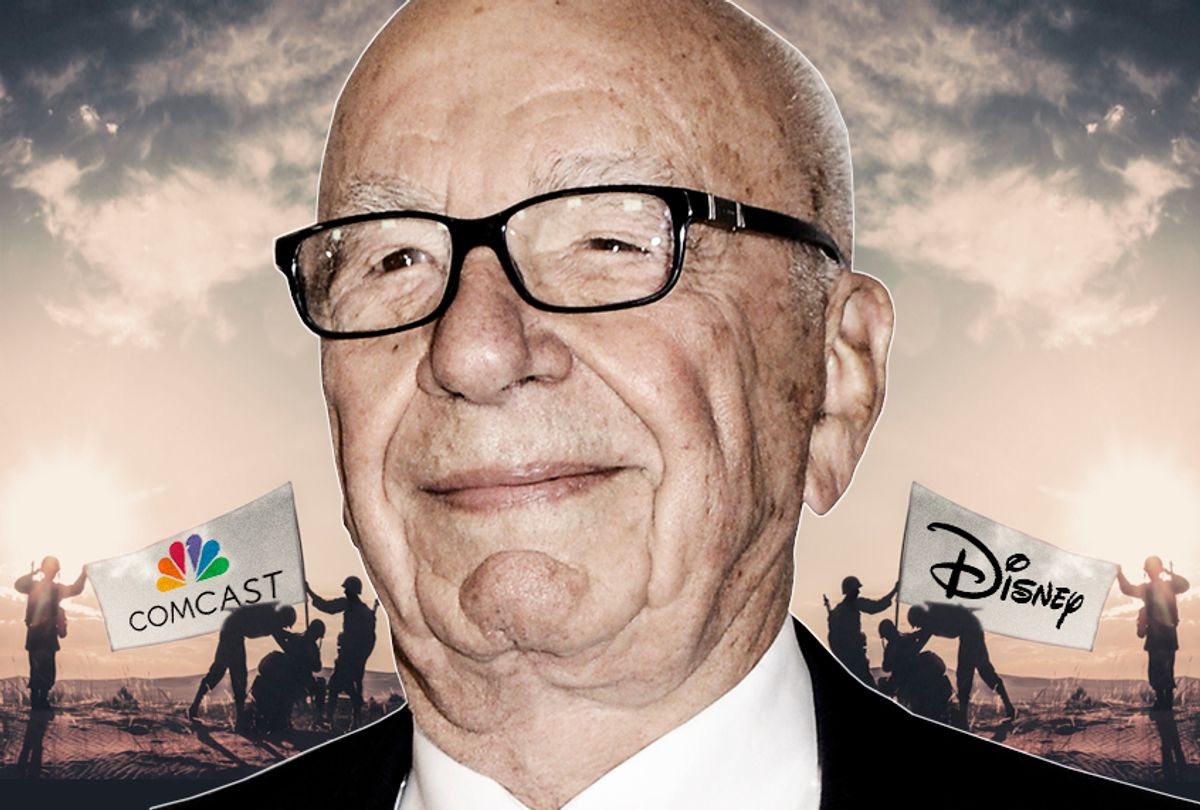

Like the nemeses from a fantasy drama, a game of thrones is playing out in the world of digital media, and by summer we could witness an epic battle erupting between titans vying for control of a media kingdom currently ruled by Rupert Murdoch.

In one part of the large and complicated map is AT&T, the world’s largest telecommunications company, which is fighting U.S. antitrust authorities for the right to buy Time Warner, the third-largest entertainment company, whose holdings include major television, news and movie assets, including HBO, CNN and TNT.

The $85 billion deal would not only give AT&T ownership of content for its 40 million video and broadband customers but also immense leverage to charge rival distributors like Verizon and Charter more for access to programming. The telecom company denies its acquisition of Time Warner would lead to higher prices, but the Justice Department and critics of the trend toward consolidation between two industries view their borders as increasingly blurry.

“Leverage matters in video content negotiations because millions of dollars change hands depending on who blinks first,” Makan Delrahim, head of the Justice Department’s antitrust division, said in court filing earlier this month.

The case has attracted unusual public attention because it will help define what kinds of deals can be made between creators and distributors of digital content moving forward. Internet service providers like Comcast, AT&T and Verizon see content ownership as the source of new revenue streams, as the price of internet services fall; they argue ISPs need content to fight upstart rivals like Netflix, Sling TV and Amazon Video.

But those new content creators are concerned that ISPs like AT&T and Comcast could favor their own media assets by throttling bandwidth of outside providers and gouging rivals for access to lucrative programming. The Federal Communications Commission’s decision last year to remove net neutrality rules, which guaranteed equal access to internet streaming, has opened the way for distributors to favor their own content over their rivals.

The Justice Department is expected to rule on the AT&T/Time Warner case on June 12, the results of which could spark a tug-of-war between two other kingdoms on the map, Comcast and Walt Disney Co., for most of 21st Century Fox.

Murdoch is selling most of his media empire in order to focus on news and sports through Fox News, Fox Business, the FS1 and FS2 sports networks, and other holdings.

Disney has offered $52 billion for Fox’s major overseas television providers, Sky of Britain and Star of India, its 30 percent stake in media streamer Hulu, nearly two dozen U.S. regional Fox sports networks, cable channels National Geographic and FX, a television production studio and the entire 20th Century Fox film library and production studios.

But if AT&T emerges victorious in its battle with the Justice Department, Comcast, which has long coveted Fox’s media holdings, could resume its efforts in a hostile $60 billion takeover bid against Disney, arguing that if AT&T can buy Time Warner, it should have the right to buy Fox. Comcast CEO Brian Roberts has said he will only challenge Disney’s bid for most of Fox if AT&T wins its antitrust case, according to Reuters.

A hostile takeover by Comcast would add to the telecom’s already formidable stable of offerings from its ownership of NBCUniversal, which includes the huge Universal Pictures film studio library, channels like E! and Bravo, and anything with “NBC” attached to its name.

Also, unlike Disney, Comcast is also a digital distribution giant with nearly 50 million video and broadband customers in the U.S. And AT&T currently doesn’t own its own content to distribute on its network, unlike Comcast.

Comcast is the largest cable and broadband service provider in the U.S. and is seeking to broaden its global reach; last month, it offered $31 billion for the 61 percent of Sky that Fox doesn’t already own. Comcast’s move almost certainly guarantees U.S. ownership of the European pay TV group (whether by Comcast or Disney) because of British regulatory concerns over Murdoch’s dominance in British media.

All of this amounts to a great big battlefield from which only a few major commanders are likely to emerge, say industry watchers.

“There will only be a handful of global, scale players,” Todd Juenger of Bernstein Research wrote in a May 9 report about Disney’s bid for Fox. “Disney and Comcast increasingly view Fox as the seminal defining point, and this the moment in time, in determining which company ascends to that role.”

Much like HBO’s series “Game of Thrones,” the digital media landscape is increasingly looking like a contest where only a small number of powerful players will emerge from the battlefields.

Shares