Federal bankruptcy court, stage for the quotidian tragedies of personal debt and commerce, is the last place anyone would expect to turn for a head-spinning legal yarn, and even less for the verdict on a national political scandal. But sometime in the next few weeks, a Richmond, Va., bankruptcy court will be the stage for both, when Judge Douglas O. Tice Jr. calls the case of Kathleen Schwicker.

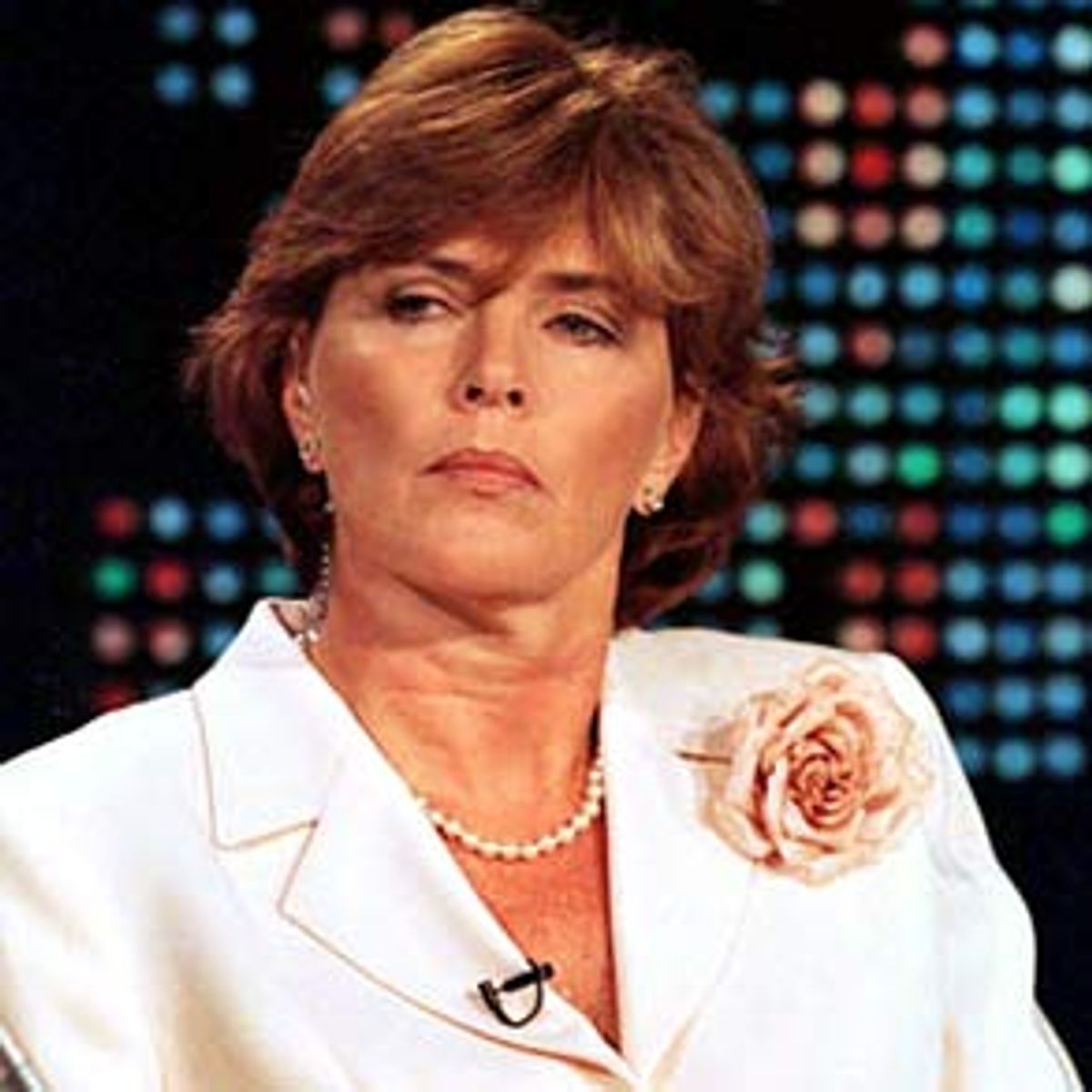

Kathleen who? Until her recent remarriage, Kathleen Schwicker was Kathleen Willey. Almost two years ago, Willey went on "60 Minutes" to accuse President Clinton of unwanted sexual advances in the Oval Office, followed up by dark, never-confirmed tales of threats and intimidation by presidential operatives. Willey has remarried, changed her name and relocated to Ramrod Key, Fla. Now her bankruptcy appears to be one more effort at a new start, at leaving behind an overwrought period of life beginning with her husband Ed Willey's 1993 suicide and culminating in her 1998 grand jury testimony for Independent Counsel Kenneth Starr.

