Let me start by reminding you what I wrote in my Salon column just last month:

"The outlook, therefore, isn't for another noninflationary boom. It's for stagflation -- the combination of low performance and rising prices some of us dimly remember from the Vietnam War."

Let me also remind you that last March, when the United States had its first month of good job growth in a while, I labeled the ensuing media frenzy "a fit of ejaculatio praecox." Since which time, we've heard not a line of doubt from the business press. "The economy is strong and getting stronger," said President Bush, and like good soldiers, the commentariat fell in line.

But today we have news that is hard to avoid. Newly revised data are out from that exciting, inspiring, fantastic first quarter.

Real economic growth did not accelerate to 4.4 percent from the 4.1 percent pace of the fourth quarter of 2003, as first thought. Instead, the growth rate fell, to 3.9 percent. Meanwhile, inflation rose faster than predicted. The inflation rate was 3.5 percent for gross domestic purchases, as opposed to the previously estimated 3.3 percent. The chain price deflator (a commonly used measure of inflation) was up to 2.9 percent from 2.6 percent, and core inflation (excluding food and energy) was up to 2 percent from 1.7 percent.

Forecasters were caught flatfooted by these revisions. They had expected the growth rate to be unchanged at 4.4 percent -- not rising inflation.

Why is this happening? The most important reason is the effect of increasing demand on imports. Imports came in high, partly as an enduring consequence of outsourcing and the loss of domestic competitiveness during the Bush slump. With a falling dollar and a rising price for fuel, imports are also more expensive, putting a double whammy on the trade deficit.

Moreover, it was spending on nondurable goods (including gas) that was up -- by almost 7 percent -- while spending on durable goods actually declined. This is not a good sign.

Why the surprise? It lies partly in the incurable optimism of members of the business press. They want growth and rising markets. They believe in the psychological power of their own voices. But they have no underlying theory beyond the idea that psychology matters and that optimism leads to growth. Doubters therefore get squelched. Our voices are dissonant, and our arguments are, well, just a bit too difficult. But when bad things happen, we are not surprised.

What have the effects been on working families? We already knew that real wages have fallen so far in 2004, which is another way of saying that consumer price inflation has outpaced average wage growth. Sen. John Kerry made this point accurately the other day -- and got attacked for it in the Washington Post, which then had to print a correction. It read in part: "We were wrong and Mr. Kerry was right: Hourly wages for non-supervisory workers rose 2.2 percent, while the consumer price index rose 3.1 percent."

Will we make up for this in the second quarter, giving Karl Rove his perfectly timed election boom? Six months ago, I'd have said yes. Now, though, one can't be sure. I'd been figuring on large tax refunds and an "echo" in military spending as the Pentagon restocked its munitions one year after the start of the Iraq war. Are these happening? I don't know. There are few indicators from the second quarter yet. Housing appears strong -- everyone wants to beat rising mortgage rates. But manufacturing orders are down for two months in a row.

Meanwhile, all indications are that the Federal Reserve will start raising interest rates this week. Don't take that too seriously, however: It could still be bluff. In the late 1990s, for years on end, Fed chairman Alan Greenspan signaled that interest rates would soon rise. Yet in meeting after meeting of the Federal Open Market Committee, they did not. (It was Greenspan's finest hour.)

The economic weakness now showing up might persuade him to hold off for six more weeks. The rising inflation rate might, on the other hand, persuade him to raise rates more aggressively. Inflation is still low, but it's not hypothetical any longer.

If Greenspan raises rates, what does he expect the move will actually accomplish? Most who comment on this topic treat rising interest rates as a necessary, inevitable, irresistible reaction to rising prices. The motivation and the mechanism are beyond the scope of an intelligent question. And so the press does not ever ask what the exact link from rising interest rates to inflation control might be.

For members of the Federal Reserve, which meets in private, there is no similar excuse. They know. They know that the only reason to raise interest rates is to slow down the economic growth rate and so to increase unemployment. Their theory -- the only theory they've got -- holds that rising inflation is a consequence of labor markets that are too tight, of unemployment rates that are too low, of wages rising faster than prices and rising real wages squeezing real profits.

But wait. We know this is not the case. We are still short well over 1 million jobs compared with where we were four years back. We are still at least 5 million jobs short of what we should have. And while productivity is rising, real wages are falling. Whatever is pushing up prices, in other words, it isn't wages. The only thing in full boom right now is corporate profits -- up a stunning 40 percent over the past year.

