All eyes are on the Consumer Financial Protection Bureau (CFPB) this week. The agency’s director, Richard Cordray, stepped down on Friday, after leading the bureau in returning more than $12 billion to 29 million consumers in just six years.

Under the plain language of the Dodd-Frank Act, deputy director Leandra English is now the acting head of the agency. But Trump immediately moved to install Office of Management and Budget (OMB) Director Mick Mulvaney — who once called the CFPB a “sick, sad joke” — in the role instead, causing a clash that undermines the CFPB’s ability to do the important work of defending American consumers against powerful financial interests.

But this attempted coup is merely the latest attack on the Bureau at consumers’ expense.

Since its inception in 2010, industry lobbyists and their allies in Congress have repeatedly tried to stymie, defund and even outright kill the agency. While the bureau will surely have many more attacks to weather in coming years, attempts to weaken the CFPB only seem to drive new and passionate supporters to its defense.

Take the recent congressional fight over the CFPB rule to curb forced arbitration. This battle had all the makings of an epic David-and-Goliath showdown: an eclectic band of unlikely allies fighting for the little guy against a well-funded army of bank lobbyists.

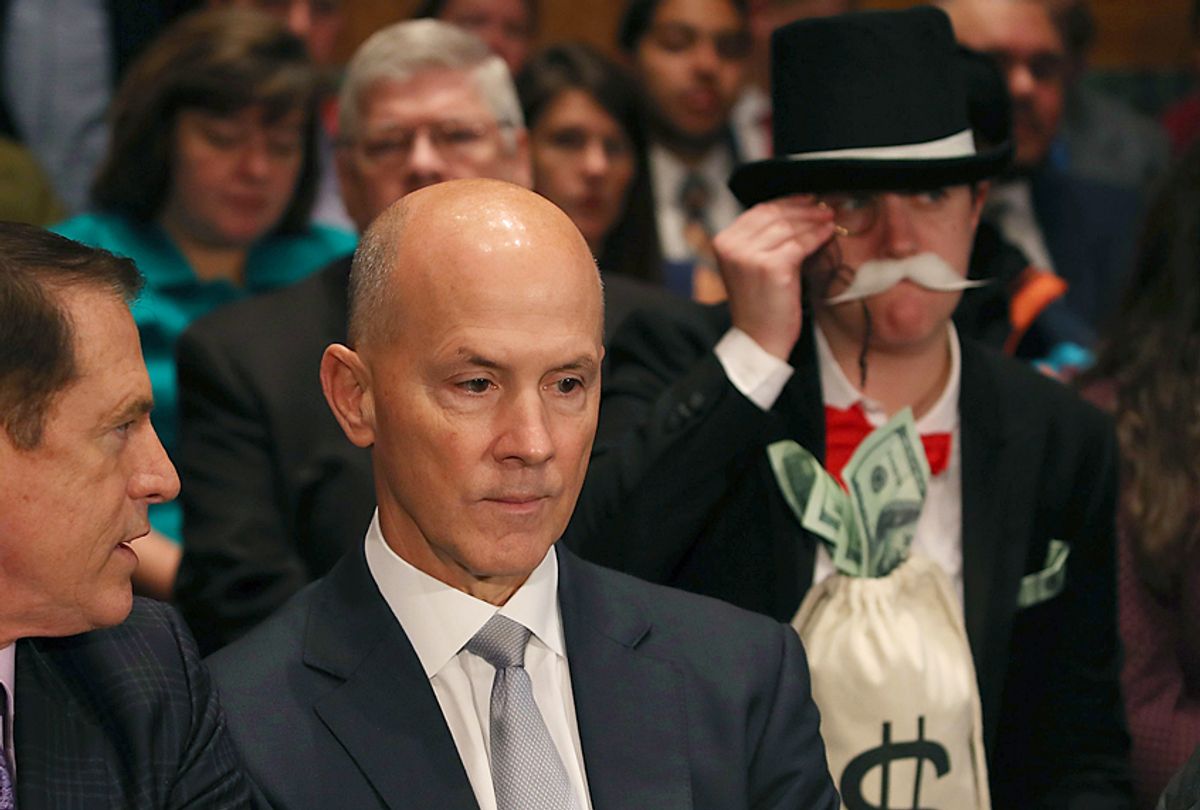

Then came a deluge of financial scandals ranging from Wells Fargo to Equifax, along with congressional hearings with ashen-faced CEOs to raise the stakes. October even saw the emergence of a viral folk hero, when my surprise photobomb as “Monopoly Man” garnered national attention just weeks before the vote.

