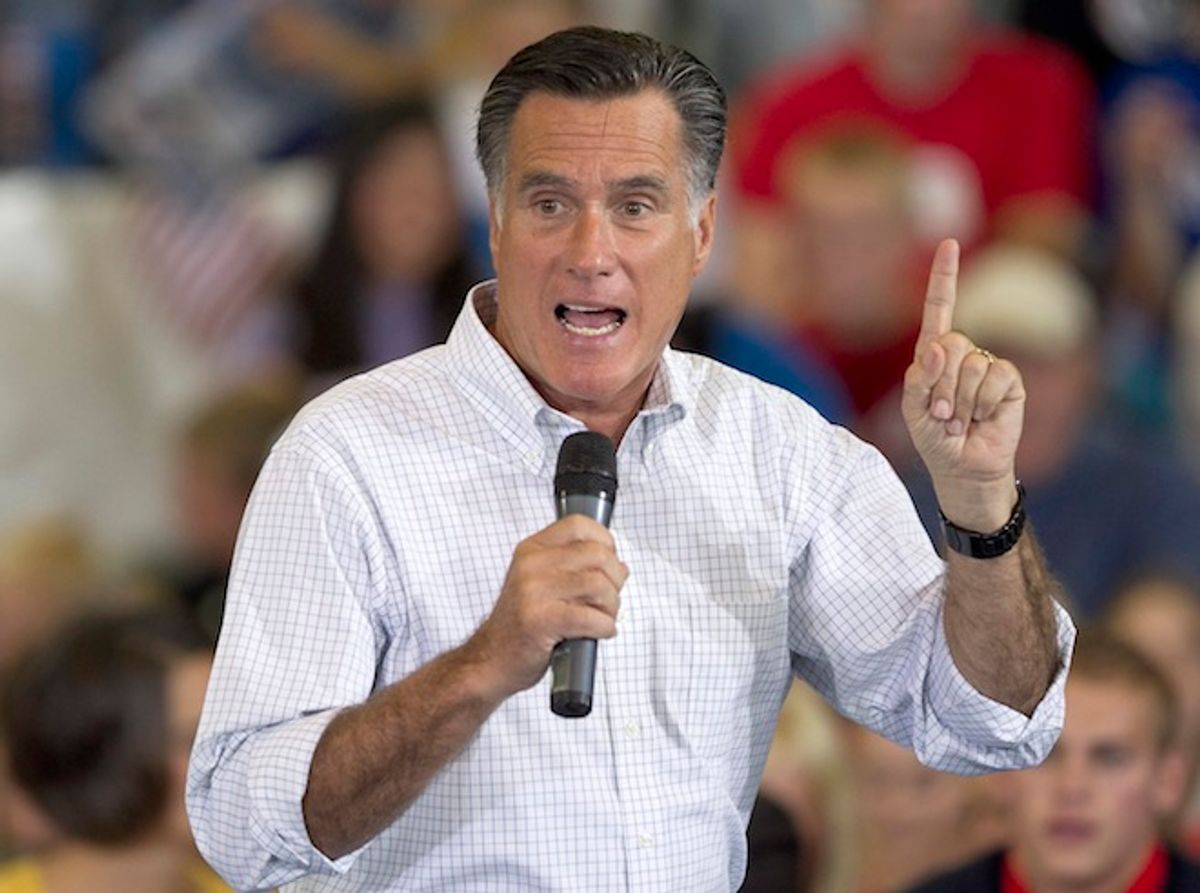

On Tuesday, Mitt Romney hinted at a key detail about his mysterious tax reform proposal. While he had previously suggested that he might eliminate some tax deductions or credits to pay for his proposal to reduce rates by one-fifth, yesterday he suggested that he would instead cap each taxpayer's total deductions at $17,000. Some questions remain, such as whether he would include the exclusion for health insurance in the cap, whether it applies to single filers or married couples, or whether it would raise enough money to pay for his proposed cuts. (Probably not.) But assume that it's a cap on the value of the biggest deductions, such as the mortgage interest deduction and the deduction for state and local taxes.

