Republicans’ corporate tax cuts aren’t getting more popular as planned — and that’s a big problem for the party.

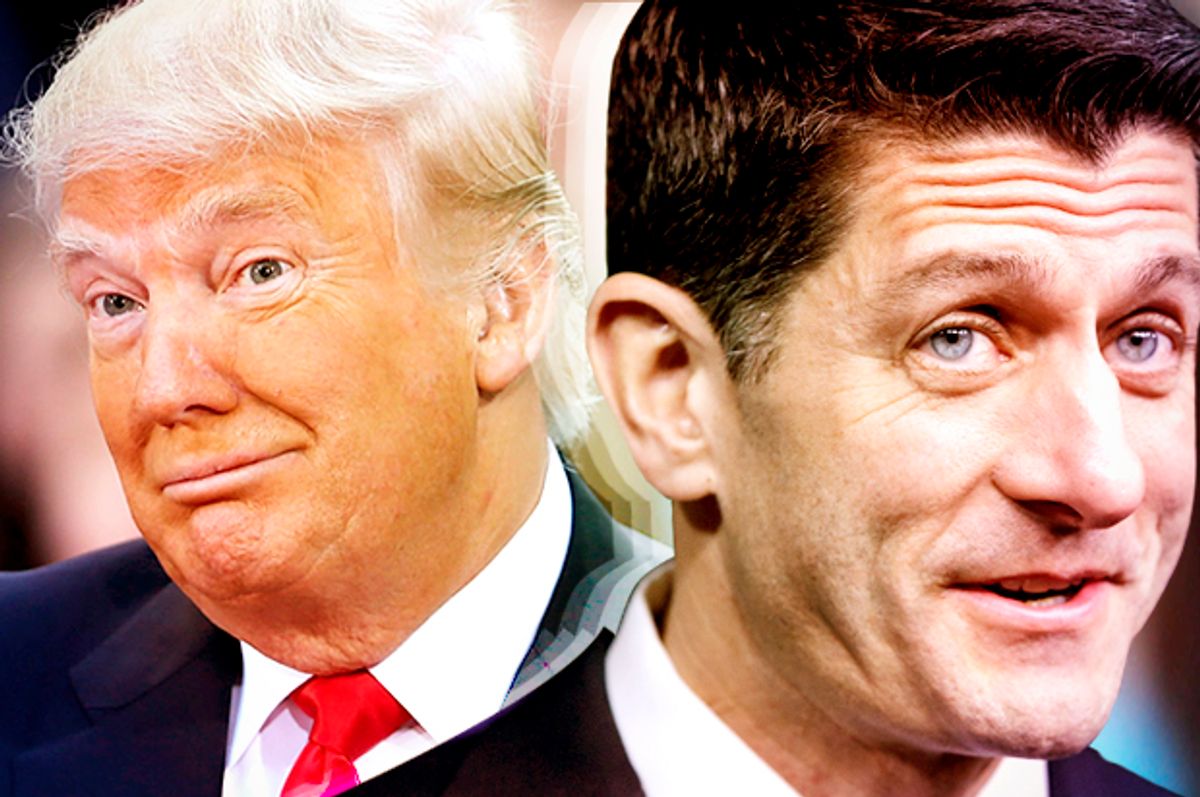

It’s been a little over two months since President Donald Trump signed the bill into law, but it’s becoming clearer each day that the GOP’s signature legislative accomplishment during their first turn at dominating the federal government in a dozen years has turned into a complete dud.

For a minute there — as Republicans rushed to publicize every temporary bonus announced by a company and attributed to the GOP tax bill, even though several had been announced months earlier — it looked like the law was a winning issue for Trump’s party.

A historically unpopular tax cut before it was passed (somehow Paul Ryan managed to make cutting taxes unpopular), the law finally gained a positive rating with a majority of Americans early last month, as the first round of workers’ paychecks reflected a modest increase in take-home pay. According to an analysis by the Tax Policy Center, "taxpayers in the middle-income quintile (those with income between about $49,000 and $86,000) will receive an average tax cut of about $900,” spread out across 52 or 26 paychecks.

Coupled with Trump’s trumpeting of the law’s supposed benefits on Twitter and Fox News heralding his supposedly remarkable leadership getting Republicans to support a tax cut, Republicans were eager to quash any talk of an impending blue wave with a relentless promotional campaign. It certainly also helped that wage growth in January accelerated to its highest level since the recession.

But then the Dow Jones plummeted by more than 1,000 points — twice. And despite the minimal pay bumps upwards of 80 percent of Americans have seen in their paycheck, most Americans still don't have any real insight into what the tax overhaul will mean for 2018’s filing. Many may be surprised to learn at the end of the year that based on the new regulations and revised withholding tables, they owe Uncle Sam. Of course, that won’t be noticed until after the 2018 midterm election — no doubt by design.

Even as American corporations were making near-record profits, Republicans insisted on spending nearly $1 trillion of the bill’s total $1.5 trillion cost to slash the statutory rate for corporations from 35 percent down to 21 percent. The percentage of the federal revenue generated by corporate taxes is now expected to drop to the lowest level since World War II.

And as predicted, much of the windfall is already ending up in the pockets of the wealthy — not workers. Warren Buffett announced that Berkshire Hathaway received a $29,000,000,000 (that's billion) windfall from the tax cut.

Many U.S. corporations are double dipping instead of trickling down, boosting their own stock prices by buying back their stocks. Almost 100 American corporations have trumpeted such maneuvers since the bill’s passage.

