When the economy fell apart, I panicked like everyone else. I read the papers. I watched the news, and I learned the talking points so that I could nod, gravely, when cocktail banter turned toward the sorry state of financial affairs. Only problem was -- I didn't exactly know what I was talking about. Mortgage crisis? Government bailout?

You can say that I'm an ignorant American (and you'd be right). You can say that I should know more about my personal finances (and you'd be right). The fact remains that I'm a reasonably intelligent, college-educated American who didn't know what an "FDIC-insured bank" was. Hey, I like to drive, but that doesn't mean I know how to build an engine. Don't we have people for that?

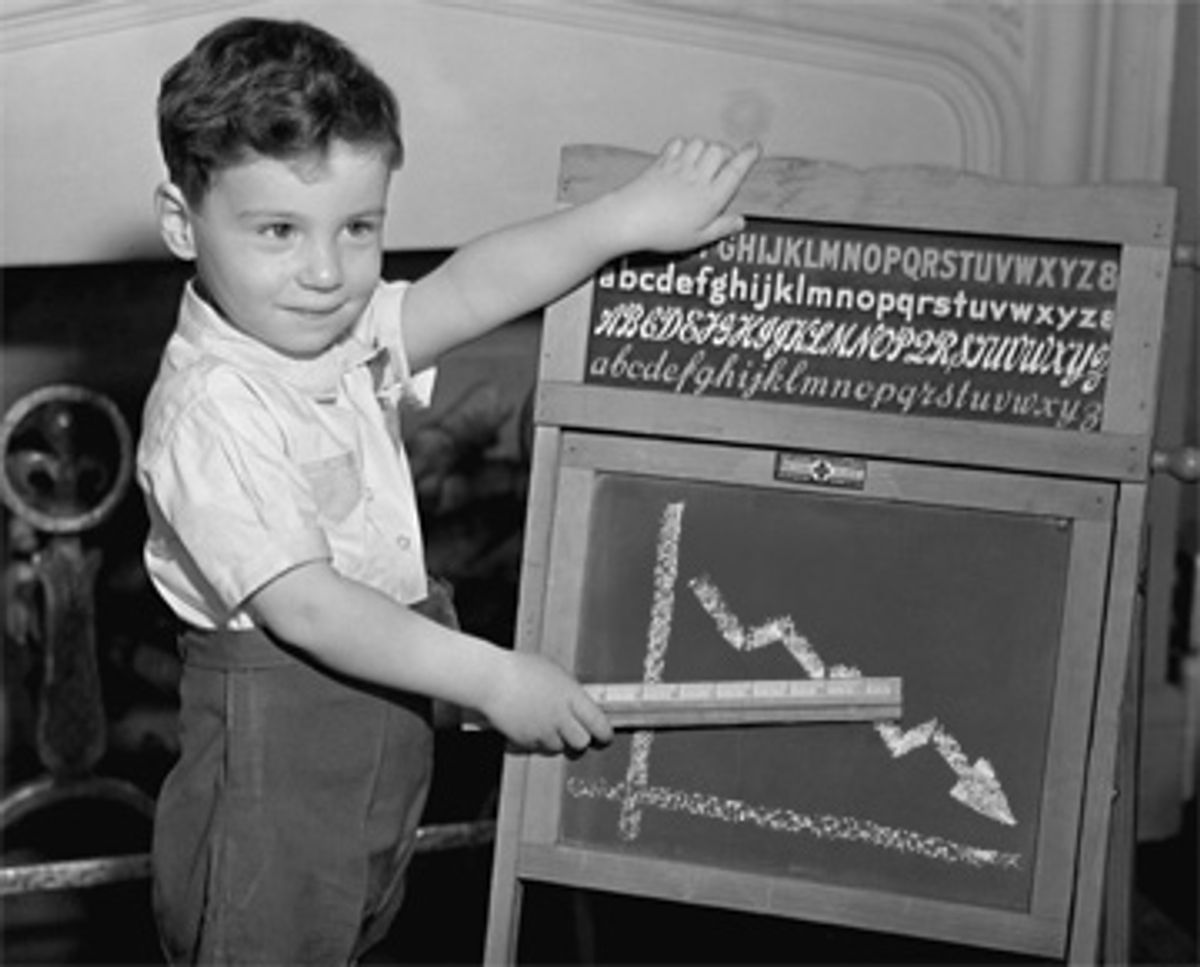

Still, as the country's financial infrastructure collapses around us, the idea of learning the basic vocabulary of our economy's engine has become not merely attractive but mandatory. The media is awash in data, panic and fear, but there's not enough clear-headed advice that someone like me can understand. So I decided to consult experts for a new financial series named after the phrase I want to say to every talking-head economist on TV right now: "Talk to Me Like I'm 5."

