The trade group for the payday loan industry, which profits from interest rates as high as 950% a year imposed on the poorest among us, is planning to hold its annual conference this year at Trump’s golf resort near Miami.

The trade group for the payday loan industry, which profits from interest rates as high as 950% a year imposed on the poorest among us, is planning to hold its annual conference this year at Trump’s golf resort near Miami.

The industry will have a lot to celebrate at the four-day conference in April of the Community Financial Services Association of America, which spent $460,000 on federal lobbying in 2017. The Consumer Financial Protection Bureau, our nation’s independent agency that is supposed to be a watchdog for consumers, recently announced that the bureau will reconsider a rule that could have cut industry revenue by two-thirds.

The bureau also ended an investigation into an installment lender whose PAC gave at least $4,500 in campaign donations to Mick Mulvaney, the former South Carolina congressman who is now the acting head of the bureau. The bureau also dropped a lawsuit in Kansas against four payday lending companies that charged interest rates of 440% to 950%.

“Mulvaney is inviting financial predators to help him dismantle consumer safeguards,” said Bart Naylor of Public Citizen.

Much of the payday loan rule was supposed to take effect in August 2019. It required payday lenders to determine whether the borrower could actually repay the loan with interest within 30 days while still paying basic living expenses like rent and car expenses. The loans are often due within two weeks and have annual interest rates of about 390%.

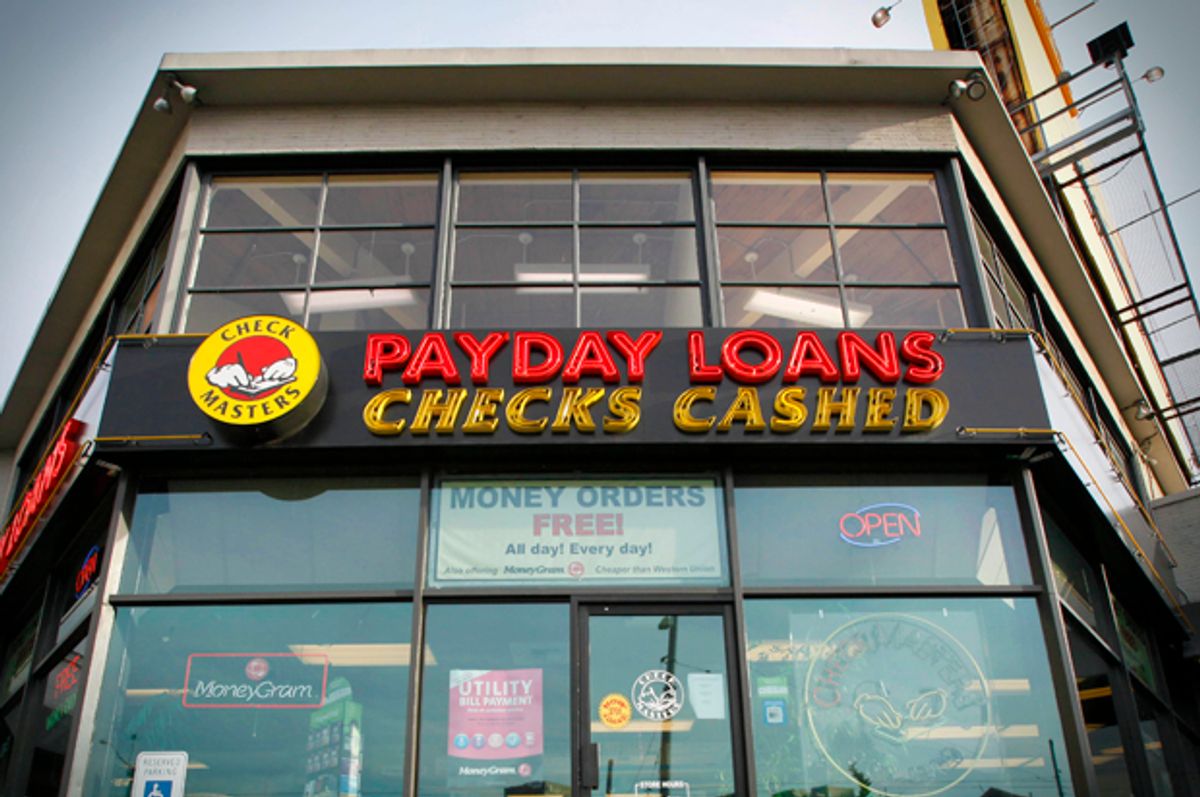

Our nation has more payday loan stores than McDonald’s restaurants — nearly 18,000. They make about $46 billion in loans each year and collect more than $7 billion in fees. Researchers estimate that about 12 million people, many who can’t get other credit, borrow from payday lenders each year.

Big banks such as Wells Fargo finance eight major payday lenders. The banks can borrow money at 0.5% from the Fed and then lend it to the payday lenders.

The rule also limited the number of times a borrower could rollover a loan. Payday loans are frequently structured with balloon payments. Borrowers unable to repay the full amount can rollover the loan, racking up hundreds of dollars in fees while still owing the original amount of the loan.

“One payday loan often leads to another payday loan and so on into a debt trap,” said Christopher Peterson, a law professor at the University of Utah who advised the bureau on the payday loan rule. “…The average borrower is taking out eight of these loans per year.”

Trump appointed Mulvaney to be acting head of the bureau, replacing Richard Cordray who resigned in November. Cordray appointed Leandra English as acting director. She has sued Trump and Mulvaney to try to block Mulvaney from running the agency. The lawsuit is pending.

Mulvaney has asked for no money to fund the agency in the second half of 2018 and has told bureau staffers to show “humility and prudence” and to not “push the envelope.”

Shares