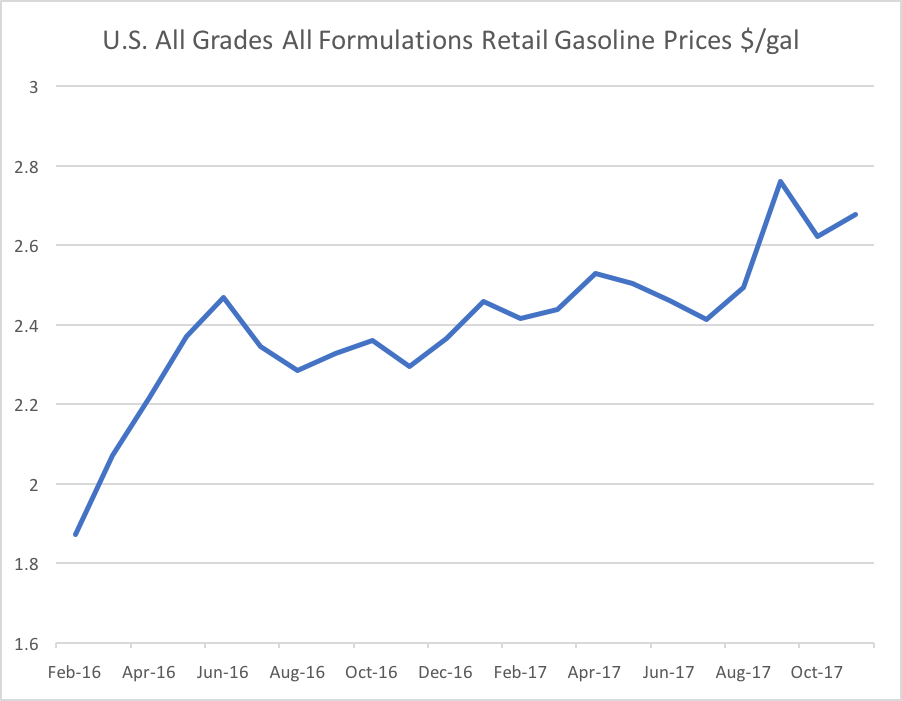

If you feel like you’ve been paying more at the pump, it’s not just the gas fumes making you hallucinate: Gasoline prices have slowly crept up over the past two years. According to the U.S. Energy Information Administration (EIA), a government agency that tracks gasoline prices, the November 2017 national average of $2.678 per gallon was over 40 percent higher than prices at the February 2016 low of $1.872 per gallon.

This isn’t exactly an historic high. You may recall back in June 2008, gasoline prices touched $4 per gallon, while from May 2011 to June 2014 they were often in the high $3 per gallon range. Yet since falling from an average of $3.76 per gallon in June 2014 down to $1.82 per gallon in February 2016 — a nine-year low — gas prices have slowly risen. Indeed, the November 2017 average of $2.678 per gallon is about 43 percent higher than that February 2016 low point.

If gas prices slowly trickle higher, is this an omen of bad economic times to come? Not necessarily, says Frank A. Wolak, the Holbrook Working Professor of Commodity Price Studies in Stanford University’s economics department. Wolak says even if gas prices continue to rise, a 1970s-style recession — in which high oil prices bludgeoned the American economy, causing rampant inflation — is unlikely to recur. Wolak told Salon that nowadays oil is primarily used for transportation fuel, whereas in the 1970s it was also used in many industrial processes that have become more flexible in their hydrocarbon requirements. “In the 1970s, a significant fraction of our electricity came from using oil to generate electricity,” Wolak says. “Now, that fraction is virtually zero.” Homes now are generally heated not with fuel oil but with natural gas, which, as Wolak noted, tends to be about 1/6th the price per BTU (a unit of heat) compared to oil. “In the 1970s, we saw the effect of rising [oil] costs as a lot of people were using it to heat their homes,” Wolak continued. “Now it’s natural gas. It’s not the same. Likewise, industrial processes that once used oil now use alternatives when oil becomes expensive.”

Even if higher oil prices aren’t likely to lead to an economic recession, they can still have an impact on everyday consumers, particularly those from lower income brackets. A 2012 article by economist Isabell Sawhill, published by think-thank the Brookings Institute, claimed that higher gas prices were “especially harmful to lower- and moderate-income households.” “Every dollar increase [in gas prices],” Sawhill wrote, “holding the number of miles driven constant, would cost these moderate- and lower-income households an extra $530 per year.” Sawhill noted that “for a family with an annual income of $20,000, this is an additional 2.7% of their total income. . . . Although higher gas prices eventually encourage consumers to cut back on driving or switch to more fuel-efficient vehicles, in the short-run they may have few options but to cut back on other expenditures in the family budget.”

A brief published by the Urban Institute, another D.C.-based think-tank, largely agreed with Sawhill’s analysis. Titled “Impact of Rising Gas Prices on Below-Poverty Commuters,” the paper notes that 64.7 percent of workers who live below the poverty line commute to work by car. “Because their incomes are much lower, poor commuters spend a much higher proportion of their wages on gas,” the article continues. “As gas prices double, the increase in costs represents a disproportionate increase in the burden for below-poverty commuters.” The authors note that if gas doubles from $2 per gallon to $4 per gallon, that increase will take “4.3 percent of income from below-poverty commuters,” but only “1.0 percent from those above poverty.”

Shares