Last night and again this morning, Senate GOP leaders stabbed the conservative movement in the front, first by rejecting and then by mocking their strategy to force a binary choice between shutting down the government and defunding Obamacare.

"I just don't happen to think filibustering a bill that defunds Obamacare is the best route to defunding Obamacare," Mitch McConnell said on the Senate floor Tuesday morning.

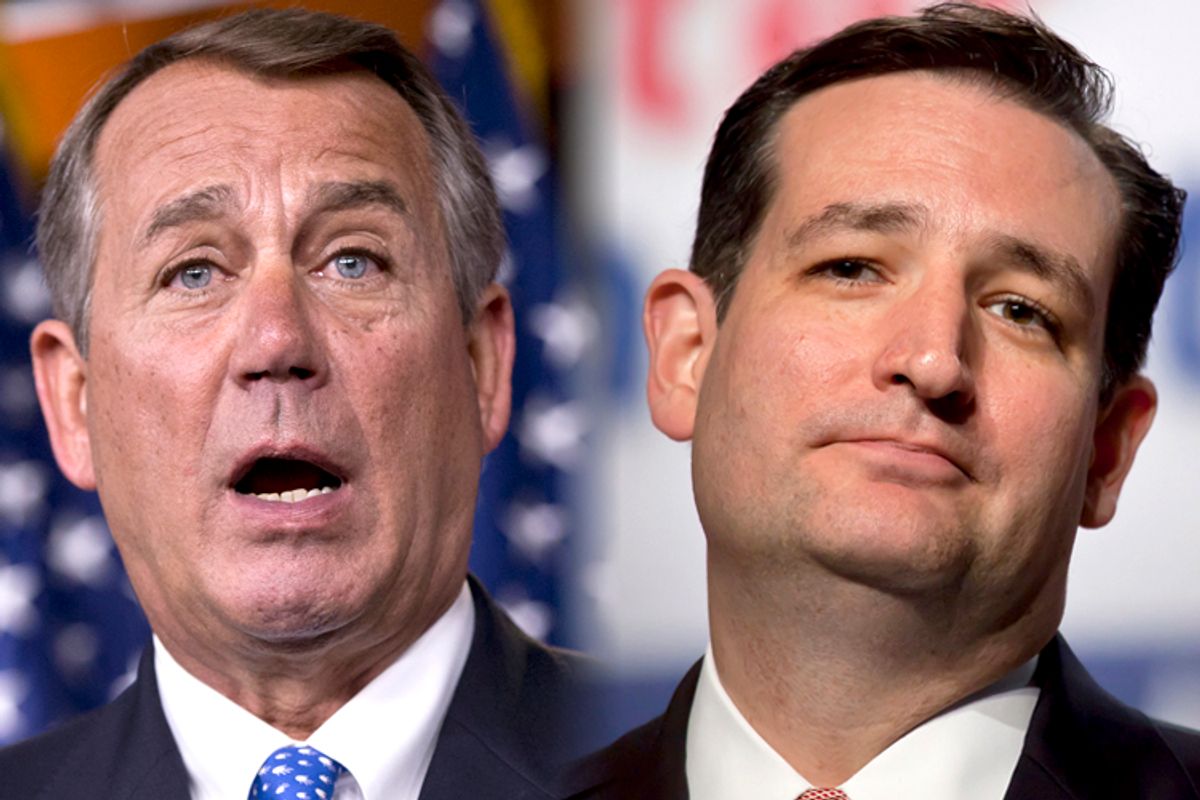

That quite likely was the climax of this lumbering government shutdown saga. Ted Cruz will complain some more, Senate Republicans will roll their eyes at him and clear the way for Democrats to strip the defunding rider from the government spending bill. Then in the most predictable denouement since the outcome of the last Washington Racial Epithets game, House Republicans will shrug, fund the government, and Obamacare enrollment will open on schedule.

Several commentators have watched the defund campaign go flaccid and responded by reissuing breathless exhortations that the risk of a debt default next month is much more severe than the risk of a shutdown ever was.

Here's Steve Benen, Ezra Klein and Jonathan Chait, just today.

But it seems to me the past week's events set up the following equation -- cave on defunding Obamacare + ??? = win the debt limit fight -- and it's up to one of these guys to solve for ???

They all proceed from the same basic premise -- the GOP's demands are so extreme, and the Democrats' commitment not to negotiating so ironclad, that Congress simply can't increase the debt limit without one party folding. Parties don't like to fold, ergo the risk of default is high.

I think this logic is flawed for a few reasons. Parties fold all the time. The GOP's demands are actually wishes couched as demands. Their insistence on concessions from President Obama isn't actually as black and white as the doomsayers portray it.

But on top of these misapprehensions, the debt limit freakout caucus also misrepresents a straightforward argument that the fight will be resolved fairly harmlessly as a lazily reductive assumption.

Chait says, "The debt-ceiling showdowns of 2011 and last spring both resolved themselves without triggering an economic meltdown, and so most people have come to assume the same will happen again this fall."

This is a caricature, which allows doomsayers to grapple with a few basic facts. I and many others are pretty sanguine about this debt limit fight not because everything worked out OK earlier this year and in 2011, but because 1) everyone has said the debt limit will be increased; 2) the votes are there to increase the debt limit; 3) there are multiple procedural avenues that lead to votes on a debt limit increase; 4) at least two of them lead there without Republicans extracting concessions from President Obama.

House Republicans have a whole laundry list of non-starter debt limit "demands," the most high-profile of which is a rider that would "delay" (as opposed to "defund") Obamacare. Assuming John Boehner can pass that bill with GOP votes, it'll come to the Senate, which is currently giving the public an object lesson in how Democrats can strip all of these riders on their own, while Republicans pretend they fought to the bitter end to extort the president. Don't believe me? See the McConnell quote at the top of this article and replace the word "defund-" with "delay-."

John Boehner doesn't want to default on the national debt. He's said he's not willing to allow it. And lucky for him, there are enough votes in the House to pass the clean (or nearly entirely clean) debt limit bill that comes back from the Senate.

There are other ways out of this mess too. They're not as harmless for individual Senate Republicans. But if for some reason Boehner can't clear a debt limit bill on his own, one of them will prevail.

The process might be loud, it might shake economic confidence over the coming few weeks. It's in Democrats' best interest to play up the dangers and Republicans' interest to play up their craziness until the fight is resolved. But the risk of default remains extremely low.

Shares