“Money talks,” Elvis Costello once observed, “and it’s persuasive.” The belief that this is especially true in the world of politics led to the passage of the Federal Election Campaign Act. In the aftermath of Watergate the FECA was strengthened in an attempt to limit the corrupting influence of money on politics, and, until 2010, the Supreme Court largely upheld Congress’s power to do so.

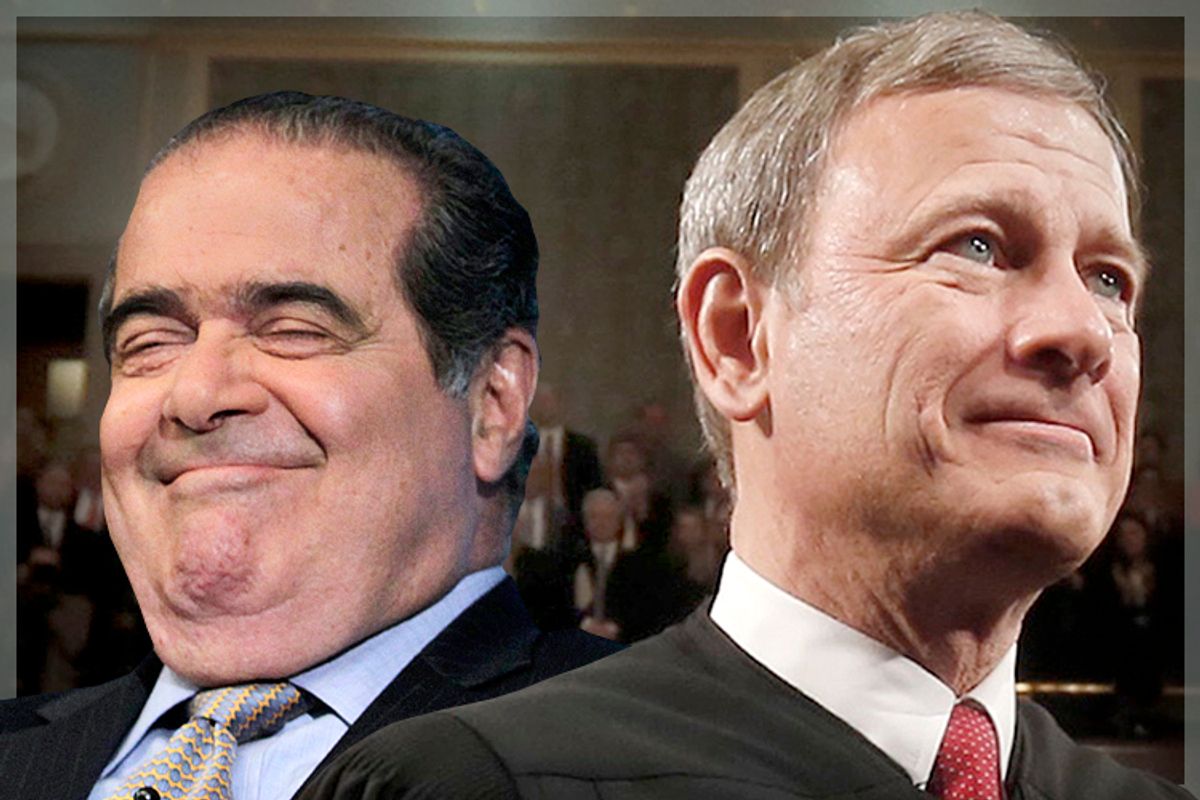

That year the Citizens United case, which essentially found that the free speech rights of corporations were more important than legislative attempts to keep money from corrupting the political process, occasioned a great deal of outrage. But that case marked merely the beginning of what is likely to prove to be a series of increasingly successful assaults on campaign finance laws.

And now, Wednesday, the next blow to attempting to keep the rich from being able to buy politicians as effortlessly as they purchase anything else has been struck by McCutcheon v. FEC, a Supreme Court case dealing with limits on how much money individuals can contribute to candidates.

McCutcheon has now struck down overall limits on individual campaign contributions. This latest outburst of judicial activism in the struggle to render campaign finance laws completely toothless is merely accelerating a historical process that is coming to seem almost inevitable.

To see why, consider the practical implications of the theory that weak or nonexistent limits on campaign finance will allow the rich to transform what is putatively a democratic republic into an unapologetic plutocracy.

If money can buy the political outcomes desired by the super-wealthy oligarchs at the apex of our increasingly unequal economy, then there are only two possible ways to avoid this result. First, we can assume that that there is a strong distinction between law and politics, that judges make legal rather than political decisions, and that legal decisions, unlike political outcomes, cannot be bought.

Or, in the alternative, we can construct a society that does not tolerate the sort of vast accumulations of individual and family wealth that would allow a tiny economic elite to buy both the legislative and the judicial processes.

Pursuing the first alternative is obviously naive. If stupendous wealth is free to buy electoral results, it will also be free to buy judicial decisions as well. And, as the outcome in Citizens United demonstrated, this will not even require anything as crude as straightforward bribery.

If the Koch brothers want the First Amendment to mean that rich people have a constitutional right to buy unlimited political influence, they and their ilk will use their wealth to eventually bring about the social and political conditions that will guarantee that five people who sincerely agree with them on this point will be sitting on the Supreme Court.

The second alternative to avoiding a frank plutocracy is (perhaps) more plausible, as it does not depend on the fiction that the judicial interpretation of our laws is not itself a political process.

Yet an important new book by economist Thomas Piketty points to a pessimistic conclusion in this regard. Drawing on hundreds of years of economic data (some of which has only recently become available to researchers) Piketty reaches a simple but disturbing conclusion: In the long run, the return on capital tends to be greater than the growth rate of the economies in which that capital is located.

What this means is that in a modern market economy the increasing concentration of wealth in the hands of the already-rich is as natural as water flowing downhill, and can only be ameliorated by powerful political intervention, in the form of wealth redistribution via taxes, and to a lesser extent laws that systematically protect labor from capital. (Piketty argues that, because of historical circumstances that are unlikely to be repeated, this sort of intervention happened in the Western world in general, and in America in particular, between the First World War and the early 1970s.)

Readers can already guess the dire conclusion that flows from combining Piketty’s theory with the plausible assumption that unregulated wealth leads to plutocracy: If the only way to avoid plutocracy would be to employ political processes that the plutocrats themselves will eventually buy lock, stock and barrel, then the only way to avoid being ruled by the Lords of Capital is to become one of them. This, in effect, is the contemporary GOP’s economic creed in a nutshell.

Shares