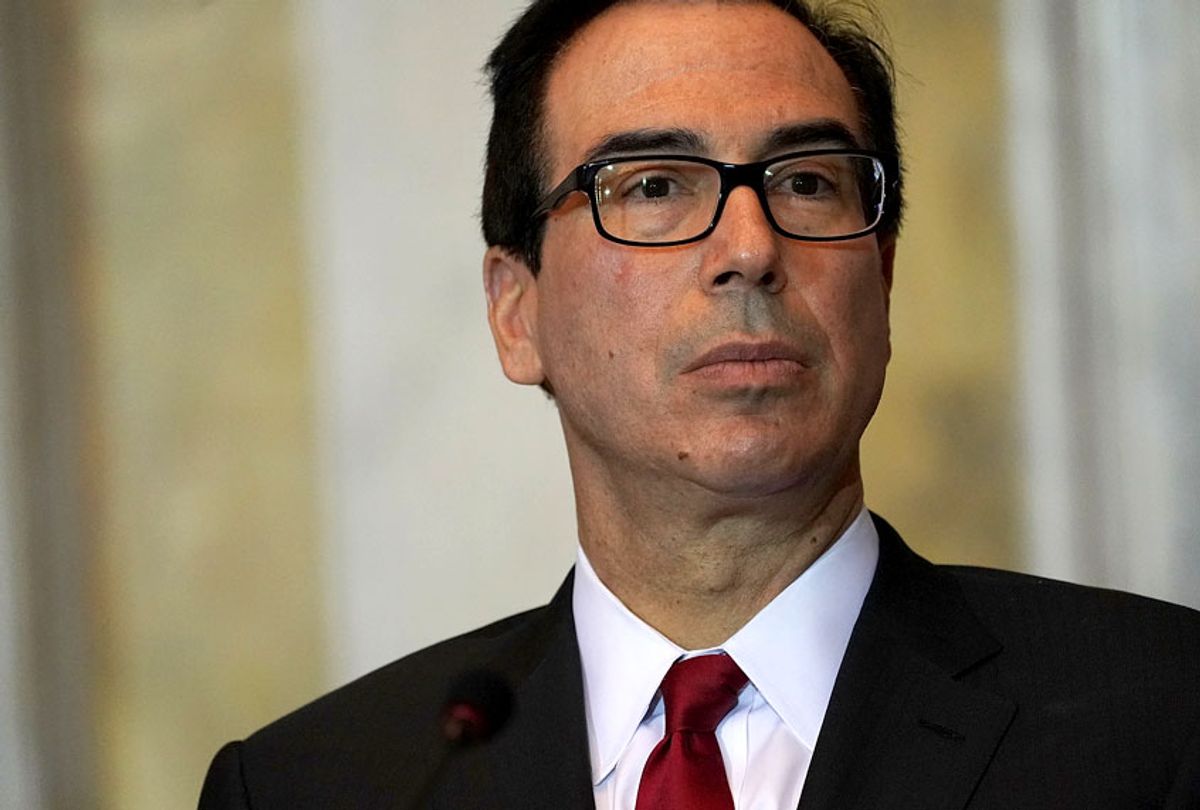

On Thursday, Pulitzer Prize-winning business writer David Cay Johnston wrote an editorial laying out the hard truth for Treasury Secretary Steven Mnuchin: he has no legal choice but to hand over President Donald Trump’s tax returns to Congress. The law says he must.

“The reason will no doubt surprise those who think Trump can thumb his nose at the law governing Congressional access to anyone’s tax returns, including his,” wrote Johnston. “It will for sure shock Trump, who claims that ‘the law is 100 percent on my side.'”

But not so: “Under Section 6103 of our tax code, Treasury officials ‘shall’ turn over the tax returns ‘upon written request’ of the chair of either Congressional tax committee or the federal employee who runs the Congressional Joint Committee on Taxation. No request has ever been refused, a host of former Congressional tax aides tell me.”

Furthermore, he wrote, there is “a law requiring every federal ’employee’ who touches the tax system to do their duty or be removed from office,” fined up to $10,000, and imprisoned for up to five years.

When push comes to shove, said Johnston, Mnuchin won’t risk it, as removal from office would financially ruin him. IRS commissioner Charles Rettig could lose his law license, as well.

But even if they do comply, said Johnston, they may still have legal problems, thanks to “the provision requiring removal from office for anyone who ‘conspires or colludes with any other person.'”

“Mnuchin has acknowledged that Treasury officials talked with White House officials. And Rettig indicated he has spoken with Mnuchin and others at Treasury,” concluded Johnston. “How many others were in the loop? Maybe Congressional hearings will tell us.”

Shares