Lawyers for former President Donald Trump's companies on Monday threw former longtime Chief Financial Officer Allen Weisselberg under the bus during opening statements at a criminal trial over whether the company committed tax fraud.

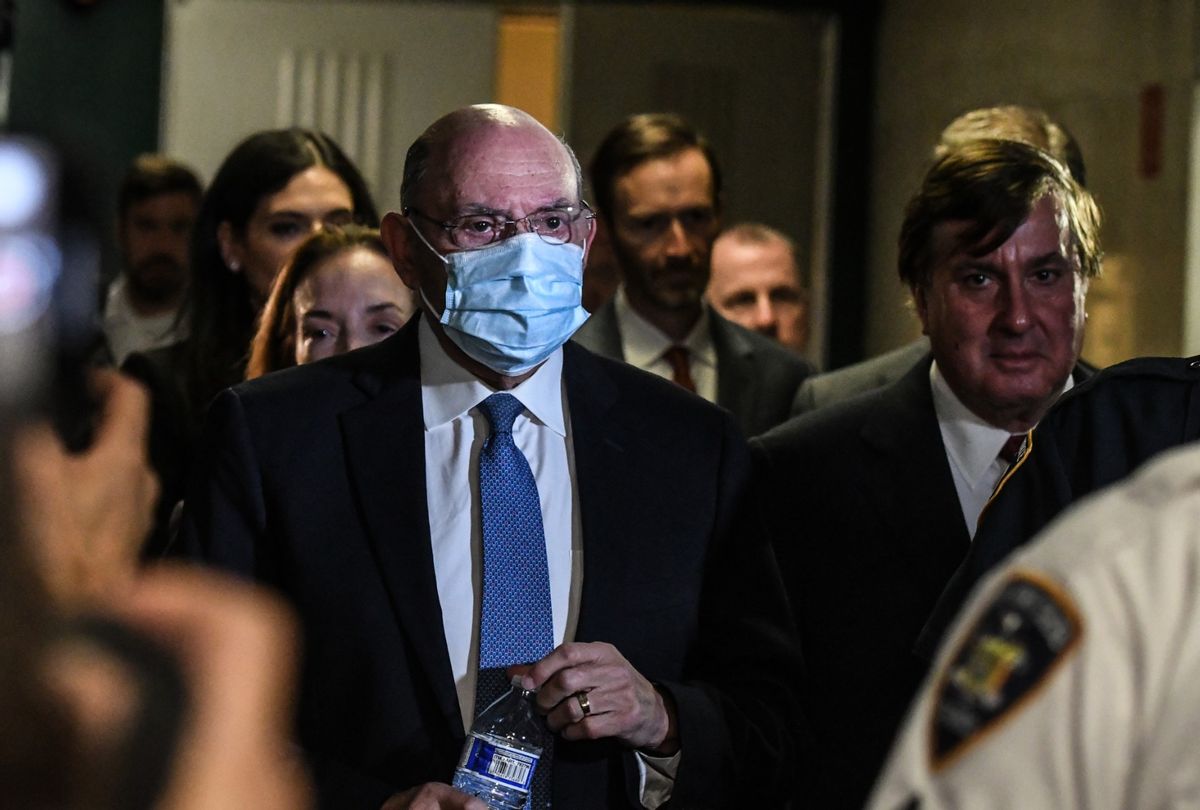

Weisselberg and two of Trump's companies were indicted in Manhattan last year after prosecutors said the company's compensation to Weisselberg included perks like apartments, luxury cars and private school tuition for his grandchildren that were never reported on his taxes. Weisselberg in August pleaded guilty to 15 charges, including grand larceny, tax fraud and falsifying business records. He agreed to serve five months in prison, pay $1.9 million in back taxes and penalties and agreed to testify at the Trump Organization's trial.

Prosecutors on Monday detailed his offenses and vowed that Weisselberg would give jurors the "inside story of how he conducted this tax scheme."

"This case is about greed and cheating, cheating on taxes," prosecutor Susan Hoffinger said in court, according to Politico. "The scheme was conducted, directed and authorized at the highest level of the accounting department."

Lawyers representing two of Trump's businesses at the trial, meanwhile, threw Weisselberg under the bus and suggested that Trump may be the real victim of the scheme.

"Weisselberg did it for Weisselberg," Michael van der Veen, a lawyer for Trump's payroll company, said in court.

Van der Veen argued that Weisselberg abused the Trump family's trust after 50 years of working for the family.

"Given the decades he was there and the projects he worked on and that he was with this family when times were good and when times weren't so good—he was trusted by everyone, he was trusted to protect this company," he said, according to Mother Jones. "He was like family to the Trump family, and no employee was trusted more than he, but he made mistakes."

He went on to claim that Trump only found out about Weisselberg's efforts to avoid taxes when he was indicted.

"You were all here during jury selection and heard the D.A. repeatedly argue that Donald Trump was involved in or even knew what Allen Weissleberg was doing," he claimed. "You will learn that Mr. Weisselberg hid what he was doing from the company and from the owners of the companies."

But Weisselberg still remains on the company's payroll, which van der Veen suggested was out of the goodness of the Trumps' hearts.

"Since his crimes were discovered, he has been treated like a close family member who made serious and even criminal mistakes," he said. "We all know the Bible story of the prodigal son—a man who put his own personal goals and desires ahead of his family's—and when it all falls apart, he is taken back in by the same family and allowed to move forward."

Want a daily wrap-up of all the news and commentary Salon has to offer? Subscribe to our morning newsletter, Crash Course.

Even though Trump signed the checks for things like private school tuition for Weisselberg's grandchildren, it was only Weisselberg's responsibility, he claimed.

"Allen Weisselberg has admitted to cheating on his taxes, his taxes!" van der Veen argued.

Susan Necheles, an attorney for the Trump Corporation, made a similar plea to jurors and argued that they should not let their opinion of the former president influence their verdict.

"You must not consider this case to be a referendum on President Trump or his politics," she said. "It started and it ended with Allen Weisselberg. Allen Weisselberg did this."

The two Trump companies are charged with nine felony counts, including criminal tax fraud, conspiracy and falsifying business records and could face a $1.6 million fine. Trump, his company and his three eldest children have also been accused of a decade-long tax fraud scheme by New York Attorney General Letitia James in a civil probe.

Trump himself has not been criminally charged in the Manhattan case but Hoffinger made clear that the alleged criminal conduct occurred between 2005 and 2017, when the companies were "owned by Donald Trump."

"The evidence will show that when Donald Trump was elected president at the end of 2016, these companies finally had to clean up these fraudulent tax practices," she said. "There was concern about extra scrutiny of these companies because of Donald Trump's election."

Hoffinger added that no one had more financial authority than Weisselberg "except for Donald Trump."

Read more

about the Trump Organization legal battles

Shares