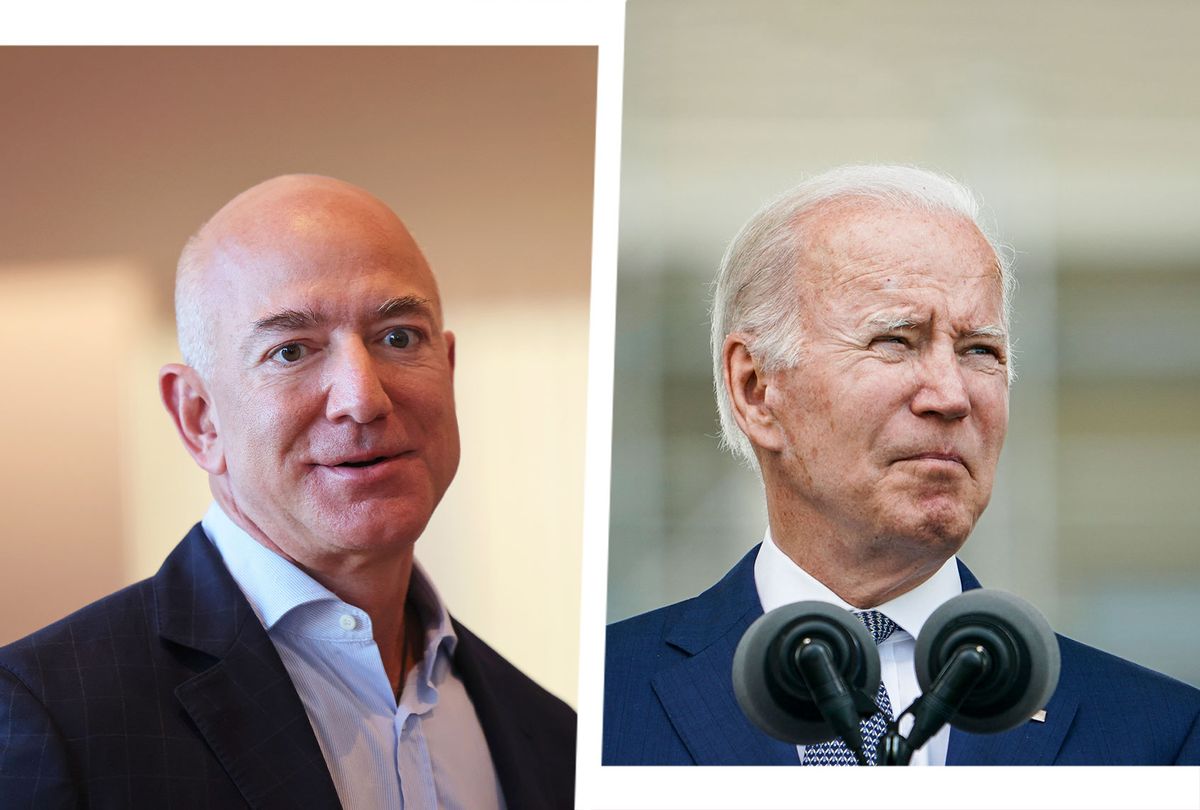

The White House clapped back at Amazon CEO Jeff Bezos on Monday after the multibillionaire criticized the president's plan to combat inflation with steeper corporate taxes, saying that "it doesn't require a huge leap to figure out why" Bezos, whose $1.63 trillion company paid no taxes last year, would be opposed to the plan.

The online crossfire began on Friday, shortly after President Biden took to Twitter by saying, "You want to bring down inflation? Let's make sure the wealthiest corporations pay their fair share."

Though Biden did not namecheck Amazon directly, his comment did not sit well with Bezos, who immediately accused the president of pushing disinformation by drawing a connection between inflation and corporate taxes

"The newly created Disinformation Board should review this tweet, or maybe they need to form a new Non Sequitur Board instead," Bezos said in response. "Raising corp taxes is fine to discuss. Taming inflation is critical to discuss. Mushing them together is just misdirection."

Bezos even praised West Virginia Sen. Joe Manchin's obstruction of his own party's anti-poverty and climate action agenda.

RELATED: Taking the Amazon union battle to the C-suite: Shareholders fight back against "higher immorality"

But the White House did not back down from the executive's criticism.

"It doesn't take a huge leap to figure out why one of the wealthiest individuals on Earth opposes an economic agenda for the middle class that cuts some of the biggest costs families face … by asking the richest taxpayers and corporations to pay their fair share," White House spokesperson Andrew Bates told CNBC.

Want a daily wrap-up of all the news and commentary Salon has to offer? Subscribe to our morning newsletter, Crash Course.

The Bezos-Biden spat comes as the price of food and fuel soars across the U.S., putting millions of working Americans at further risk of food insecurity and eviction as the nation still reels from the pandemic. The annual rate of inflation was about 8.3% ending in April, the highest it's been in 40 years. Meanwhile, Securities and Exchange Commission filings for 100 U.S. companies reveal that corporations have used inflation as a pretext for raising prices while boosting their profits.

On Twitter, however, Bezos appeared to attribute the radical rise in prices to federal spending, a talking point that Republicans have used to pin the blame on Biden.

"Remember the Administration tried their best to add another $3.5 TRILLION to federal spending," he tweeted. "They failed, but if they had succeeded, inflation would be even higher than it is today, and inflation today is at a 40 year high."

But as Salon reported back in April, many experts have told a different story, citing corporate consolidation, corporate profiteering, and deregulation as chief reasons for price increases across the board. "You don't see any correlation between inflation and the generosity of fiscal relief. Inflation is up everywhere, regardless of whether countries were stingy or generous," Josh Bivens, Director of Research at the Economic Policy Institute, told Salon at the time.

RELATED: Mitch McConnell leads Republicans in profiting off of corporate price hikes

Lindsay Owens, Executive Director of the Groundwork Collaborative, told Salon that in order to fight inflation, Biden will need to disincentivize companies from applying the profit-driven markups to their products that are causing prices to rise. (Markups represent the difference between a product's selling price and its production cost.)

"Since the pandemic, about 54% of the price increases we're seeing are coming from what we call the markup," she said in an interview, citing research from the Economic Policy Institute. "That piece gets a lot less fun and a lot less lucrative," she added, when "it's taxed back and shipped off to the Treasury."

Even Larry Summers, who attributed the inflation to Biden's fiscal spending, echoed Owens' sentiment this week over Twitter, saying that Bezos is "mostly wrong in his recent attack on the @JoeBiden Admin. It is perfectly reasonable to believe, as I do and @POTUS asserts, that we should raise taxes to reduce demand to contain inflation and that the increases should be as progressive as possible."

RELATED: Why Joe Biden is afraid to blame Big Business for inflation

Some experts have suggested that higher corporate taxes could actually lead to higher inflation. In one Washington Post article, Bloomberg Opinion columnist Karl W. Smith argued that such hikes would "reduce the profitability of new investments, further dampening the incentive to increase production." Because "less investment also leads to less supply," he added, "the net effect could be to increase inflation pressures."

However, Owens disputed this claim, citing the aftermath of Trump's decision to cut the corporate tax rate from 35% to 21% in 2017.

"We just had a big reduction in the corporate tax rate under President Trump with the Tax Cuts and Jobs Act," she said. "It didn't result in big wage increases for workers, it didn't result in a lot of additional productive investment and growth in the real economy, and it definitely didn't translate into lower prices for consumers.

Shares