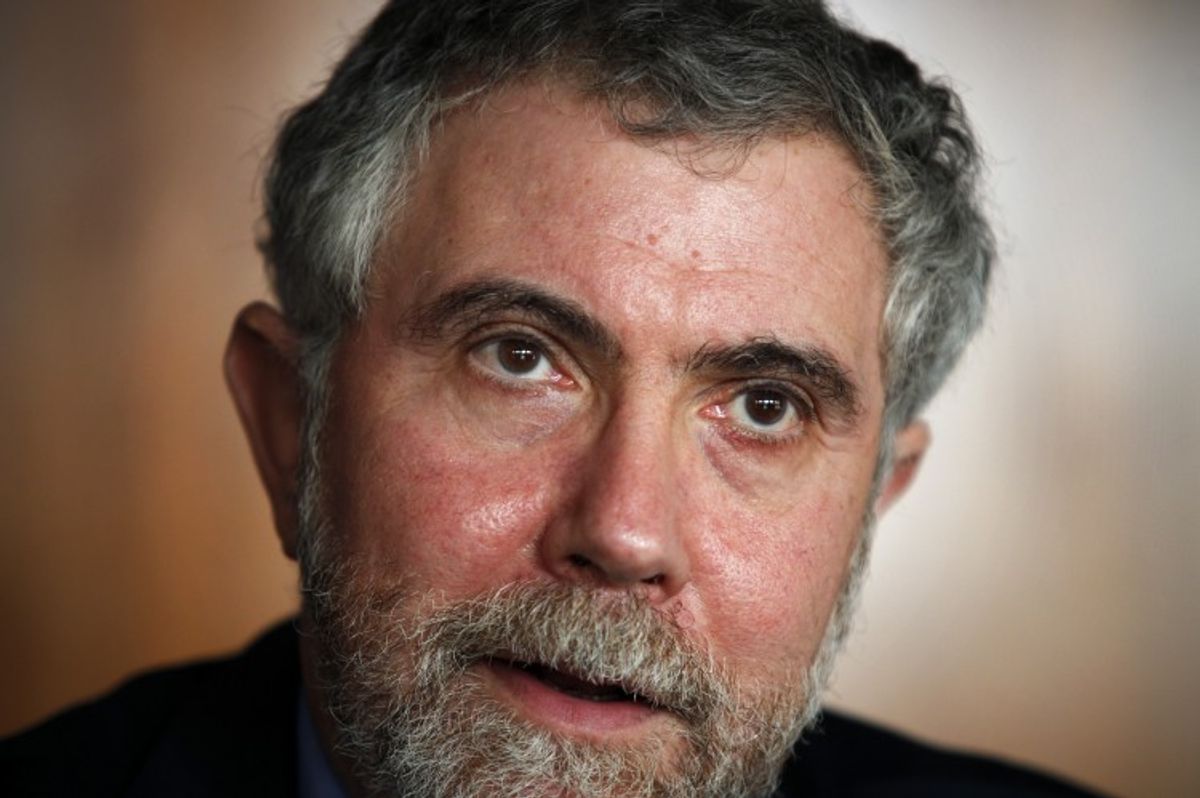

While some people may be celebrating the passage in the House of the Ryan-Murray budget as a defeat for the far right, Paul Krugman takes a look at the big picture in his latest column for the New York Times and finds little to cheer.

"[I]f you take a longer perspective," Krugman writes, referring to the Tea Party takeover of Congress in 2010, "what you see is a triumph of anti-government ideology that has had enormously destructive effects on American workers."

Krugman notes that since Republicans roared back into the House majority some three years ago, counter-cyclical federal government spending has dried up, while state-level spending has nearly "collapsed." And the areas where the cuts have been harshest have been the very same where investment is most important — both in the short- and long-term.

"We haven’t seen anything like the recent government cutbacks since the 1950s, and probably since the demobilization that followed World War II," Krugman writes. "What has been cut? It’s a complex picture, but the most obvious cuts have been in education, infrastructure, research, and conservation."

More from Krugman at the New York Times:

There are three things you need to know about these harsh cuts.

First, they were unnecessary. The Washington establishment may have hyperventilated about debt and deficits, but markets have never shown any concern at all about U.S. creditworthiness. In fact, borrowing costs have stayed at near-record lows throughout.

Second, the cuts did huge short-term economic damage. Small-government advocates like to claim that reducing government spending encourages private spending — and when the economy is booming, they have a point. The recent cuts, however, took place at the worst possible moment, the aftermath of a financial crisis. Families were struggling to cope with the debt they had run up during the housing bubble; businesses were reluctant to invest given the weakness of consumer demand. Under these conditions, government cutbacks simply swelled the ranks of the unemployed — and as family incomes fell, so did consumer spending, compounding the damage.

The result was to deepen and prolong America’s jobs crisis. Those cuts in government spending are the main reason we still have high unemployment, more than five years after Lehman Brothers fell.

Finally, if you look at my list of major areas that were cut, you’ll notice that they mainly involve investing in the future. So we aren’t just looking at short-term harm, we’re also looking at a long-term degradation of our prospects, reinforced by the corrosive effects of sustained high unemployment.

Shares