But coming the same week that former Starr spokesman Charles Bakaly faces contempt-of-court charges, Willey's bankruptcy case raises more questions about the probity of Starr's investigation. The facts revealed in Willey's bankruptcy filing and other documents obtained by Salon also raise questions about her past and character, and Starr's decision to grant her sweeping immunity as a central strategy in his inquiry.

Willey claims she is virtually destitute. Her bankruptcy petition, filed in April, declares she has just $50 in her checking account, $2,000 worth of jewelry and $3,700 worth of household furniture. Her Subaru Outback, worth $13,000, has been claimed by her lawyers as collateral for unpaid bills.

In fact, Willey is far from destitute. She has been living in comfort in a suburban home, on a budget of thousands of dollars a month. Court records and other documents obtained by Salon suggest that in 1997 and 1998, at the very time she was going public with her accusations of genital groping by President Clinton several years before, Willey was at the center of a complicated series of asset transfers that appear to have been designed to insulate her money and property from the scrutiny of courts and creditors -- and claiming under oath in Virginia that she could not remember basic personal matters from just weeks earlier.

It is a noteworthy tale of legal intrigue: In declaring bankruptcy, Willey claimed personal debts of over $700,000. But financial records suggest that at least two-thirds of that "debt" consists of Willey's own assets, shifted on paper to her children while she has continued to reap the benefits. At the heart of this complicated financial maneuver, records suggest, is the manipulation of a $160,000 loan to create the appearance of a debt.

The road to Tuesday's bankruptcy hearing goes back to 1991 -- long before Kathleen Willey emerged as a White House volunteer with a tale to tell. It begins not with a presidential grope but with financial transactions by her now-deceased husband, Ed Willey Jr.

To understand Willey's predicament, it helps to understand her husband. Ed Willey Jr. was a Richmond attorney and investor in local real estate deals. He was the son of the speaker of Virginia's Assembly -- and so in theory, born to the state's political aristocracy. In fact he was the Willey clan's black sheep. Sometime around 1970 -- according to Kathleen Willey's own account in her application for a volunteer position at the White House -- Ed Jr. was charged with manslaughter in an auto accident, though the charges were later dropped. His taste for fast money further alienated Willey from his father.

When Ed Jr. married Kathy in 1971, their joint dedication to ostentation -- the condo in Vail, the Rolex watches and jewelry -- did nothing to dispel that reputation, though many in Richmond still find it convenient to blame outsider Kathy for driving her husband's greed quotient into the stratosphere. Whatever the truth, by the early 1990s Ed Willey Jr. was beginning a long slide into debt, ultimately owing the IRS alone $325,000.

In August 1991, Ed Willey turned to a longtime friend for help: Richmond developer, architect and political activist Louis Salomonsky. Salomonsky was Gov. Douglas Wilder's personal financial trustee and a successful player in local real estate projects that sometimes ended in scandal and indictments; though Salomonsky was named in at least one indictment, he was never charged himself.

Salomonsky agreed to lend the Willeys $160,000, according to court transcripts and Willey financial records obtained by Salon. The Willeys secured the loan with collateral: their suburban home worth over $200,000, part of a real estate partnership and their life insurance policy of over $1 million.

And in a final gesture, Salomonsky secured a promise of repayment not just from the Willeys themselves but from a company called "Planning and Zoning," which Ed had set up as a protective front for his real estate investments -- a company technically owned by his adult children.

This is a lot of collateral for a $160,000 loan -- but given the Willeys' life on the financial edge, any of their assets might evaporate at any time, so Salomonsky was evidently hedging his bets.

A few months later, despite the Willeys' precarious financial condition, they managed to contribute $10,000 to presidential candidate Bill Clinton; they met Clinton during a campaign swing through Richmond, where he received a congratulatory kiss from Kathy which her husband reportedly bragged about for weeks.

