"Lord, enlighten thou our enemies," prayed 19th century British economist and moral philosopher John Stuart Mill in his "Essay on Coleridge." "Sharpen their wits, give acuteness to their perceptions, and consecutiveness and clearness to their reasoning powers. We are in danger from their folly, not from their wisdom: their weakness is what fills us with apprehension, not their strength."

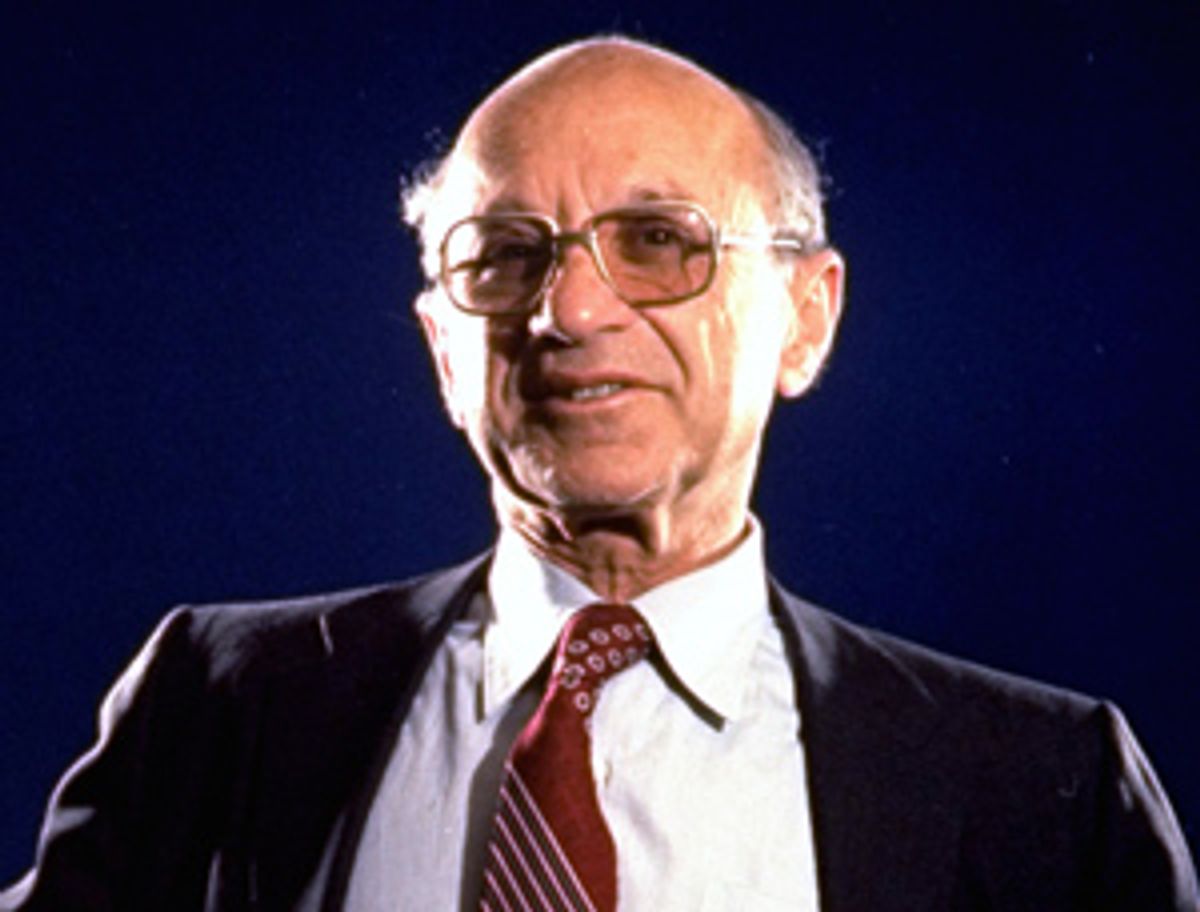

For every left-of-center American economist in the second half of the 20th century, Milton Friedman (1912-2006), Nobel Prize winner, founder of the conservative "Chicago School" of economics and advisor to Republicans from Goldwater to Reagan, was the incarnate answer to John Stuart Mill's prayer. His wits were sharp, his perceptions acute, his arguments strong, his reasoning powers clear, coherent and terrifyingly quick. You tangled with him at your peril. And you left not necessarily convinced, but well aware of the weak points in your own argument.

Gen. William Westmoreland, testifying before President Nixon's Commission on an All-Volunteer [Military] Force, denounced the idea of phasing out the draft and putting only volunteers in uniform, saying that he did not want to command "an army of mercenaries." Friedman, a member of the 15-person commission, interrupted him. "General," Friedman asked, "would you rather command an army of slaves?" Westmoreland got angry: "I don't like to hear our patriotic draftees referred to as slaves." And Friedman got rolling: "I don't like to hear our patriotic volunteers referred to as mercenaries." And he did not stop: " If they are mercenaries, then I, sir, am a mercenary professor, and you, sir, are a mercenary general. We are served by mercenary physicians, we use a mercenary lawyer, and we get our meat from a mercenary butcher." As George Shultz liked to say: "Everybody loves to argue with Milton, particularly when he isn't there."

