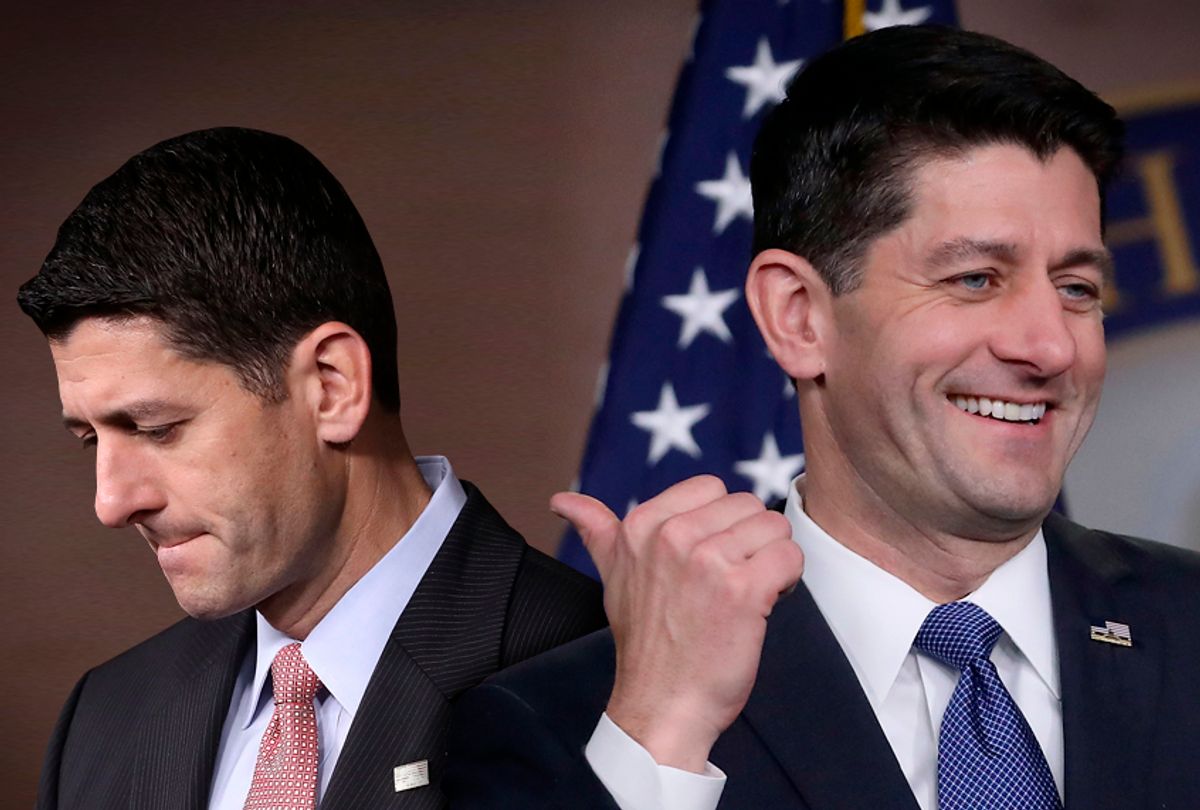

As promised, only days before Christmas, Republicans are poised to fulfill the first major overhaul of the U.S. tax code in 30 years. But instead of running a slow victory lap into the 2018 midterm elections, Republican ideologues in Congress -- led by House Speaker Paul Ryan -- appear determined to snatch defeat from the jaws of victory in the name of discredited supply-side dogma.

Even though the postcard-size tax return that President Trump promised every American won’t be coming anytime soon, Republicans are delivering on three major orthodoxies with a singular bill. In addition to a dramatic slashing of the corporate tax rate, the Republican tax bill does away with the Affordable Care Act’s individual mandate and opens the Arctic National Wildlife Refuge to oil exploration. Short of stacking the Supreme Court with eight other justices in the mold of Clarence Thomas, no single act of Congress could succinctly meet such a wide-array of long-term Republican goals.

But the plan remains wildly unpopular, and now Republicans seem about to be sucked under by the force of their own success.

Despite what Republicans have argued, the more Americans learn about the tax plan, the less they support it. According to a recent survey by Democratic advocacy group Priorities USA, in a poll of more than 12,000 voters across 20 House districts, Republican approval ratings fell an average of three points after they were “exposed to ads about the tax plan.” In an average of the last nine polls compiled by FiveThirtyEight, there is a negative 19 percentage point split between support and opposition for the bill. Americans are opposed to the bill because they think it disproportionately benefits the rich — meaning that Republican messaging on trickle-down no longer holds water.

The Republican plan cuts the corporate tax rate nearly in half. In order to pay for the permanent 21 percent corporate tax rate without increasing the deficit after 10 years, per Senate rules, Republicans allowed the tax cuts on individuals to expire. Republicans also ignored Trump’s impassioned campaign pledge to get rid of the "carried interest" loophole that allows wealthy private equity fund managers to claim a lower capital gains rate on much of their income from investments. The wealthiest small-business owners get about a 20 percent rate reduction on so-called pass-through businesses, whose profits are passed to owners and taxed as individual income.

Meanwhile, in 10 years time, tax cuts for 53 percent of Americans will expire. The whole package is a major redistribution of wealth away from the American middle class to those who are already wealthy.

In the name of deficit reduction, Republicans are already signaling their eagerness to cut the programs that help many of the same Americans that elected Trump, thereby rejecting the Two Santa Claus theory that has dominated modern Republican political economic thinking.

Journalist Jude Wanniski’s 1976 essay argued that each political party needs to be a different sort of Santa Claus, offering goods to the public in the form of services or tax cuts. Heeding Wanniski’s advice, Republicans since the days of Ronald Reagan have concentrated on tax-rate reductions over deficit reduction — and it has paid off politically. Paul Ryan appears dead set on changing that now.

A University of Chicago survey of economists found near unanimity in the opinion that the Republican tax plan would increase the debt without substantially accelerating economic growth. Yet this deficit-busting plan is likely only the beginning of more reforms that set the stage for cuts to Medicare, Medicaid and Social Security during an election year. Facing an election in which the party in power historically loses seats, such a gamble by Republicans looks like a disastrous sacrifice at the altar of ideology.

Republicans in the Senate only narrowly passed an earlier version of the tax bill on a 51-49 vote. Majority Leader Mitch McConnell short-circuited the normal legislative process for a sloppy, rushed job that ensures only the wealthy and their savvy tax lawyers can exploit the new reforms. It is as though a direct benefit to the rich donors who will fund their 2018 campaigns is Republicans' only hope when faced with a historically unpopular bill championed by a historically unpopular president.

“My donors are basically saying, ‘Get it done or don’t ever call me again,’” Rep. Chris Collins of New York famously admitted of the GOP tax plan.

Maybe that's why Republican National Committee volunteers knocked on more than 364,000 doors and made nearly 150,000 phone calls in 18 states in support for the GOP tax plan from the first week of September through last week. It will take much more campaigning, however, to help Republicans overcome their new image: The party that hands out tax cuts to the wealthy and now wants to slash Social Security.

Shares