Within a few months of the presidential election, though, the euphoria was evaporating. Ed Willey was behaving like panic-stricken Ray Liotta at the end of Goodfellas -- the financial noose drawing as close and fast as Liotta's FBI pursuers. By March 1993, Kathy Willey sought refuge two hours northward, in a volunteer job in the White House counsel's office. In her White House application, obtained by Salon, she repeatedly describes legally troubled Ed Willey Jr. as her "former husband," though she was still married at the time.

On October 15, Ed Willey went to Kathy with a confession: He had illicitly "borrowed" $200,000 from the escrow account of two clients, a brother and sister named Anthony Lanasa and Josie Abbott. Caught with both hands in the cookie jar, Ed had promised to repay the money in a matter of weeks if they would avoid reporting him to the state bar committee -- but he needed Kathy's signature on the contract. Reluctantly, she signed.

On Nov. 29, 1993 -- the same day Willey later said she was groped by President Clinton when she went to seek his advice -- Ed Willey shot himself.

Suddenly, all of the Willeys' long-simmering financial crises boiled over. Kathy's name was on that contract with her husband's embezzlement victims. Legally, the aggrieved brother and sister were poised to take Kathy's house, to attach that life insurance policy and, perhaps, to secure far more of her assets as damages in a lawsuit. Kathy, who had arranged to sell her home and already had her eye on another in one of Richmond's up-market suburbs, was instead in danger of losing every dime.

Rescue came from Ed Willey's old friend Lou Salomonsky. Salomonsky and another politically connected Richmond attorney, Daniel Gecker, moved with astonishing speed to protect the Willey family's remaining assets from both the Lanasa-Abbott lawsuit and the IRS. Salomonsky declines to comment on the Willey bankruptcy, saying only that "I was a protector of the children, after their father's death, and of her."

First, Salomonsky transferred the $160,000 note on the loan Ed and Kathy had arranged in 1991 to the Willey's two college-age children, or rather, to "Planning and Zoning," the family company with their names on it. On paper, Kathy Willey now owed the money to her children rather than Salomonsky. The children -- with Salomonsky as their business agent and Gecker as the attorney for every party involved -- moved to "collect" on the debt by foreclosing on their own mother's house, a transaction completed in 1996.

Salomonsky's own real estate company bought the house at foreclosure and promptly sold it. The Willey children bought the new home Kathleen had been eyeing, and in 1997 began renting it to her for $450 per month -- a laughably low rent in affluent Midlothian.

And then there was Ed Willey's life insurance -- more than $1 million worth, with Kathy designated the beneficiary for half of it. But Kathy refused her portion -- ensuring that whole payoff would go to her children. The children began "loaning" their mother living expenses out of the insurance proceeds she had turned over to them.

The upshot: Kathy Willey received $200,000 cash from her children in the last five years according to her bankruptcy petition, not to mention tens of thousands of dollars worth of subsidized housing. Those loans alone make up one-third of the debts listed on her bankruptcy application. And in Virginia, at least, it's all perfectly legal.

Lanasa and Abbott, outraged, sued Kathy Willey and Ed's estate in 1994 for "wrongfully converting" the life insurance funds, but the Virginia Supreme Court could find nothing in the state's laws to forbid it.

Another key part of the deal, however, remains very much subject to debate. To better understand Lanasa and Abbott's anger, recall that the Willey children salvaged their mother's assets through their acquisition of Louis Salomonsky's $160,000 note, which in turn entitled them to foreclose on their mother's house.

Yet according to Willey family insurance records obtained by Salon, by the time of the foreclosure, Kathy's $160,000 note to Salomonsky no longer existed. In January 1994, weeks after Ed Willey's suicide, Salomonsky had been paid off in full by Ed's life insurance. Indeed, on December 29, 1994, Salomonsky wrote to the Equitable Life Insurance Company citing his 1991 agreement with Ed and Kathy, demanding that he receive "all net proceeds" of Ed's policy; after he was paid his $160,000 plus more than $40,000 interest, the remainder could be turned over to the Willeys.

On January 25, 1994, Equitable cut a check to Salomonsky for $204,063. The foreclosure of Willey's house, in other words, was based on a debt which had, in fact, been paid off months before.

Was the foreclosure legal? That depends on whom you ask. Kathy Willey's attorney Ed Gecker replies with a polite "no comment" when asked about the transaction. Privately, say sources close to the case, he defends the arrangement by saying that since Salomonsky was repaid out of life insurance the Willey children would otherwise have gotten, they had the legal right to pursue the lost funds against their mother.

