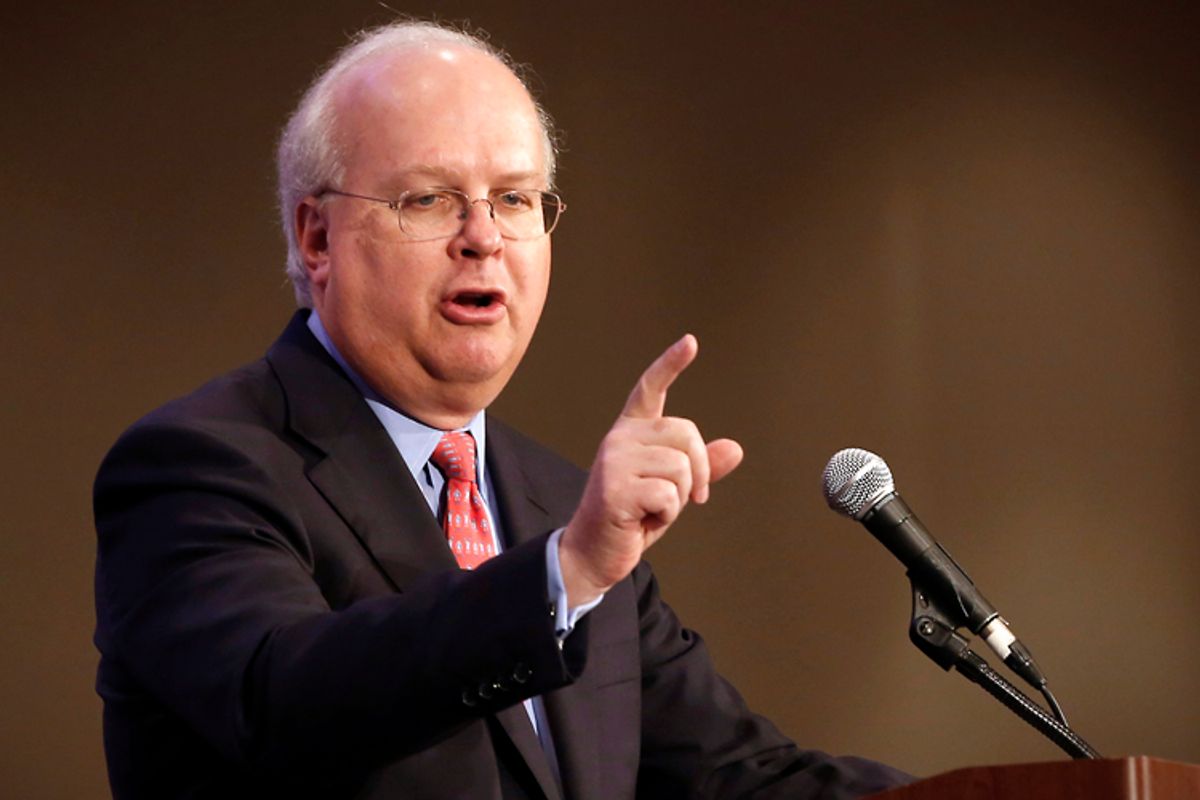

The dark money giant Crossroads GPS, launched by Republican strategist Karl Rove, told the IRS it raised almost $180 million in 2012, including one donation of $22.5 million, another of $18 million and another of $10 million. Fifty donations were for $1 million or more. Because the group is a social welfare nonprofit, none of the donors have to be made public.

The dark money giant Crossroads GPS, launched by Republican strategist Karl Rove, told the IRS it raised almost $180 million in 2012, including one donation of $22.5 million, another of $18 million and another of $10 million. Fifty donations were for $1 million or more. Because the group is a social welfare nonprofit, none of the donors have to be made public.

The details come from the group’s 2012 tax return, which Crossroads made available today at their Washington office. We picked up a copy and you can see it here.

The group also reported spending almost$75 million on direct and indirect campaign activities.

Crossroads GPS, also known as Crossroads Grassroots Policy Strategies, is the largest social nonprofit active in elections. The group was created after the Supreme Court’s 2010 Citizens United ruling opened the door to unlimited corporate and union spending on elections, to super PACs and to hundreds of millions of dollars in anonymous money.

In Crossroads’ application for nonprofit status in 2010, the group told the IRS that while it planned to spend money on elections, “any such activity will be limited in amount, and will not constitute the organization’s primary purpose.”

In the 2012 cycle, Crossroads told the Federal Election Commission it spent almost twice as much on political ads as the next most active social welfare nonprofit, Americans for Prosperity, backed by conservative billionaire brothers Charles and David Koch.

