Pomp and circumstance ruled at the signing into law of the Telecommunications Act of 1996. Held inside the rotunda of the Library of Congress, a bill-signing first, the ceremony featured an array of bipartisan legislators praising the comprehensive package. Newly appointed Speaker of the House Newt Gingrich heralded the act as a jobs and knowledge bill. Vice President Al Gore stressed how public interest was central to the telecommunications revolution.

After speaking by videoconference with students at Calvin Coolidge High School in Washington, Gore watched as President Clinton signed the bill using the same pen President Eisenhower did in 1957 to sign the bill that created the interstate highway system, which had been written by ex-Sen. Gore, D-Tenn., the vice president's father. Clinton then used a digital pen to sign an electronic copy to be posted on the Internet.

In his remarks that day Clinton boasted that the "landmark legislation fulfills my administration's promise to reform our telecommunications laws in a manner that leads to competition and private investment, promotes universal service and provides for flexible government regulation."

Five years later nobody doubts that the law was indeed a landmark -- not only because congressional efforts to update the country's vast communications industries for the first time since the 1930s had themselves dragged on through the '80s and well into the '90s but also because the Telecom Act, as it became known, unleashed unprecedented deregulation and media consolidation, among the most pronounced in American history.

Nowhere has that consolidation been more acutely felt than in radio -- where just two companies, Clear Channel and Infinity, now dominate the nation's commercial radio stations. The result, many longtime radio industry observers feel, has been the degradation of commercial radio as a creative, independent medium.

