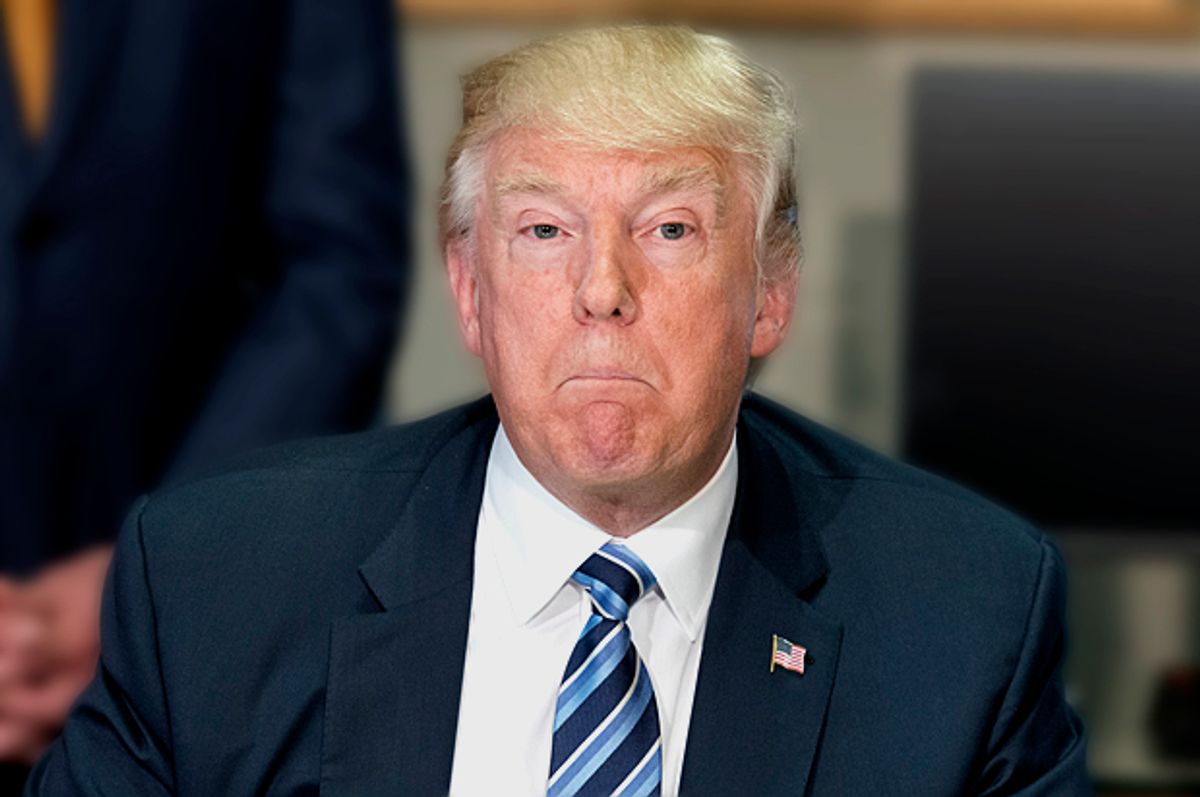

Many Republicans are concerned that President Donald Trump's ambitious tax plan will significantly increase the budget deficit, but that isn't stopping the president from pushing for a sweeping set of tax reductions.

This will include a proposed cut on foreign profits received by American companies and a reduction in the top tax rate for pass-through businesses from 39.6 percent to 15 percent, according to The Wall Street Journal. He also wants to get rid of many of the income-tax brackets for individuals, although there is still disagreement over where to set the rates. Secretary of the Treasury Steven Mnuchin is reported to want a top rate of 37 percent, while Trump pushed for a 33 percent rate during the 2016 presidential campaign.

In a concession to a cause championed by his daughter Ivanka, Trump will also push for an expanded Child and Dependent Care Credit — but that would primarily benefit the wealthy, with 70 percent of the benefits going to families with incomes in excess of $100,000.

Finally, he is proposing to increase the standardized deduction, which currently rests at $6,300 for individuals and $12,600 for families. During the campaign, Trump proposed raising it to $15,000 for individuals and $30,000 for families.

While many tax experts are concerned that all of these cuts would significantly increase the budget deficit, Finance Committee Chairman Sen. Orrin Hatch, R-Utah, told the Associated Press that he's "not convinced that cutting taxes is necessarily going to blow a hole in the deficit. I actually believe it could stimulate the economy and get the economy moving."

"Now, whether 15 percent is the right figure or not, that's a matter to be determined," he added.

By contrast, historian and Republican policy adviser Bruce Bartlett wrote in The New York Times that dynamic scoring — the system used by some Republicans to argue that tax cuts pay for themselves — is "just another way for Republicans to enact tax cuts and block tax increases. It is not about honest revenue-estimating; it’s about using smoke and mirrors to institutionalize Republican ideology into the budget process. Why six Democrats joined the Senate Republicans in this move remains to be seen."

[jwplayer file="http://media.salon.com/2017/04/36185656a0a67ee943be4f53bf50666e.mp4" image="http://media.salon.com/2017/04/3d4259759c8f43bbb0a06283403fd0c7-1280x720.png"][/jwplayer]

Shares