Crossroads is in the crosshairs of campaign finance watchdogs, who have criticized social welfare nonprofits for exploiting loopholes in tax and election rules to be able to pour millions from undisclosed donors into campaigns. Democrats have also targeted Crossroads for special attention. In 2012, the lawyer for President Barack Obama’s reelection campaign asked the FEC to force Crossroads to register as a political committee and disclose its donors. (So far, that hasn’t happened.)

“There is no way in the world that $20 million-plus contributions, $10 million-plus contributions, that are funding campaign ads should be kept secret from the American people,” said Fred Wertheimer, the president of Democracy 21, who has worked to rein in outside spending in politics for decades.

Social welfare nonprofits are allowed to spend money on elections, but they are also supposed to be able to prove that social welfare is their primary purpose. ProPublica has focused extensively on how many of these groups have poured much of their resources into political races.

Tax returns are one of the few places in which groups are required to detail both their revenues and expenditures and justify their social welfare mission. But the returns are often filed more than a year after an election.

About 150 of these nonprofits reported spending more than $254 million in 2012 on ads, phone calls and mailings. Most of that money — more than 85 percent — was spent by conservative groups.

Crossroads GPS and its sister super PAC, American Crossroads, provide a blueprint of how these outside-spending groups work. The Rove juggernaut gives potential donors the option of giving to a super PAC, which has to report its donors, or to a social welfare nonprofit, which doesn’t.

Some people and corporations prefer the anonymous option. American Crossroads, for instance, raised about $117.5 million in the 2012 cycle, according to the FEC, as opposed to the $180 million Crossroads GPS collected.

Both super PACs and social welfare nonprofits can accept unlimited contributions, unlike candidates and regular political action committees.

The Wall Street Journal first reported an early look at Crossroads GPS’s tax return last Thursday. (ProPublica initially asked for a copy of the group’s tax return on Thursday morning, but Jonathan Collegio, the group’s spokesman, said, “It’s not available yet.” He also said it wasn’t available on Friday, the deadline for filing the return. On Monday, Collegio said the return was available for pickup.)

In a cover letter accompanying the tax filing, Collegio positioned the group as a balance to unions and other liberal groups. “Crossroads GPS serves as a counterweight to well-funded labor unions and other far-left advocacy groups that promote more government, more regulation and higher taxes,” Collegio wrote.

He also pointed out that the group didn’t just get big contributions. It also had 1,254 small donors, who gave less than $5,000 each. (That works out to $348,361, or .2 percent of Crossroads total revenue.)

On its tax return, Crossroads justified its social welfare mission in part by saying it spent more than $74 million on public communication and building “grassroots to influence policymaking outcomes through grassroots mobilization and advocacy.” It also said it spent more than $3.2 million on research and handed out more than $35 million in grants, mainly to similarly aligned social welfare nonprofits active in politics.

Of those grants, Crossroads gave $26.4 million to Americans for Tax Reform, and $2.15 million to the Center for Individual Freedom. It told the IRS that these grants were not supposed to be spent on elections.

In the group’s statement, Collegio said the group had a ratio of 60.2 percent of social welfare spending to 38.8 percent of political spending in 2012. (It is not clear where the missing 1 percent went.)

Among the things Crossroads appears to have counted as part of its spending on social welfare are tens of millions on ads criticizing Obama in swing states in 2012.

Most of those ads stopped short of telling people how to vote and didn’t need to be reported to the FEC.

The IRS says it considers an ad to be political simply if it seems aimed at influencing an election, not just because of when it runs. But so far, despite promises to crack down on social welfare nonprofits engaged in too much political activity, the IRS has taken a hands-off approach to the groups. Its most significant enforcement action so far has been to deny the recognition of one small Democratic group and its affiliates in 2011.

In May, a scandal erupted over the IRS targeting the applications of conservative Tea Party groups for extra review, and since then, it’s not clear how — or if — the agency is going to tackle the highly charged issue. The battle will soon move to the courts. In August, Democracy 21, Public Citizen, the Campaign Legal Center and Rep. Chris Van Hollen, a Maryland Democrat, filed a federal lawsuit aiming to force the IRS to block social welfare groups from engaging in overt campaign spending.

There is another potential hurdle for Crossroads GPS. As of this month, according to the IRS website, the agency hasn’t yet recognized the tax-exempt status of Crossroads, which applied for recognition in September 2010. That’s a longer wait than faced by any of the major politically active social welfare nonprofits applying since the Citizens United decision.

Shares