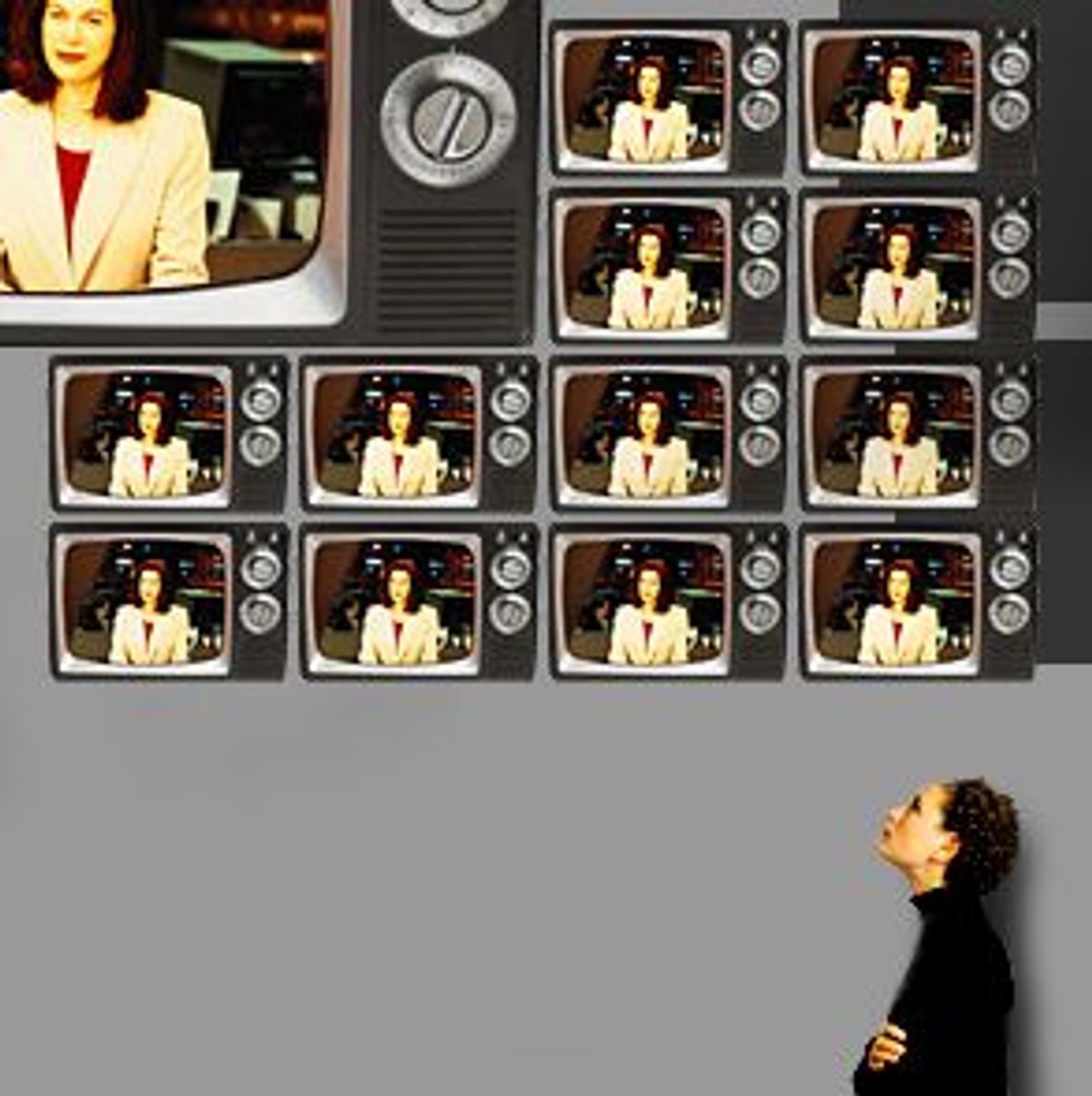

But Clear Channel and Infinity are also raking in the cash. So now the question is, who's next? Because just across the broadcast spectrum, big owners in the television industry are looking at what happened to radio and licking their lips. If they get their way, the same thing that happened to radio may well happen to TV: more consolidation, more homogenization and, of course, more profits for the few at the top.

In late 1995, when the Telecom Act was being assembled, it was most often portrayed by its backers as a way to allow Baby Bell phone companies to get into the long-distance business, promote competition, introduce the V-chip to parents, police Internet porn and deregulate cable rates. Indeed, the Telecom Act's laundry list of initiatives covered nearly 200 pages of legislation. Down toward the bottom of that list, though, was a provision, one that received very little public attention (Clinton never even mentioned it during his extended remarks at the bill signing), that lifted all ownership limits for radio station broadcasters nationwide -- and allowed them to operate as many as eight signals in the country's largest markets.

To describe the new law's sweeping implications for radio as "radical" would be an understatement. Prior to this law, tightly regulated broadcasters could own just 40 stations nationally, and only two in a given market. Years earlier, those limits had been relaxed, very cautiously, by the Federal Communications Commission. But suddenly, without the FCC's input or any public hearings, the kind of sweeping deregulation that most broadcasters hadn't even fantasized about two years earlier was ushered in overnight.

"We were watching the vote come down in a hotel room in '95 and we were high-fiving each other," recalls the former head of a major radio group, who requested anonymity. "We knew the multiple-station deals we'd been working on would come to fruition."

Over at Jacor Communications, billionaire investor Sam Zell, who got into the radio business in the early '90s with an eye on the coming consolidation, was pounding on the desk of his CEO, Randy Michaels, telling him to start buying stations immediately.

Michaels did. And so did lots of other deep-pocketed investors. Since the passage of the Telecom Act, 10,000 radio station transactions worth approximately $100 billion have taken place, according to BIA Financial Network. Consequently, there are 1,100 fewer station owners in the business today, down nearly 30 percent since 1996. The largest operator, Clear Channel Communications (whose radio chief is Michaels), owns nearly 1,200 stations. (According to this consolidation chart, Clear Channel today consists of what were once 70 separate broadcast companies.)

In theory, the Telecom Act was supposed to allow scores of aggressive radio companies to acquire a couple of hundred stations each and cash in on efficiencies of scale. And that did happen within months of the act's signing. But it didn't stop there. Spurred on by a flood of Wall Street investment money, a handful of conglomerates simply kept acquiring until they had essentially carved up the dial.