Thinking as hard as he could until he got to the root of the issues was his most powerful skill. "Even at 94," wrote "Freakonomics" author Steven Levitt, currently a professor in the same University of Chicago economics department where Friedman taught from 1946 to 1976, "he would teach me something about economics whenever we talked." In Friday's New York Times, Chicago economist Austen Goolsbee quotes from Milton Friedman's Nobel autobiography:

Friedman said that when he arrived [at the University of Chicago] in the 1930s, he encountered a "vibrant intellectual atmosphere of a kind that I had never dreamed existed."

"I have never recovered."

His worldview began with a bedrock belief in people and their ability to make judgments for themselves, and thus an imperative to maximize individual freedom. On top of that was layered a trust in free markets as almost always the best and most magical way of coordinating every conceivable task. On top of that was layered a powerful conviction that a look at the empirical facts -- a comparison, or a "marking to market," of one's beliefs with reality -- would generate the right conclusions. And crowning that was a fear and suspicion of government as an easily captured tool for the enrichment of cynical and selfish interests. Suffusing all was a faith in the power of argument and the primacy of reason. Friedman was an optimist. He was convinced people could be taught the truths of economics, and if people were properly taught, then institutions could be built to protect society as a whole against the corruption and overreach of the government.

And he did fear the government. He was a conservative of the old, libertarian school, from the days before the scolds had captured the levers of power in the conservative movement. He hated any government intrusion into people's private business. And he interpreted "people's private business" extremely widely. He detested the war on drugs, which he saw as a cruel and destructive breeder of crime and violence. He scorned government licensing of professionals -- especially doctors, who heard over and over again about how their incomes were boosted by restrictions on the number of doctors that made Americans sicker. He abhorred deficit spending -- again, he was a conservative from another era. He feared that cynical politicians could pretend that the costs of government were less than they were by pushing the raising of taxes to pay for spending off into the future. He sought to inoculate citizens against such political games of three-card monte. "Remember," he would say, "to spend is to tax."

This did not mean that government had no role to play. He endorsed the enforcement of property rights, adjudication of contract disputes -- the standard and powerful rule-of-law underpinnings of the market -- plus a host of other government interventions when empirical circumstances made them appropriate. Sometime empirical circumstances could win Friedman some unexpected allies. Left-wing Mayor Ken Livingstone's congestion tax on cars in central London is an idea straight out of Milton Friedman. Friedman's negative income tax is one of the parents of what is now America's largest anti-poverty program: the earned-income tax credit, which was greatly expanded by Bill Clinton. And, most important, government had a very powerful and necessary role to play in keeping the monetary system working smoothly through proper control of the money stock. If there was always sufficient liquidity in the economy -- enough but not too much -- then you could trust the market system to do its job. If not, you got the Great Depression, or hyperinflation.

Prior to Friedman, the economic giant of the previous generation, John Maynard Keynes, was an equally ferocious debater. The Great Depression had convinced Keynes that central bankers alone could not rescue and stabilize the market economy. In Keynes' view, stronger and more drastic strategic interventions were needed to boost or curb demand directly. Keynes was perhaps the prime influence on U.S. liberals and U.S. economic policy up through the Reagan era; Friedman worked tirelessly to supplant and minimize his influence.

In their "Monetary History of the United States," Friedman and coauthor Anna J. Schwartz argued that the Keynesian reliance on intervention was a misreading of the lessons of the Depression. Friedman did think that government was required to undertake relatively narrow but crucial strategic interventions to stabilize the macroeconomy -- keep production, employment and prices on an even keel. But he believed the Depression might have been rapidly alleviated by skillful monetary management alone. Over the course of 40 years, Friedman's position carried the day, in a few developing economies like Chile that have applied Chicago School theories, and at home. Current Federal Reserve chairman Ben Bernanke now holds Friedman's view, not Keynes', of what kind of strategic interventions in the economy are necessary to provide for maximum production, employment and purchasing power, and stable prices.

Friedman's thought is, I believe, best seen as the fusion of two strong and very American currents: libertarianism and pragmatism. Friedman was a pragmatic libertarian. He believed that -- as an empirical matter -- giving individuals freedom and letting them coordinate their actions by buying and selling on markets would produce the best results. It was not that he thought this was a natural law. He didn't believe that markets always worked best. It was, rather, that he believed that places where markets failed were atypical; that where markets failed there were almost always enormous profit opportunities from entrepreneurial redesign of institutions; and that the market system would create new opportunities for trade that would route around market failures. Most important, his distrust of government told him that government failure was pervasive, and that any expansion of government beyond the classical liberal state would be highly likely to cause more trouble than it could solve.

For right-of-center American libertarians, Milton Friedman was a powerful leader. For left-of-center American liberals, Milton Friedman was an enlightened adversary, and one whose view is now ascendant. We are all the stronger for his work. We will miss him.

Shares