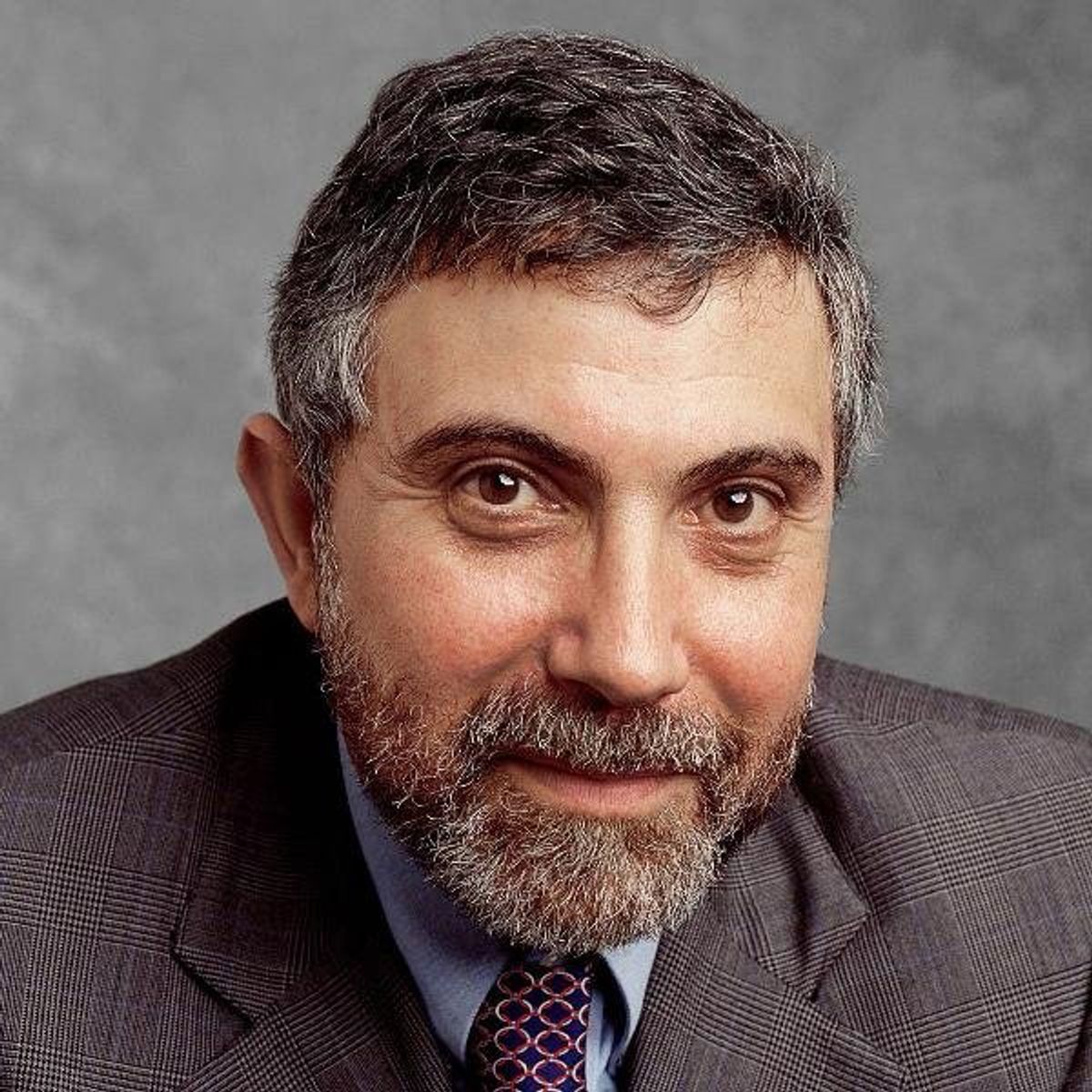

It's not every day you see two writers employed by the same paper going at each other hammer and tongs, especially when that publication is The New York Times. But op/ed columnist Paul Krugman is not one to idly stand by when he feels his honor has been impugned, and business writer Andrew Ross Sorkin doesn't seem to know when it's time to just fold your cards and leave the table, so it's possible that the fireworks are only just beginning to heat up. If nothing else, it's got to be great for traffic!

Sorkin, the boy-wonder who dazzled the publishing world with his bathroom-break-by-bathroom-break account of the financial crisis, "Too Big To Fail," touched things off by asserting in a column on Tuesday that Krugman and economist Nouriel Roubini had both "declared that we should follow the example of the Swedes by nationalizing the entire banking system. "

Italics mine.

Krugman immediately sent Sorkin a white glove and offered him his choice of weapons for a duel in front of the New York Stock Exchange. No wait, that's wrong. He demanded an apology in his blog. "I certainly never said anything like that," he wrote.

I wanted the government to take temporary full ownership of a few weak banks, mainly Citigroup and possibly B of A. I defy Sorkin to find any examples of me calling for a total takeover.

At seven p.m. in the evening, Eastern time, Sorkin responded. He accepted Krugman's offer of a duel, with shoulder-mounted Stinger missile launchers as his weapon of choice. No, wait, that's wrong, too. He cited two columns, one by Roubini, and one by Krugman, that he says provided proof that the two economists had "declared that we should follow the example of the Swedes by nationalizing the entire banking system. "

Italics mine.

Now, I'm pretty sure Krugman doesn't need my help in a duel-to-the-death, but I went and read the full text of both columns Sorkin linked to. And in both cases the authors make it explicitly clear that when they say "nationalization" they are talking about temporarily putting only specific insolvent banks into receivership. Sure, you can cherry pick a sentence from the lead paragraph and ignore the lengthy explication that comes afterward, but excuse me for my naive impertinence: I expect better from a New York Times reporter.

Krugman:

How would nationalization take place? All the administration has to do is take its own planned "stress test" for major banks seriously, and not hide the results when a bank fails the test, making a takeover necessary. Yes, the whole thing would have a Claude Rains feel to it, as a government that has been propping up banks for months declares itself shocked, shocked at the miserable state of their balance sheets. But that's O.K.

And once again, long-term government ownership isn't the goal: like the small banks seized by the F.D.I.C. every week, major banks would be returned to private control as soon as possible. The finance blog Calculated Risk suggests that instead of calling the process nationalization, we should call it "preprivatization."

It is of course true that Krugman advocated a more forceful approach to the banking system than that ultimately chosen by the White House. History has yet to rule on whether the Obama administration will get away with the path of least aggressiveness. It would not have taken much rewriting of Sorkin's original column to make his same point. But Sorkin was sloppy, and made a factually incorrect claim that Krugman had recommended "nationalizing the entire banking system."

Hey, no big deal. People make mistakes like that all the time. But when called on it, proper form demands that you admit what you got wrong. The classic formulation for this might be something along the lines of "My statement that Krugman demanded the complete nationalization of every bank in the United States was inartful, but my main point still holds."

Instead, Sorkin dug in and cited evidence that proved his opponent's point. And careless sloppiness suddenly becomes willful disingenuousness.

Shares