"Some of the mega-mergers took my breath away," says Susan Ness, who became an FCC commissioner in 1994 and left her post this spring. "You have a situation today where two companies basically control the major markets."

Those two companies -- Clear Channel and Viacom's Infinity Broadcasting -- together control one-third of all radio advertising revenue; in some individual markets their stations command nearly 90 percent of the ad dollars.

Today, radio is a much more lucrative, successful business than it was before the Telecom Act (thanks in part to an unprecedented number of commercials jammed into each hour). So from a purely economic perspective, there has been some benefit from deregulation. Back in 1991, thanks to fragmented ownership and a brutal media recession, 59 percent of all radio stations in America were losing money, according to a National Association of Broadcasters report.

"There wasn't a bank in America that would lend you money to buy a radio station," says longtime radio broker Gary Stevens, who recalls selling a Boston FM around that time for $9 million. The station today would go for at least $90 million.

The accelerated consolidation can be seen as a sign of strength. "As an economist, that signals to me how significant the efficiencies are," says Mark Fratrik, vice president at BIA. "The market tells you a lot of information."

But even in light of the depressed market for radio stations in the early '90s, was the removal of all ownership caps warranted? Surely a more measured raising of caps could have strengthened the economic health of radio without giving control of the entire medium to the highest bidder.

According to critics, local competition has all but vanished from radio in the wake of a consolidation that Congress did not anticipate. That consolidation, in turn, has cleared the way for listless, homogenized and automated programming, along with a near abandonment of local news, all in the name of rampant cost cutting. (One 25-year radio veteran, and current Clear Channel station executive, estimates the Telecom Act has eliminated nearly 10,000 radio-related jobs.) "It's been fabulous for shareholders, but terrible for listeners and employees," says a former broadcast group chief. "I wanted to see radio deregulation. But I think Telecom has done a disservice to what was once a great business."

"The unintended consequences [of the act] have changed irrecoverably the face of radio," says Ness, the former FCC commissioner.

The irony is that even though radio deregulation was an "afterthought" in the Telecom Act, as Stevens puts it, no other communications industry has been so dramatically affected by the legislation. And far from being viewed as a mistake by the leaders of other communications industries, it is seen as a role model.

Has deregulation helped or hurt radio? The answer to that question could have profound implications outside the world of AM and FM. That's because some of the nation's largest television station owners, as well as newspaper publishers, are lobbying Congress for the same type of sweeping deregulation radio got in the Telecom Act.

Many of the provisions currently eyed by TV station owners and newspaper publishers, such as allowing broadcasters to own stations and newspapers in the same market, as well as a lifting of the cap on the number of individual TV stations one company can own, were part of the original telecom bill. But they were taken out at the last minute to appease the White House's objections about unfair media concentration. (At the time, Clinton told aides that if the Arkansas Democrat-Gazette, which did not support him, had been allowed to own TV stations as well, he never would have been elected governor.)

Now, five years later, and with a new Republican administration signaling its eagerness to usher in further media consolidation, those exact same deregulatory provisions are back on the table on Capitol Hill and at the Federal Communications Commission.

If successful, the current deregulation push would represent "the most aggressive media consolidation initiative ever taken by a democracy," says Reed Hundt, appointed by President Clinton to the position of FCC chairman. Hundt served during the time of the telecom's bill passage and was opposed to lifting radio's ownership caps.

Some analysts and regulators suggest that before any further ownership relaxation occurs in TV, the effects of radio deregulation need to be closely examined.

"Deregulation without reasoned justification is nothing more than deregulation for its own sake. We have already been down that road and we have seen the troubling results in the radio marketplace," wrote Sen. Fritz Hollings, D-S.C., and Sen. Byron Dorgan, D-N.D., in a recent Washington Post Op-Ed piece. "Let us not repeat the mistakes that led to the rapid consolidation in radio in the marketplace for TV programming."

Additionally, in contrast to 1995, when the National Association of Broadcasters lobbied strenuously in favor of radio deregulation, a major internal rift now divides TV broadcasters on the question of whether ownership caps should be lifted. Basically, the networks and the larger station groups, with an eye to owning more profitable affiliates, badly want the caps lifted. The medium- and smaller-sized broadcast companies do not. (Most, as a rule, are highly profitable, offering a sharp contrast to the position of independent radio stations in the early '90s.)