Ilyce Glink specializes in translating economic subjects for the masses. "If you can't tell a 10-year old about a financial topic and have him understand you, then you don't understand it well enough," she told me. Glink is a radio host ("The Ilyce Glink Show" in Atlanta) and author of bestsellers such as "50 Simple Things You Can Do to Improve Your Personal Finances" and "100 Questions Every First-Time Home Buyer Should Ask." Her column "Real Estate Matters" is syndicated in more than 110 newspapers and Web sites. She has even appeared on "Oprah." All of which makes her an ideal candidate to begin our series.

She spoke with me on the phone from her home in Chicago.

What should I be doing with my finances right now?

No. 1: Save money. I know this is not exactly what Secretary of the Treasury Paulson hopes you'll do, but it's important. Most people who feel out of control of their finances can quickly regain control by reining in their spending.

Any expense that doesn't directly relate to food, shelter, utilities, debt and education for your children should be eliminated. Of course, you can't go to Bouley for dinner because you say, "Well, I have to eat." No. You can buy pasta and sauce and make dinner for less than $4 a person. Paying for your utilities doesn't mean you get to have every channel in the world. It means basic cable, maybe no cable at all. It's a return to basics.

You don't need a high-priced expert to tell you to spend less than you earn, to tell you that you shouldn't charge things on your credit card that you can't afford.

So that's the No. 1 thing I should do right now. What's No. 2?

Trade down. This is a continuation of stopping your spending. If you're going to the theater on Broadway, spending $70 on tickets, go to the movies instead. If you're going to the movies, maybe start renting. If you're renting movies, think about what things you can do for a buck or for free. Do the same with your food budget: Trade down in order to spend less.

And why not just stop going out to eat? Stop going to Broadway shows?

Well, I could say that, but it's like when you're going on a diet or trying to quit smoking. There's the temptation to backslide. So people should make a conscious choice to do more with less and take an active role in how to do that. If you're buying a newspaper every day -- and I love newspapers, so I'm sorry to say this -- it might be time to start reading the paper online. Share a subscription at the office.

There are car shares in which, for a certain dollar-per-hour amount, you can get a car when you need it. And it's better to pay $8 per hour for the hours you really need that car than pay several hundred dollars a month. Or maybe trading down could mean buying a used minivan instead of a new one. This same thing is true for home buyers. People are getting the message, finally, that you can't leverage a home by a thousand percent.

Can you explain what you mean by that?

Well, the way home buying works is, you put money down upfront. Usually you put down 20 percent of the price, and you owe 80 percent. You've leveraged your money to buy the home.

What happened was, people were putting down nothing and borrowing the cost of the entire house. Worse, they were making interest-only payments, which meant they were never paying anything toward the balance of the mortgage, or they were paying for these properties with what we call "option ARMs" [adjustable rate mortgages], which are now going bad in droves, in which they paid even less than the interest that was owed.

For example, let's say I make $50,000 a year, and I want to buy a $500,000 house. Let's say I'm only going to pay $1,000 a month on that house. But really, I should be paying $3,200 a month to pay down [the mortgage]. The missing money that I owe, that $2,200 I'm not paying, gets tacked onto what I already owe on the home with a pay-option ARM, so at the end of the third month I don't owe $500,000 on the home, I owe $506,600. By the end of the year, I'm up to $526,400 -- more than I borrowed to begin with. That's why we're in such trouble today. People were buying houses they couldn't afford. So buy cheaper. Buy something you can afford.

Now, No. 3. Keep funding your 401K. This is incredibly difficult emotionally. It's tough for me. It's tough for my financial advisor. Nobody wants to put money into the stock market right now. It's nerve-racking. But if you're in your 20s, 30, even into your 50s, you're not going to see that money for maybe 15, 20 years at the very least, most likely more.

When we look back at the Great Depression 80 years ago, we can't even relate to those people, those pictures in black and white. Forty years from now we're going to see this moment as a major blip -- a blip that had a major impact on some lives, yes, but a blip. But we will go back to building this country again, and you have to continue to invest in the future.

Now, you may not want to put so much in emerging markets --

What's that?

It's a market in any third-world or second-world country where there's a lot of growth. India, the Baltic States, China, Latin America. We call them "emerging" because they're in flux, and there are tremendous risks but also tremendous potential for gains. However, most people don't have the stomach for it. Consider what happened in Russia, where they recently decided to close trading for the week.

What most people should be doing is investing in well-run, well-funded U.S. companies. But you want to have some diversity, so choose some mutual funds that feature the stocks of small, medium and large companies. But as you rejigger your 401K portfolio, remember to also invest in bonds and maybe even leave some of the funds in cash --

What do you mean by "cash"?

