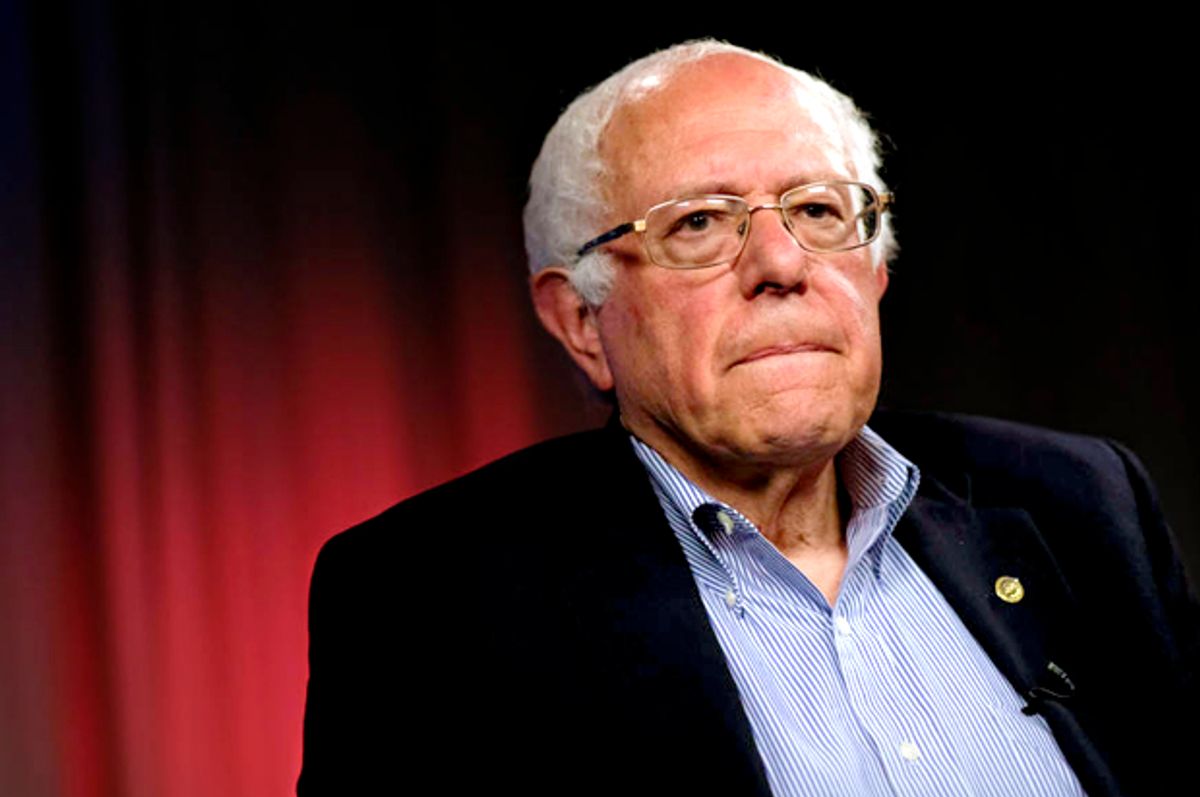

The stock market soared Wednesday in the aftermath of Sen. Bernie Sanders' suspension of his presidential campaign, a telling moment that emphasized the threat the Vermont lawmaker's bold agenda and egalitarian vision presented to Wall Street's bottom line.

As of this writing, the Dow Jones average had climbed more than 700 points following the senator's announcement.

"Sanders' exit removes the tail risk of some of his policies, immediately sets up focus on Biden vs. Trump," Ed Mills, Washington policy strategist at Raymond James, told CNBC Wednesday. "Biden's policies will get a new scrutiny now he is the presumptive nominee, but the truth of the matter is that the market will be looking towards Washington more to help the economy and much of the assistance matches his platform."

CNBC reported that the announcement from Sanders — which effectively gives former Vice President Joe Biden an uninterrupted path to the 2020 Democratic presidential nomination — combined with hopes that the U.S. economy could recover more quickly than expected from the coronavirus outbreak that crippled and paralyzed the globe.

According to CNBC:

The major averages hit their session highs after Sanders made his announcement. Some of Sanders' policy proposals, including Medicare for All, raised concern among several business owners and investors who feared taxes would go up under his presidency.

The news that Sanders was suspending his campaign was met with sadness from progressives, who mourned the end of a campaign that challenged corporate power and the supremacy of Wall Street while galvanizing a large and diverse working-class coalition into a unified movement.

Sanders, in a livestreamed speech to supporters Wednesday, vowed to continue the fight.

"We have taken on Wall Street, the insurance companies, the drug companies, the fossil fuel companies, the military industrial complex, the prison industrial complex and the greed of the entire corporate elite," said Sanders. "That struggle continues."

Shares