"We ensure our ongoing access to the secondary mortgage market by consistently producing quality mortgages... We make significant investments in personnel and technology to ensure the quality of our mortgage loan production." (From Countrywide's 2005 Form 10-K)

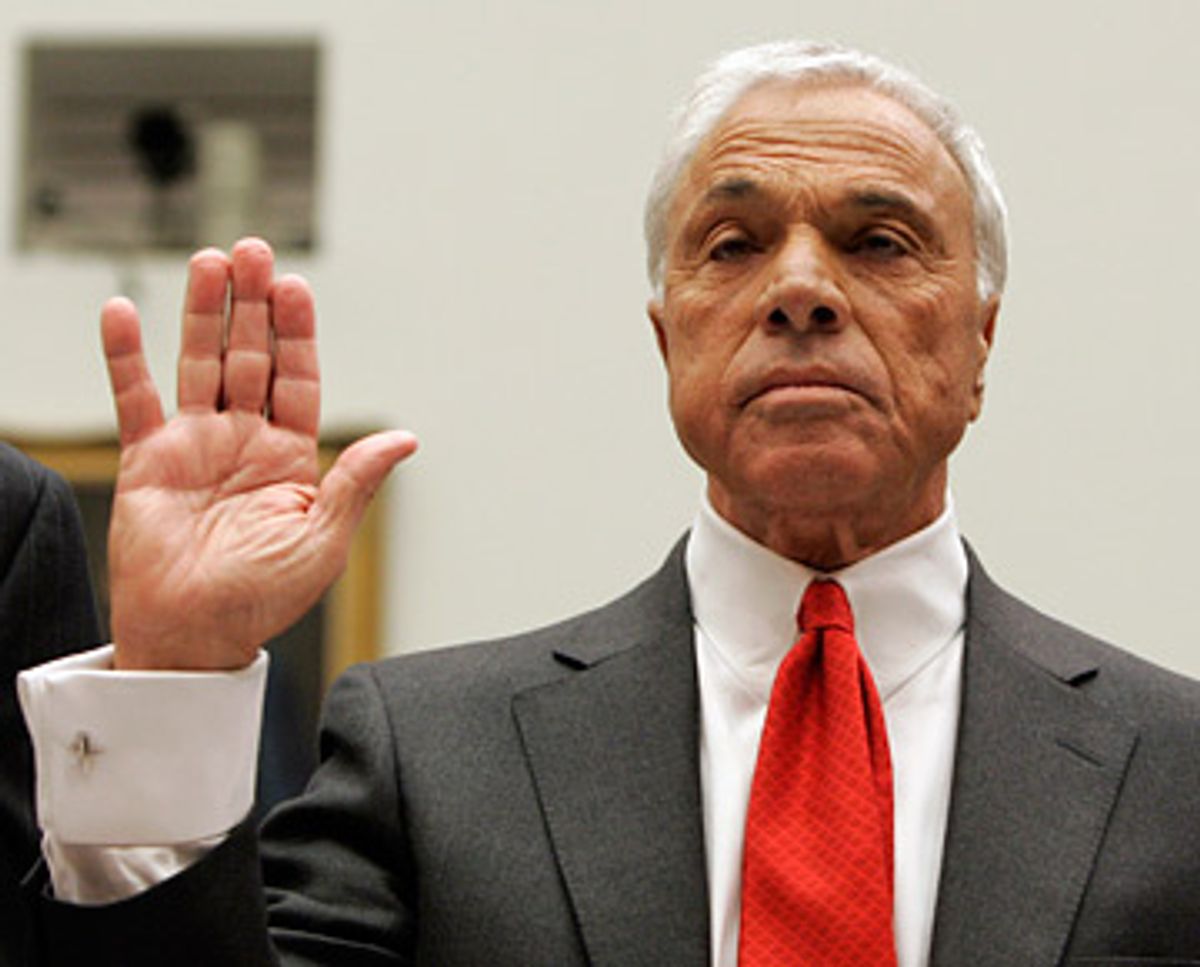

Poor Angelo Mozilo. The "left-wing anti-business press" that the former CEO of Countrywide once blamed for making too much of a fuss about his excessive compensation is about to have another field day. On Thursday, the Securities and Exchange Commission formally accused him of fraud; specifically, of misrepresenting the kind of mortgage loans his company made as the housing boom began to lose steam.