Cash. Greenbacks. The stuff that most people have in their wallets and that some people are stuffing into their mattress. But in a 401K, cash doesn't just float around. You've got to put it into a cash-equivalent account, like a money market account.

And what's a money market account?

A money market account is like a passbook savings account, except there's a tiny bit more risk, and you earn a tiny bit more income. Until recently, no one thought there was a chance that a money market account had any real risk. Then, the Reserve Primary Fund "broke the buck" [fell below $1], and people realized there is some risk to money market accounts. But now the federal government is backing money market accounts, so at the moment they are as safe as an FDIC-insured account. (That stands for Federal Deposit Insurance Corporation, by the way.)

Is there a certain percentage you should be putting into these safe, cashlike accounts?

It changes for everybody. If you're in your 20s, and you can't touch retirement funds for a while anyway, you should have more of your pile invested in stocks and bonds and the least amount in cash. Maybe 5-10 percent of your total retirement funds, if that. If you're older, you could have as much as 20 percent in cash. It depends on your risk tolerance -- and how well you want to sleep at night.

I'm hearing from people who get sick to their stomach when they open up their 401Ks each month. Should people even be looking at those right now?

I think it's terrible to have to look at your 401K statements. Awful. But I don't think you can make an intelligent decision about your finances if you don't. Most people don’t even know what they're invested in. So, first of all, open up your statement and see what your retirement funds are invested in. Then, go to morningstar.com and find out what companies are held by your 401K mutual funds. And then see how your investments are doing, and decide if you need to change your allocation.

I get asked a lot these days: Is now the time to rebalance my portfolio? Well, if the Dow drops another 1,000 points tomorrow, was today the day? The answer is yes. If it goes up 1,000 points tomorrow, was today the day? Yes. If you're not happy with the way your funds are invested, then you should move to the funds that you think will have the greatest chance for recovery as the stock market improves over time. You may also want to consider index mutual funds.

And what does that mean?

A mutual fund is an investment in a group of companies that either somebody puts together by themselves or is tied to an index. An index mutual fund is a group of stocks that follows a predetermined list, such as the Standard & Poor's list of top 500 companies in the U.S. That index is commonly called the S&P 500.

If you invest in an S&P 500 index fund, it will buy shares in each of the 500 companies in the index. If a company drops out of the index and is replaced, an S&P 500 index fund will automatically make the change. The cheapest index mutual funds are typically offered by Vanguard and Fidelity.

In a managed mutual fund, there is a fund manager who is making the decision to buy or sell shares in a particular company based on the fund's own research.

Index funds will always be cheaper, because the decision to buy or sell shares is automatic, and it doesn't happen that often. And an index fund is typically well diversified, because the fund holds so many different companies. In other words, if you invested in a total-market index fund, you'd be investing in virtually every company that trades on the stock market. It's not like you're putting all your eggs in one basket. Overall, the return of an index mutual fund tends to beat the return of something like 80 percent of managed mutual funds. So you're paying less but having a superior return.

Now, No. 4: Pay down your debt as quickly as possible.

And how do you do that, exactly?

You can stop spending. You can make more money. You have control over both of these things. So to increase your cash flow -- your money coming in -- trade down and stop spending so you have more free cash, which you then use to pay down your debt. Paying down your debt will also help repair your credit history and raise your credit score.

In my family, we use Quicken. For someone like you, use Mint.com. It's designed for young people who want access to their finances from wherever they are in the world -- and it’s free. If you want to understand where your money goes, keep track of your finances and then use a software program like Turbotax or TaxCut to do your taxes.

And actually, that would be my No. 5: Keep track of every penny you spend. Literally, write down every penny, every single day, by date. I think people have an opportunity to make an active change in their life.

Most people 50 and younger have never known a time where they couldn't buy everything they wanted. With the coming recession, that may change. Not that everything you want won't be available, but people will have to learn about deferred gratification. You'll have to wait and save for what you truly want.

I'm hearing more about people keeping their money under their mattress. What do you think about that?

It's a terrible idea! If your house goes up in flames, that money is gone. Also, money isn't that easy to sleep on -- it pokes out from the mattress, and it's uncomfortable. Honestly, if you are so terrified that your $250,000 won't be protected by FDIC, which it will be, and if you don't have enough trust that we will get through this crisis, which we will, then put your money in a safe deposit box in a bank. But I'm telling you, if the bank goes up in flames, your money is gone, which it will not be if you keep it in FDIC-insured savings.

It's incredibly important for people to be in control of their money. The idea that you're sleeping on it is a tangible way to feel that you have control, but it makes absolutely zero sense.

We've lost all of our trust in the financial markets, and we have to find it again. It takes some time. But it will happen.

Shares