Hours after David Dayen reported Thursday at The American Prospect that USAA was seizing coronavirus stimulus money from veterans with accounts at the financial institution, the bank reversed course, telling Dayen in a statement that the money seized would be returned.

"For members with negative deposit account balances, USAA will pause the collection of a negative account balance existing at the time their stimulus payment was deposited for 90 days," USAA spokesman Matthew Hartwig told Dayen. "This will allow members access to their full stimulus payment to help cover the costs of rent, food and other important necessities."

As Dayen reported Thursday, while USAA's decision is welcomed, it's ultimately just one bank of many with the technical ability to seize the funds.

"Only a global solution by Treasury can ensure that the payments get into the hands of individuals struggling to make ends meet and afford basic necessities," Dayen wrote. "A bank-by-bank or state-by-state solution will ultimately not protect everyone in time."

Original story below...

The Treasury Department last week gave U.S. financial institutions the go-ahead to seize coronavirus stimulus payments to pay off individuals' outstanding debts, and one of the nation's largest banks is reportedly already taking advantage of the green light.

"USAA, the veteran-serving financial institution, took $3,400 in CARES Act payments from the family of a disabled veteran to offset an existing debt, denying the family emergency funds during a time of personal economic stress," David Dayen, executive editor of The American Prospect, reported Thursday.

Headquartered in San Antonio, USAA has a membership of around 13 million that is comprised largely of current and former members of the military and their families.

"Text messages from USAA customers show that this is not an isolated incident," Dayen noted. "In fact, USAA is using a boilerplate statement to respond to customer complaints about taking their payments."

The New York Times on Thursday also reported that USAA and other institutions are garnishing stimulus payments.

Consumer advocates warned about this possibility after Dayen revealed Tuesday that Ronda Kent, chief disbursing officer at the Treasury Department's Bureau of the Fiscal Service, told bankers in a webinar last week that "there's nothing in the law that precludes" financial institutions from seizing stimulus payments to pay off a person's existing debts.

The law Kent referenced was the CARES Act, a multi-trillion-dollar stimulus package President Donald Trump signed last month. The CARES Act authorized one-time $1,200 payments to adults who earn less than $75,000 a year. The law also approved an additional $500 for each child under the age of 17.

Carrie, a 22-year-old mother of two from Minnesota whose husband was injured while serving in the military, told the Prospect that she doesn't "know where rent is going to come from" now that USAA has seized her family's $3,400 payment.

"It was going to help my 18-month-old get her meds," Carrie said. "I'm at a loss for words, they don't care."

Common Defense, an advocacy group that represents veterans, called USAA's seizure of stimulus payments "absolutely unacceptable" and urged Congress to "make it illegal."

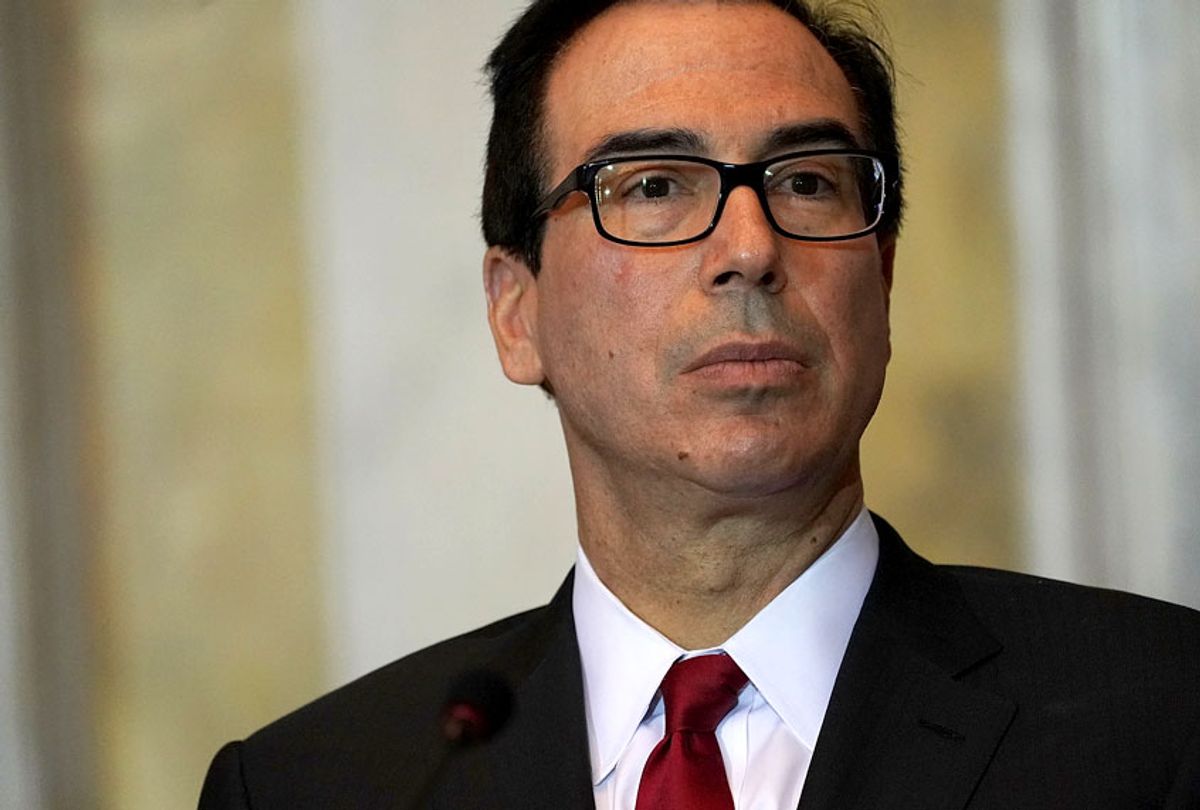

The CARES Act explicitly gives Treasury Secretary Steve Mnuchin the authority to exempt the coronavirus relief payments from debt collection by banks, but Mnuchin—a former Goldman Sachs executive—has yet to exercise that authority despite pressure from Democrats in Congress and state attorneys general.

Carrie provided the Prospect with a text exchange she had with a representative of USAA, who explained that Carrie's coronavirus payment "will be used to offset the amount owed" on a USAA account she abandoned last year. Because the IRS still had Carrie's USAA account on file, the agency sent the direct deposit there rather than to her new bank account at a different institution.

Dayen reported that Carrie said "her family did run up some debt and get overdrawn after her husband was injured. But they also experienced fraudulent use of the USAA account. The bank concluded that the family did not have sufficient proof of fraud claims, and would be liable for $8,000 in charges."

Adam Weinstein, a Navy veteran and national security editor at The New Republic, tweeted that he will cancel his USAA membership and urge his friends to do the same if the bank doesn't reverse its seizure of coronavirus payments. USAA, which is headquartered in San Antonio, has over 13 million members.

As the Times reported:

The phenomenon is swiftly becoming a political issue, with Treasury Secretary Steven Mnuchin fielding calls from senators urging him to ensure that relief money isn't garnished. Banks are legally allowed to withhold funds that go into accounts that have negative balances, and no specific provision in the CARES Act, the $2 trillion relief package that authorized the stimulus payments, prevents banks from taking customers' stimulus money to cover debts.

In a statement to the Prospect, Rep. Ilhan Omar (D-Minn.) called USAA's behavior "shameful" and urged the Treasury Department to act.

"This money was supposed to go to Minnesotans who are struggling and instead the administration is using it to help big banks who don't need the cash," said Omar. "I, along with my colleagues in Congress, are doing everything we can to put an end to this. The Treasury Department and the IRS have the authority to prohibit this cruelty, and they should."

Shares