The NAB has sided with the smaller broadcasters; and NBC, CBS and Fox have quit the trade group in protest over the issue. But the smaller broadcasters are alarmed by what they see in the radio insustry.

"Radio is the ultimate example of what can happen if you change the ownership caps," says Jerry Waldron, an attorney representing a group called Network Affiliated Stations Alliance (NASA), which opposes lifting ownership caps.

Former FCC chairman Hundt agrees. "Radio is the model. That's the harbinger for what's going to happen to TV."

According to the Telecom Act, broadcast companies are allowed to own television stations that reach 35 percent of the American viewing audience, but no more. For instance, Paxson Communications operates smaller-market stations, and owns 60 TV signals, according to BIA. CBS, NBC and ABC, though, whose owned-and-operated affiliates are in major markets, have just 16, 13 and 10 stations, respectively. The Telecom Act increased the maximum viewing-audience percentage from 25 to 35 percent. The deregulatory push now is to raise that cap again, to at least 50 percent.

NASA station members oppose raising the cap for two main reasons: They're afraid of losing local control of programming to national networks, and they're afraid of being bought up by larger competitors. "That debate is falling on more receptive ears on Capitol Hill," says Mark O'Brien, executive vice president of BIA. "Whenever you invent something you hypothesize what's going to happen, [as was done with] radio deregulation. When you do it the second time [with TV], it's a matter of looking at what happened the first time."

Hollings, chairman of the Senate Commerce, Science, and Transportation Committee, is scheduled to hold a hearing on media consolidation during the third week of July. Thanks to the recent party switch of Sen. Jim Jeffords, I-Vt., those hearings will have a much different tone than they would if the former chairman, a fierce media deregulatory proponent, Sen. John McCain, R-Ariz., were overseeing the proceedings.

Nonetheless, new FCC chairman Michael Powell (whose Senate patron is McCain) has expressed support for lifting the cap beyond 35 percent, recently couching the issue in a freedom-of-speech context. "There is something offensive to First Amendment values about that limitation," he told an audience of NAB members. (However, Powell's commitment to the First Amendment is somewhat contradictory -- earlier in June, the FCC startled some music industry executives, not to mention First Amendment activists, when it fined a pop radio station in Colorado $7,000 for playing an edited, or cleaned-up, version of an Eminem rap song.)

For now, the question of ownership caps is before the U.S. Court of Appeals for the District of Columbia. There, Viacom is contesting a similar ownership cap for cable companies. In the spring, the court ruled that the 30 percent cap for cable was arbitrary and seemed to have been "plucked out of thin air." Hearings for that case begin in the fall, with a possible ruling by year's end. Powell has signaled he'll await the outcome of that case before proceeding with any FCC action on TV ownership limits.

NASA members insist that the very notion of locally controlled television is at stake in that case. In a blistering complaint filed with the FCC, NASA detailed how time and again networks have tried to hamper independently owned affiliates from breaking away from network programming, even for additional local news, a presidential debate or a charity telethon. (According to the Muscular Dystrophy Association, virtually none of the networks' owned-and-operated local affiliates air the association's telethon.)

Network executives at ABC, CBS and NBC declined to discuss the ownership cap issue.

Independent radio advocates often complain that conglomeration leads to poor quality programming. This is not an argument one hears in the current TV regulatory debate. Indeed, some critics say that local TV programming, such as the six o'clock news, is dismal already.

But others fear that local news programming could get even worse. "Look at the radio group that helped lead the fight to lowball costs and introduce national content -- it's Infinity," says Robert McChesney, communications professor at the University of Illinois at Urbana-Champaign. He notes that Infinity was run by renowned cost-cutter Mel Karmazin, who is now president of Viacom, the owner of CBS. With any additional TV consolidation, you can bet Karmazin's "not going to be pumping money into the Little Rock newsroom," says McChesney.