The inflation the United States is experiencing isn't demand-driven. It's a product of the war, oil price uncertainty and monopolistic manipulations in sectors like healthcare.

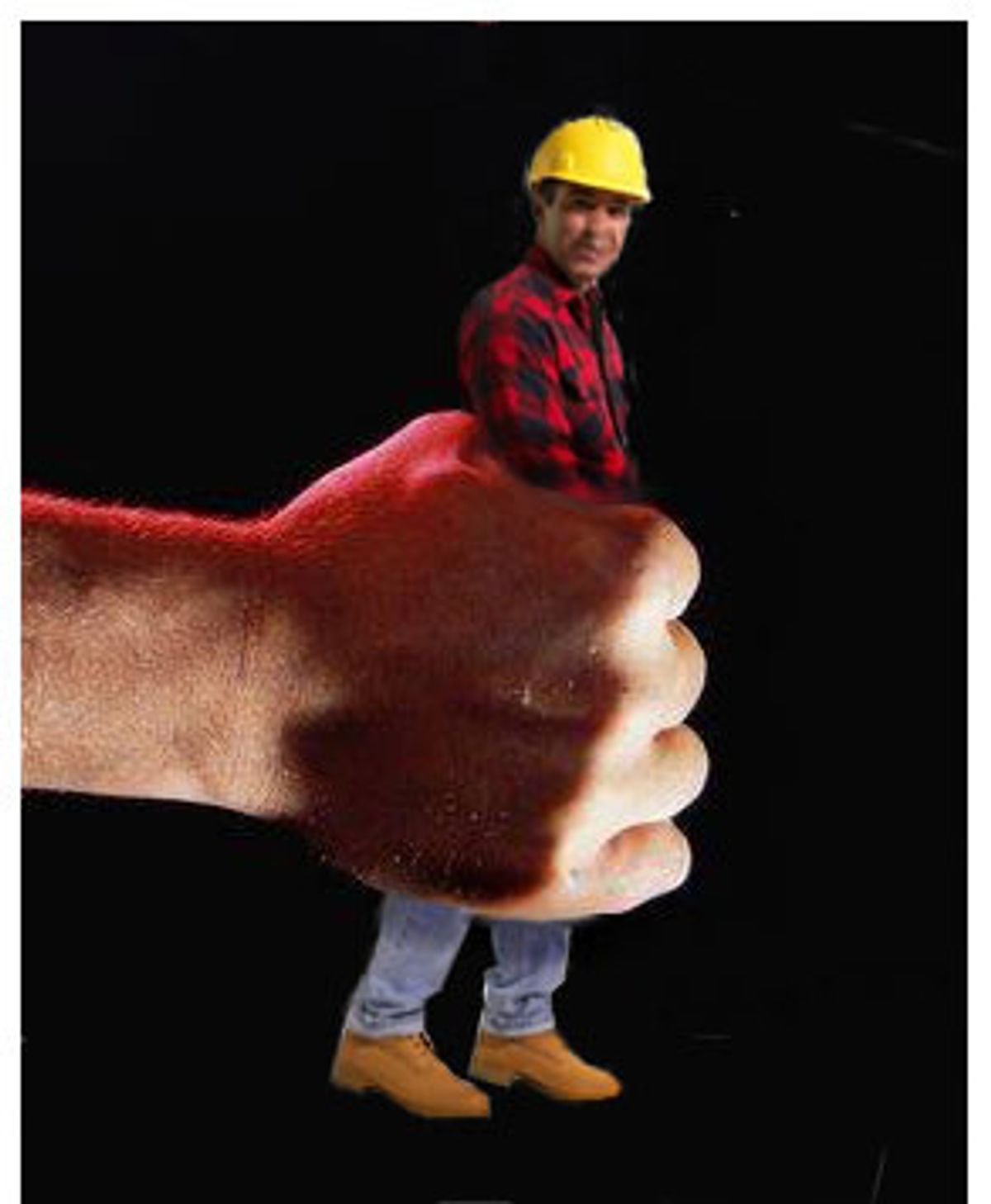

But Team Greenspan and Team Bush don't care. Their only solution to the inflation problem is to squeeze working families so hard that they don't have money to spend on anything else.

Shares