According to a recent Wall Street Journal analysis of S&P 500 companies, “Share buybacks announced by large U.S. companies have exceeded $200 billion in the past three months, more than double the prior year.” That is the largest amount unveiled in a single quarter, according to Birinyi Associates, a market research firm. By comparison, Republicans are touting $3 billion in bonuses so far for only about four million workers.

The New York Times further illuminates the chasm between wealthy stockholders and average workers:

[T]he vast majority of the billions of dollars in planned share purchases will benefit the richest 10 percent of American households, who own 84 percent of all stocks. The top 1 percent of households own about 40 percent of all stocks.

Of course, the individual tax cuts will expire in 2025, while the business cuts are permanent.

Corporate CEO's were surveyed before the bill’s passage about what they would do with the tax cut and they said they would not pass it down to workers in the form of increased wages or new jobs. Republicans continued to ram the bill through Congress undeterred.

Not a single Democrat in the House or Senate voted for the tax plan. Still, Democrats have stopped short of calling for a repeal of the bill. Perhaps learning a lesson from the opposition’s seven-year war against the Affordable Care Act, Democrats seem to understand that repealing a government benefit once it takes hold is far easier said than done.

Luckily for Democrats, the Republican tax law is unraveling before it really picked up steam.

The Koch brothers’ political network has already spent millions of dollars on TV ads and grassroots events to help improve the plan’s popularity. Americans for Prosperity, a political group associated with the billionaire brothers, launched an ad campaign earlier this month attacking Democratic senators who voted against the law. Yet attitudes about the law haven’t shifted to favor Republicans much.

According to a new HuffPost/YouGov survey, Americans were more than twice as likely to have seen news about bonuses — credited to the GOP tax cut — than stories about companies buying back shares of their own stock. However, only one-third of Americans think they will see an income tax cut. Even a new poll from a pro-Trump group found that nearly half of Americans believe major corporations are giving workers “crumbs” while top executives benefit from big bonuses, a fact Republicans pilloried House Minority Leader Nancy Pelosi for noting. A Quinnipiac University poll released Feb. 20 found that voters say they still trust Democrats more than Republicans to handle the issue of taxes. And perhaps most troubling for Republicans, if the election were held today, a USA Today/Suffolk University Poll finds that Democrats hold a 15 percentage-point advantage in the so-called generic ballot.

Except for an increase in stock buybacks, not much else positive will come of the GOP bill before November. If anything, the news will only get worse for Republicans. In late February, Disney workers alleged that their announced $1,000 bonuses were being used as leverage in labor negotiations. With each passing day, the myriad problems hidden within the massive law become apparent.

This time, thankfully, Democrats appear ready to pounce.

After failing to initially provide an alternative tax bill as the Republican bill was debated in Congress, Democrats have finally united to offer differing takedowns of the law ahead of this fall’s midterm.

The liberal group Tax March has coordinated a “Repeal the Trump Tax” national tour featuring leaders from the progressive wing of the party. The pitch against the law is an easy one to make in blue states, where Trump’s politics of vengeance has saddled middle and upper-income taxpayers with higher taxes after the elimination of the state and local tax deduction.

Red state Democrats already have their main talking point lined up: It’s the deficit, dummy.

“There’s portions of the tax bill that actually made sense,” Montana’s Jon Tester, a vulnerable Democrat up for re-election in a state Trump won by more than 20 points, told the AP. “But the thing is, who pays for it? And it’s our kids.”

Democratic Sen. Heidi Heitkamp, fighting for re-election in a state Trump won by nearly 40 percent, repeated a similar line when talking to the AP: “Most people in North Dakota — they don’t want to pass debt on to their kids.”

It took 8 painful years to bring down the deficit from the $1.4 trillion inherited by Barack Obama to the $0.5 trillion he bequeathed to Trump. The CBO estimates it will take only 2 years to balloon the deficit back up to $1.1 trillion thanks to the GOP’s tax cuts.

First-term Indiana Democrat Sen. Joe Donnelly laid out his pitch to voters in his red state in an interview with the Washington Post this week.

“We’ll have a thousand dollars out there. And you’ll get that. And in return — and this is the part that goes unspoken — we’re going to send your children and grandchildren and great-grandchildren the bill for that. They will pay it with interest, repeatedly, year after year after year, much of it going to the Chinese and others,” he said.

Every Democrat up for re-election — blue, purple, or red state — can run against the ultimate cost of the law — Republicans’ threats to cuts to Medicaid, Social Security and the rest of the social safety net. As Ron Brownstein notes, this was a winning strategy for Bill Clinton, who “won his epic budget showdown with a Republican-controlled Congress in 1995 and 1996 by linking the GOP’s tax cuts with its simultaneous proposals to cut Medicare and Medicaid.”

Maryland Sen. Chris Van Hollen, who leads Senate Democrats’ 2018 campaign efforts, seems to agree. He recently told the Washington Post: “It doesn’t matter if you’re a red state or a blue state, the idea of running up the debt by $1.5 trillion and cutting Medicare and Medicaid to pay for tax cuts for big corporations and the wealthy is not popular.”

Republicans, and their billionaire backers, will ramp up their boosting of the tax bill in the run-up to this fall’s election. The U.S. Chamber of Commerce is readying a multimillion-dollar ad campaign. Unable to make good on their years-long promise to repeal the Affordable Care Act, tax cuts are the only thing Republicans have to hang their midterm hopes onto.

Democrats just have to keep up the fight. It’s already working.

Shares