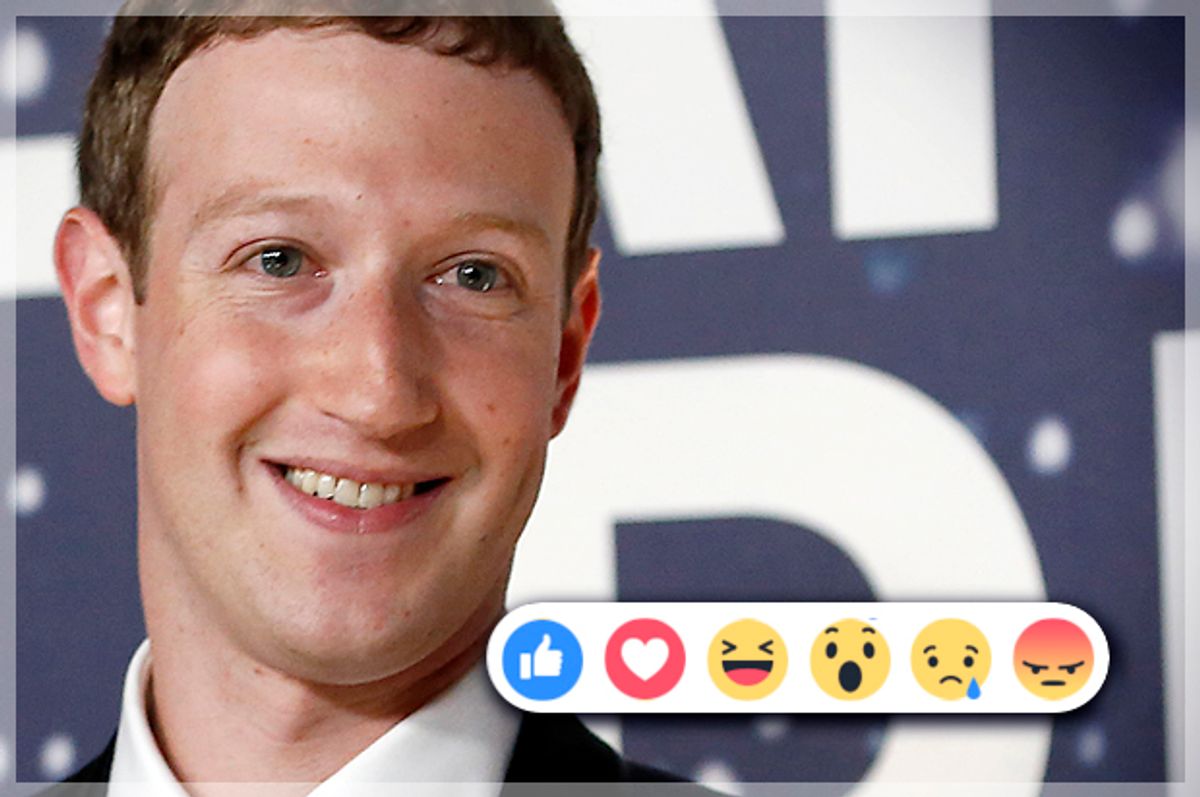

Don't blame Facebook for sending mixed messages — Mark Zuckerberg's social media giant is in an odd financial place right now: Despite posting a quarterly profit on Wednesday that wildly exceeded industry expectations, they're still bracing for impending losses, hoping their investors will do likewise, and suffering in the stock market as a result of this dour (but justifiable) outlook.

Facebook's third quarter revenue increased 56 percent to $7 billion, the company reported on Wednesday, nearly tripling its quarterly profit to $2.38 billion. Apart from companies that are growing due to acquisitions, Facebook's top-line growth rate is twice that of any American company with at least $20 billion in annual revenue.

Much of this growth can be attributed to its dominance in mobile advertising, which is incidentally the same reason experts are predicting a decline next year.

"We expect revenue growth rates will decline as we lap strong quarters," said Chief Financial Officer David Wehner during a conference call with investors on Thursday. Because Facebook will stop showing users more ads in their news feeds, they will lose a vital ingredient in the formula that has fueled their revenue growth for the past two years. With that ingredient gone, Wehner told analysts, investors should brace themselves.

"As I mentioned last quarter, we continue to expect ad load will play a less significant role driving revenue growth after mid-2017," Wehner explained. "Over the past two years we have averaged about 50% compound revenue growth in advertising. Ad load has been one of the three primary factors fueling that growth. With a much smaller contribution from this important factor going forward, we expect to see ad revenue growth rates come down meaningfully."

The stock market reacted with predictable dismay at this report. On Thursday shares of Facebook were valued at $121.42 during premarket trading, down 4.5 percent.

Shares