Acting on a directive from Congress, the CFPB spent five years studying forced arbitration and carefully crafting a rule to rein in its most harmful effects. The agency found that financial giants routinely bury these “ripoff clauses” in the fine print of take-it-or-leave-it contracts to kick charges of fraud and lawbreaking out of public courts.

Consumers who've been harmed are then pushed into private arbitration proceedings, where big banks are able to handpick a firm to decide disputes in secret, and where the average consumer who goes through the process is ordered to pay their bank or lender more than $7,700.

The CFPB came up with a simple solution: Allow consumers to choose whether to bring claims in arbitration or join together with others harmed by these practices in public court.

Class action lawsuits are an indispensable tool to hold lawbreakers accountable for widespread fraud, returning $440 million per year directly to millions of consumers – after accounting for attorneys’ fees and court costs and how often such actions are blocked by forced arbitration. These actions also help root out fraud and deter misconduct. Wells Fargo profited for years by creating millions of fake accounts and shunting harmed customers into secret arbitration, where they were barred from speaking publicly about the bank’s fraudulent practices.

Equifax followed Wells’ lead in the wake of its massive data breach, effectively daring the affected consumers to file 145 million separate claims in arbitration if they expected relief. The credit bureau backtracked in response to public outcry, but Equifax’s absurd gambit laid bare the true goal of forced arbitration: No class action suits means no accountability.

That is why both financial giants — and their trade associations, led by the U.S. Chamber of Commerce and the American Bankers Association — lobbied so hard to repeal the arbitration rule.

On the other side, our band of unlikely allies fought to restore rights: a wide-ranging coalition of 370 consumer, civil rights, faith, labor and community organizations; 423 legal scholars and academics; a united front of military groups, including the American Legion, the Military Coalition and 29 others; conservative authors and organizations, including Citizen Outreach,

American Future Fund, Let Freedom Ring and Tea Party Nation, as well as nearly 100,000 individual consumers who signed petitions to oppose repeal of the rule.

This level of bipartisan agreement is rare in any congressional battle, but indicative of the broad support for consumer protections. In October, a GOP polling firm found that 67 percent of Americans supported the CFPB rule, across political affiliations. Support skyrocketed to 75 percent once respondents were reminded of the Equifax scandal.

Even so, bank lobbyists pushed to scrap these protections — on Oct. 24, a razor-thin Republican majority in Congress chose to side with their donors over their constituents. In the end, Vice President Mike Pence was summoned to the Capitol in the dead of night to cast a rare tie-breaking vote in the Senate to take away our right to sue banks that cheat us. Trump then ignored an unprecedented plea from the American Legion and other military groups to veto the resolution, and signed H.J. Res. 111 into law.

The repeal of the CFPB arbitration rule marked a truly shameful moment in recent legislative history. Yet while American consumers lost this round of the fight to hold banks accountable in court, together we demonstrated how robust the public support for that right is. Many more of us stand ready to defend and strengthen consumer protections.

This week makes clear that there will be no shortage of battles, at the CFPB and elsewhere.

Forced arbitration clauses are buried in contracts for cell phones, employment, brokers and more. Other agencies — including the Securities and Exchange Commission (SEC), the Federal Communications Commission and the Equal Employment Opportunity Commission (EEOC), among others — have the authority to restrict or ban forced arbitration within their purviews. Now is the time for them to act.

Congress must also line up behind the public and pass comprehensive legislation such as the Arbitration Fairness Act to ban forced arbitration across sectors — restoring rights in consumer disputes as well as employment, civil rights and antitrust.

The loss of the arbitration rule and the attempt to install Mulvaney should motivate all of us to fight even harder to defend the CFPB and end abusive practices like forced arbitration. With an expanded set of allies and renewed energy, we still have a shot to defeat Goliath.

Amanda Werner directed the campaign to defend the CFPB arbitration rule with Public Citizen and Americans for Financial Reform and continues to fight for corporate accountability through creative activism. Follow Amanda on Twitter: @wamandajd

Shares