The bigger TV consolidation debate, though, centers on the affiliates' "right to reject" provision. According to the FCC, that provision allows them to pass up network programming "that the licensee feels to be unsatisfactory or contrary to the public interest," or to air "any program which in the station's opinion is of greater local or national importance."

Networks as a rule want their affiliates nationwide to carry as much network programming as possible, which boosts the networks' ratings. But sometimes affiliates simply don't want to air rating dogs, like NBC's XFL prime-time football league. Other times it's more about local choice, such as being forced to air major league playoff games rather than presidential debates. Independently owned affiliates insist that the "right to reject" provision has become a hollow one -- with some networks leveling punitive fines for preemptions or threatening to terminate a station's network affiliation -- and would become virtually nonexistent with further ownership consolidation.

If the networks are able to own more and more affiliates, the ability for local stations to control any of their programming would essentially disappear. Instead of local programmers deciding what should go on the air, the decisions would all be made by the network, with affiliates acting merely as storefronts.

If left unchecked, or even accelerated by deregulation, "the nation's local network-affiliated television stations will ultimately be transformed into mere passive conduits for their networks' national programming," reads the NASA statement.

In a word, says NASA attorney Waldron, "homogenization."

Sound familiar? That's the same complaint being leveled about today's consolidated radio.

Radio has "become homogenized. Radio is not as alive, not as immediate. Because what's happened in large markets is [that] you have two large players divide up the [music] formats so they're not competing head to head anymore," says former FCC commissioner Ness. She suggests that consolidation has eliminated competition. Clinton himself, in a speech this month to broadcasters, expressed "mixed feelings" about the Telecom Act's impact on radio, noting there has been "more consolidation than we wanted."

So how did all this happen? How did the Telecommunications Act ignite a radio deregulation revolution that some jealous TV broadcasters now want to duplicate?

The quick and easy excuse is to blame it all on Hillary Rodham Clinton.

Or, more specifically, on the success of the 1994 Republican revolution, which is often credited to -- or blamed on -- Hillary Clinton's healthcare fiasco. Because literally within hours of capturing control of the House of Representatives, legislative leaders, led by Newt Gingrich, began working on sweeping new media deregulation legislation. Gingrich's affiliated think tank, the Progress and Freedom Foundation, even put together the "Magna Carta for the Knowledge Age," a veritable call to arms for telecommunications deregulation.

"Losing the House in '94 was without question a seminal moment in the political history of the media," says former FCC chairman Hundt.

As the New York Times reported in early '95, broadcast "lobbyists have seldom met more receptive lawmakers. Committee Republicans have held numerous meetings with industry executives since January, at which they implored companies to offer suggestions about the ways that Congress could help them."

The version of the telecom bill that originally passed easily in the House offers ample proof of the New York Times' report. That version would have allowed one company to own the only cable television system in a market, the only daily newspaper, a TV signal and every local radio station.

But oddly enough, as the telecom bill was being debated, advocates of radio's deregulation ended up benefiting from its devalued status as a serious news and information provider. So while the more extreme reductions in ownership caps on television and newspaper ownership in the House-passed bill were removed in the final version, radio deregulation sailed through.

"Radio is not regarded as having the same role in the political debate; that's why a lot of people on both sides of the aisle just felt it wasn't an important topic," says Hundt.

Radio station broker Steven agrees: "Politicians only care about TV news dissemination; they want that finger on that button. We've made the case that radio offers such a minimal service of information flow, politicians were not worried about it and let us go."

Radio broadcasters were also aided by the NAB's stealth lobbying campaign, which purposely kept the radio ownership issue off the radar as the Baby Bells and cable companies grabbed most of the Telecom Act attention. "The NAB knew to lay low," says one source familiar with the trade association's strategy at the time. "The secret was not to be out front and center on it. If there had been a separate radio deregulation bill, it wouldn't have passed. There would have been hearings, and a real hue and cry."

If you listen today, there is an audible hue and cry. It's just coming five years late.

Shares