The Republican Party really does not want to talk about its tax cuts ahead of the midterm elections, despite vowing that the tax bill passed last year would be wildly successful.

Last year's Republican tax legislation gave 70 percent of its tax cuts to the top 20 percent of earners, according to the Center for Budget and Policy Priorities, and 34 percent to the top 1 percent. In September, House Republicans quietly passed another set of tax cuts that would overwhelmingly favor the rich and increase the deficit even further than the first bill, though that legislation is not expected to pass the Senate.

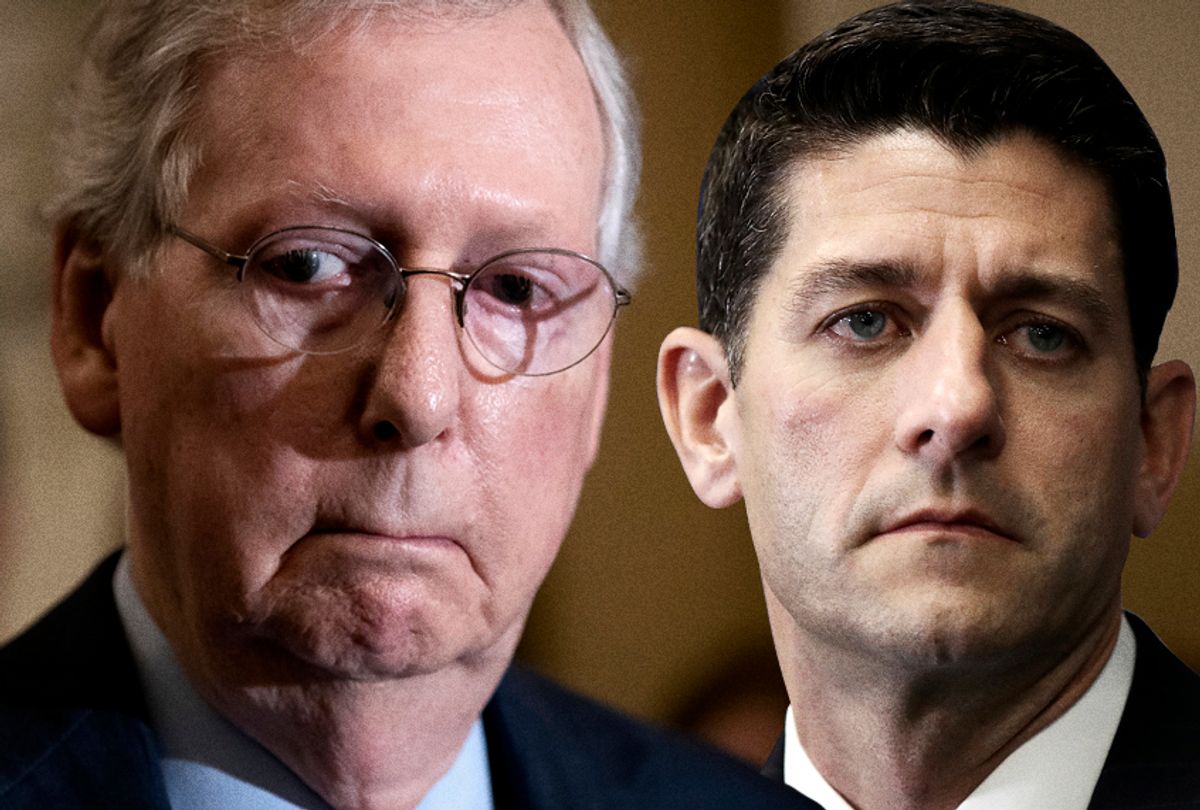

It's the biggest legislative win House Speaker Paul Ryan and President Donald Trump have had in the past two years, but you're not likely to hear about it on the campaign trail. Republican mentions of the tax cuts have plummeted as their own internal polling shows that 61 percent of Americans believe the tax cuts benefit the rich and large corporations over the middle class. More than 60 percent of Americans said the bill did not result in an increase in pay, and 51 percent said the cuts haven't helped them financially.

The Congressional Leadership Fund (CLF), the leading House Republican PAC aligned with Ryan, has mentioned the tax cut bill in just 17.3 percent of their ads this year, according to an analysis by Kantar Media’s CMAG, which tracks political advertising. By comparison, nearly 73 percent of their ads touted the tax cuts in February. That month, CLF head Corry Bliss told the New York Times it would be foolish for any candidate to talk about anything other than the tax cuts.

“For members or anybody else who cares about keeping control of Congress, if you find yourself talking about anything but the middle class tax cut, shut up and stop talking,” he said at the time. “Any time spent on TV talking about anything but how we’re helping the middle class is a waste of time and does nothing to help us win in 2018.”

Those predictions have not panned out. A RealClearPolitics analysis suggests that an average of just 39 percent approve of the tax legislation.

The widespread unpopularity of the GOP's supposed central achievement was on full display in the special election last year in Pennsylvania's 18th congressional district, where Democrat Conor Lamb narrowly defeated Republican Rick Saccone.

In early February, a month before the election, two-thirds of ads backing Saccone mentioned the tax cuts, Politico reported. By late February, that number had fallen to 14 percent. By early March, days before the election, mentions of the tax cuts had virtually disappeared.

Not only are the tax cuts unpopular, but Senate Majority Leader Mitch McConnell has recently suggested making cuts to popular government programs, largely in order to pay down the enormous deficit created by the GOP tax bill. McConnell told Newsweek that the deficit growth has been “very disturbing” but said it was being driven by the "three big entitlement programs that are very popular” – referring to Social Security, Medicare, and Medicaid.

Democrats quickly moved to capitalize on the unpopular tax cuts and the threat of McConnell's remarks.

“There’s a whole new level of clear and present danger for these programs,” Democratic Congressional Campaign Committee spokesman Tyler Law told Vox. “People are rightfully scared, and that’s resonating. In poll after poll, district by district, voters respond very strongly to a message that takes the tax bill head-on as a handout to the wealthy and large corporations that will lead to deep cuts to Social Security and Medicare.”

Shares