in national average for Walmart stores.) (Scott Keck, with data from Joe Minicozzi / Public Interest Projects)

By paying attention to the relationship between land, distance, scale, and cash flow—in other words, by building more connected, complex places—the city regained its soul and its good health.

Excerpted from "Happy City: Transforming Our Lives Through Urban Design" by Charles Montgomery, published in November 2013 by Farrar, Straus and Giroux, LLC. Copyright © 2013 by Charles Montgomery. All rights reserved.

Shares