At first glance, the SEC's case appears damning. As early as September 2004, Mozilo and two other top Countrywide executives were aware that the company was making increasingly risky loans. Indeed, the impression one gets of Mozilo from the SEC's complaint is that the CEO knew exactly how crappy the loans Countrywide made were. At one point, he called Countrywide's "80/20" loans (in which one loan is made for the first 80 percent of the purchase and then a second "piggyback" loan for the remaining 20 percent) the most "toxic product" he had ever seen in his years in the business. Mozilo was also appalled at the spread of "Pay-Option adjustable rate mortgages" that allowed borrowers to make minimum payments that didn't even cover accruing interest. He sent numerous e-mails to other executives warning that default rates were sure to balloon on these mortgage products, and tried to stop Countrywide from even offering them.

He also knew that it would get harder and harder to pool these loans and sell them as securities to Wall Street investors, and worried that if the real estate market took a dive, Countrywide would face major liquidity issues. (He was right!)

All this makes sense. As CEO of the biggest mortgage lender in the country and a man with decades of experience in the industry, Mozilo had a better vantage point than just about anyone to see what was happening in the mortgage business. But armed with that knowledge, what did he and his fellow executives do? They told investors and the general public that nothing was wrong. Mere days after railing about the danger of Pay-Option ARMS, Mozilo gave a speech at a conference extolling their value. In documents filed with the SEC in 2005, 2006, 2007, Countrywide asserted that it was different from its competitors because of the high quality of its loans. In other words, Mozilo lied through his teeth, time and again, and the SEC has him to dead to rights.

From 2005 through 2007, Mozilo, along with David Sambol, chief operating officer and president, and Eric Sieracki, chief financial officer, held Countrywide out as primarily a maker of prime quality mortgage loans, qualitatively different from competitors who engaged primarily in riskier lending. To support this false characterization, Mozilo, Sieracki, and Sambol hid from investors that Countrywide, in an effort to increase market share, engaged in an unprecedented expansion of its underwriting guidelines from 2005 and into 2007. Specifically, Countrywide developed what was referred to as a "supermarket" strategy, where it attempted to offer any product that was offered by any competitor. By the end of 2006, Countrywide's underwriting guidelines were as wide as they had ever been, and Countrywide was writing riskier and riskier loans. Even these expansive underwriting guidelines were not sufficient to support Countrywide's desired growth, so Countrywide wrote an increasing number of loans as "exceptions" that failed to meet its already wide underwriting guidelines even though exception loans had a higher rate of default.

The obvious question to ask here is why would anyone engage in such wilfully self-destructive behavior? But there's an equally obvious answer. Money. Because even as Mozilo was extolling how great Countrywide's loans were --- an assertion he didn't believe for a second -- he was at the same time scrambling to sell shares in Countrywide that generated hundreds of millions of dollars. It's a classic case of insider trading -- he was in possession of material knowledge that Countrywide was headed for disaster, and he got what he could while the going was good.

Mozilo should, of course, be prosecuted for anything misleading he said to the general public, perhaps even including his notorious statement in March 2007 that the housing bust "will be great for Countrywide at the end of the day because all the irrational competitors will be gone." But there are other implications to consider here.

First: Countrywide's example makes a mockery of the idea that government pressure to expand low-income and minority housing can be blamed for the housing boom and bust. Countrywide watered down its underwriting guidelines and gave mortgage loans to anyone who could sign a piece of paper for one reason, and one reason only -- to generate revenue. Private competitors with ever lower underwriting standards threatened to take market share away from Countrywide, so Countrywide matched their standards in a race to the bottom. Countrywide needed to keep its market share and volume high, because it had come to depend on the revenue from reselling the repackaged loans into the secondary market. In 1006 alone, it made half a billion dollars from such sales. (In 2007, that number fell to $14.9 million!)

Growing market share kept Countrywide's stock price high. Wall Street's appetite for securitized mortgage products meant it could unload whatever bad loans it had made as fast as it could repackage them. Government mandates to increase homeownership hardly appear to be a significant factor in Countrywide's sage of greed and stupidity.

Second: The focus on Mozilo's misdeeds makes him into something of a scapegoat for the entire subprime mortgage crisis. I'm not saying he doesn't deserve that honor: Countrywide was the biggest mortgage lender in the United States, and as such, did more than its fair share in propelling the global economy to its doom.

But he was hardly the only guilty party in that scheme! Shall we start naming names? Who else's head deserves to go on the block?

(NOTE: This post was substantially revised and updated about an hour after its initial publication.)

Shares