Because Romney would keep the preference for capital gains and dividend income and lower the top rate, any proposal to eliminate major deductions would in effect be, exactly as the Obama campaign has argued, a tax increase for the middle class to pay for a tax cut for the rich. A cap would work differently. Since it would impact only those whose deductions total more than $17,000, it would affect only the fairly well-off – those whose mortgage interest, state and local taxes, out-of-pocket health expenses, and other deductions exceed $17,000. As Suzy Khimm points out at Wonkblog, that will mostly be wealthy people in high-tax jurisdictions – but even the purchaser of a $450,000 house in Washington, DC would pay $18,000 in mortgage interest at the beginning.

Because Romney would keep the preference for capital gains and dividend income and lower the top rate, any proposal to eliminate major deductions would in effect be, exactly as the Obama campaign has argued, a tax increase for the middle class to pay for a tax cut for the rich. A cap would work differently. Since it would impact only those whose deductions total more than $17,000, it would affect only the fairly well-off – those whose mortgage interest, state and local taxes, out-of-pocket health expenses, and other deductions exceed $17,000. As Suzy Khimm points out at Wonkblog, that will mostly be wealthy people in high-tax jurisdictions – but even the purchaser of a $450,000 house in Washington, DC would pay $18,000 in mortgage interest at the beginning.

Yet the Romney proposal as a whole, with capital gains still protected, would nonetheless redistribute income from the merely well-off to the very, very rich. To see what I mean, let's look at Mitt Romney's own tax return for 2011: Romney's deductions total $4,519,140 – a lot of money. At his average tax rate of 14 percent, deductions saved him $632,679. A cap would take away all but about $2,000 of that $632,679.

But look at what the capital gains preference does for him: Romney took home $12,573,249 in capital gains in 2011. (I've left out dividends, just to keep it simple.) At 15 percent, that's about $1,885,950 of his taxes. But if he paid the same rate as on ordinary income, 35 percent, he would pay about $4.4 million. So the capital gains preference saved him $2.5 million, while deductions saved him only about $632,000.

I'm just using Romney as an example here, partly because he's a very rich person whose tax return I happen to have. But a well-off family, earning maybe $200,000 a year in ordinary income with a $600,000 house, is already paying a much higher rate than the Romneys of the world and would face a significant increase.

There's one more thing about this proposal that hasn't really been mentioned: It would be a giant intergenerational transfer from young to old. Just as Paul Ryan's Medicare proposal creates a generational divide between those currently under 55 (who have spent much of their working lives in a stagnant economy) and those who are older and whose benefits would be protected, capping deductions has a similar generational effect. Why? Because younger people benefit disproportionately from the mortgage interest tax deduction and older people benefit from preferential rates on capital gains and dividends.

The mortgage interest deduction is worth much more in the early life of a mortgage, when most of each monthly payment is interest, than later, when it becomes mostly principal. And the deduction has no value for people who have paid off their homes or paid mostly in cash from the sale of an old home. Finally, older homeowners are more likely to have purchased before the real estate bubble of the 2000s. In a 2008 paper, the economists James Poterba and Todd Sinai examined the distribution of tax deductions by age and other categories. They found that homeowners between the ages of 25 and 35 got an average value from the mortgage interest deduction of $1,155, and homeowners between 35 and 50 got $1,598. But homeowners over 65 got only $149 on average from the deduction.

Who benefits from the preference for capital gains and dividends? Here's a chart from Paul Caron's TaxProf Blog:

As the chart indicates, taxpayers over 65 are twice as likely to have capital gains or dividend income than those 45-55, and those preferred sources of income make up much more of their income than for younger groups – six times as much in the case of dividends. The Romney tax plan would protect this advantage.

While many older Americans live under great economic stress and poverty, there is a significant portion of them who benefited greatly from the economic prosperity of the post-War era, who had significant economic gains from their early investments in housing and in the stock market in the 1970s and 1980s, and who also benefit from programs such as Medicare and Social Security that provide them significant economic security. The younger generation (by which I mean those under 55) has not had the same advantages, and both Ryan's budget and Romney's tax plan would make it worse for them while protecting the wealthiest of the older generation.

Shares