The Republican tax reform bill is going to hit one place particularly hard that has already been harmed by President Donald Trump's policies: Puerto Rico.

The tax reform bill includes a 12.5 percent tax on "intangible assets" held by American companies abroad, as well as a minimum of a 10 percent tax on companies' profits abroad, according to the Tampa Bay Times. Because Puerto Rico is treated as both a domestic entity and a foreign one in the American tax code, the new bill means that businesses in Puerto Rico will pay a higher tax rate than those on the American mainland. The end result could very well be an exodus of businesses away from the American commonwealth — and at the very time when it is still reeling from the impact of Hurricane Maria.

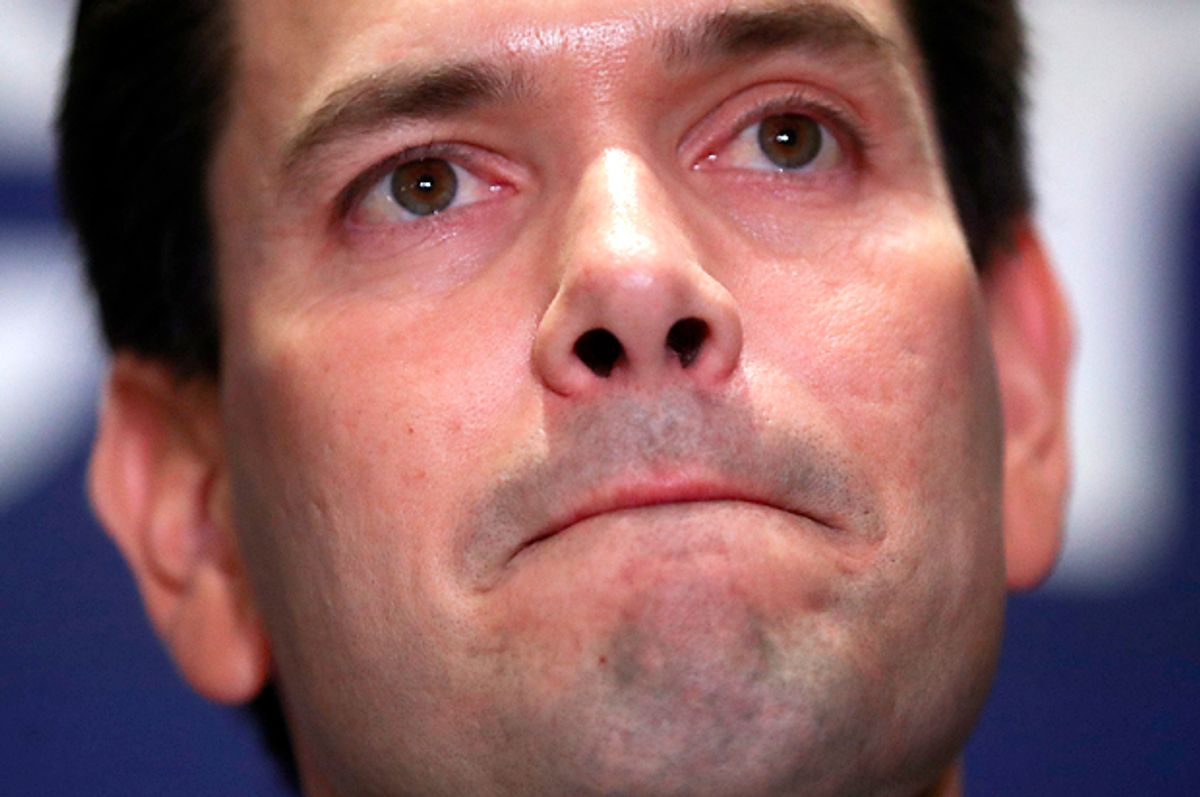

"Many senators and congressman came to Puerto Rico and they pledged their support. But when the time came to support Puerto Rico, they essentially bailed," Puerto Rican Governor Ricardo Rosselló said about the bill's impact on the island. He specifically singled out Sen. Marco Rubio, R-Fla., for supporting the measure.

"They certainly turned a blind eye, turned their back on Puerto Rico," Rosselló recently told NBC News. "It is a devastating blow to the people of Puerto Rico. Senator Rubio seemed to understand what it meant that it had a severe impact on Puerto Rico. So it is disappointing," he said.

Rubio has recently received positive press for begging his colleagues to throw scraps at the working-class in the form of an increased child tax credit in the GOP bill.

Rosselló has vowed, however, to achieve political retribution against Rubio and other congressmen who voted to raise taxes that would negatively impact Puerto Rico, according to Politico. This included telling The Miami Herald that he was "very disappointed with the fact the Senator Rubio is going to be voting for this tax bill particularly when we had the opportunity to address the potentially devastating effects on Puerto Rico."

Rubio responded by telling Politico, "Sometimes people in politics, when they feel under duress or they feel they’re being criticized for their job performance, look for someone to blame it on. I find it disappointing. He knows better than anyone how much we have done before, during and after the storm."

Rosselló responded by telling Politico, "My message was not directed at Rubio. He has opened his doors for us in the past. My disappointment was at that vote. In the larger picture there’s going to be an aftermath" as a result of the way the tax reform bill will impact Puerto Rico.

Rep. Darren Soto, D-Fla., who is of Puerto Rican descent, denounced the bill by arguing that it would cause even more Puerto Ricans to migrate to Florida. "They already have a bad taste in their mouth because of Trump, and this is going to add more salt to the wounds. With a million of us already here and 250,000 more arriving in the last two months, I would imagine that would be enough political pressure," Soto explained.

The Republican Party has in general been perceived as insensitive to the needs of Puerto Ricans in the aftermath of Hurricane Maria. By allowing a suspension of the Jones Act of 1920 to expire — a bill that only allowed American ships that were built, manned and owned by American citizens to transport goods between American ports — Trump made it more difficult for the people of Puerto Rico to receive the goods and services they desperately need for relief.

Shares