Joseph Koestner, a Richmond attorney who represented Lanasa and Abbot until they dropped their case out of sheer frustration, called it "a scam" in a 1997 court hearing in which -- without access to insurance records showing the debt to Salomonsky had been paid -- he was trying to establish a money trail. "If that $160,000 wasn't owed, then that $160,000 ... went someplace, and I want to know where it went," he said.

Today, Koestner still believes his former clients were victims of "an elaborate shell game." The Willey-Salomonsky transactions, he says, were designed only to conceal Willey's assets from his clients without diminishing her benefit from them -- as the housing subsidy and open-ended loans from her children indicate. "The children's interests were not diminished at all when that note was paid back," he says.

Just how active a player was Kathy Willey in these maneuvers? In court, she pled ignorance of the most routine financial matters. In fact, around the same time she was appearing on "60 Minutes" and before Ken Starr's grand jury to detail purported incidents that had occurred four years earlier, in Virginia legal proceedings Willey was pleading ignorance of vastly more recent personal matters.

Asked by Koestner in that 1997 hearing whether she was at that time in debt, she responded, "I don't know." When did she sign papers transferring the $160,000 note? "I don't remember." Did she know why the note was transferred? "No." How much had she borrowed from her children? The Virginia judicial officer reigning over the hearing finally grew so exasperated that he threatened her with contempt: "It waxes extremely strange to me, ma'am, that you cannot answer a question about whether you owe $160,000 or are owed $160,000."

Whether or not the scheme was technically legal, in any event, it is profoundly revealing of the atmosphere of evasiveness and deceit surrounding Kathy Willey by 1997, when tales of her encounter in the Oval Office first led her to be subpoenaed by Paula Jones' lawyers. Indeed, she was pleading poor memory about her massive debt during the very period that her story of being groped by Clinton was floating into public view through Newsweek's Michael Isikoff and the Jones lawyers.

What does Willey's active, years-long evasion of this massive debt -- even if falling on the safe side of the legal line, as Gecker asserts -- say about her motivations in going public with the Clinton story? According to an FBI interview with attorney Gecker during the independent counsel's negotiations over Willey's immunity, he and his client decided that the best solution to her financial problems might be a big book deal.

Gecker, says the FBI interview, "did recall thinking that if [O.J. Simpson girlfriend] Paula Barbieri could get millions for writing a book, it might be in my client's best interest to consider a book deal, especially since she currently has a judgement against her for almost $300,000."

If the inside narrative of Kathleen Willey's bankruptcy raises fresh questions about her credibility, it also begs renewed scrutiny of the standards and methods by which Starr sought to make his case against Clinton. On April 24, 1998, the FBI interviewed Gecker at length in his Richmond office. He described several smaller-scale "deceptions" by his client, and then provided detailed records of the Lanasa-Abbott case and the Willey camp's convoluted financial transactions.

Weeks later Starr granted Willey rare transactional immunity, despite the extraordinary trail of financial manipulation, most of it already in the independent counsel's hands, according to FBI records prior to the immunity agreement. And Starr ignored this same record in prosecuting (but failing to convict) Willey's former friend Julie Hiatt Steele for refusing to back up Willey's sexual-harassment story.

When historians evaluate the Clinton scandals still playing out this week, the questions raised in Kathleen Willey's bankruptcy should form a crucial part of the picture. The crisis leading to Clinton' impeachment was powered not just by Starr's "right-wing conspiracy," but through the independent counsel's collusion with such troubled individuals as Willey, whom Clinton repeatedly invited into his orbit. Like that even more central player, Monica Lewinsky, Willey was a questionable character of dubious qualifications, gaining access to the president only through the corrupting power of campaign contributions. (Lewinsky, recall, gained her White House internship thanks to the political connections and contributions of her mother's boyfriend.) Did Starr's team overlook Willey's hopelessly clouded record, or was it deliberately obfuscated?

Koestner, former attorney for Lanasa and Abbot, says he was never even contacted by Starr or the FBI. "When those people did not even call me," he says, "it demonstrated to me that Ken Starr was a joke." Willey may get financial absolution in Richmond's bankruptcy court this week, but historical absolution for Starr is rendered more unlikely by her case.

Shares