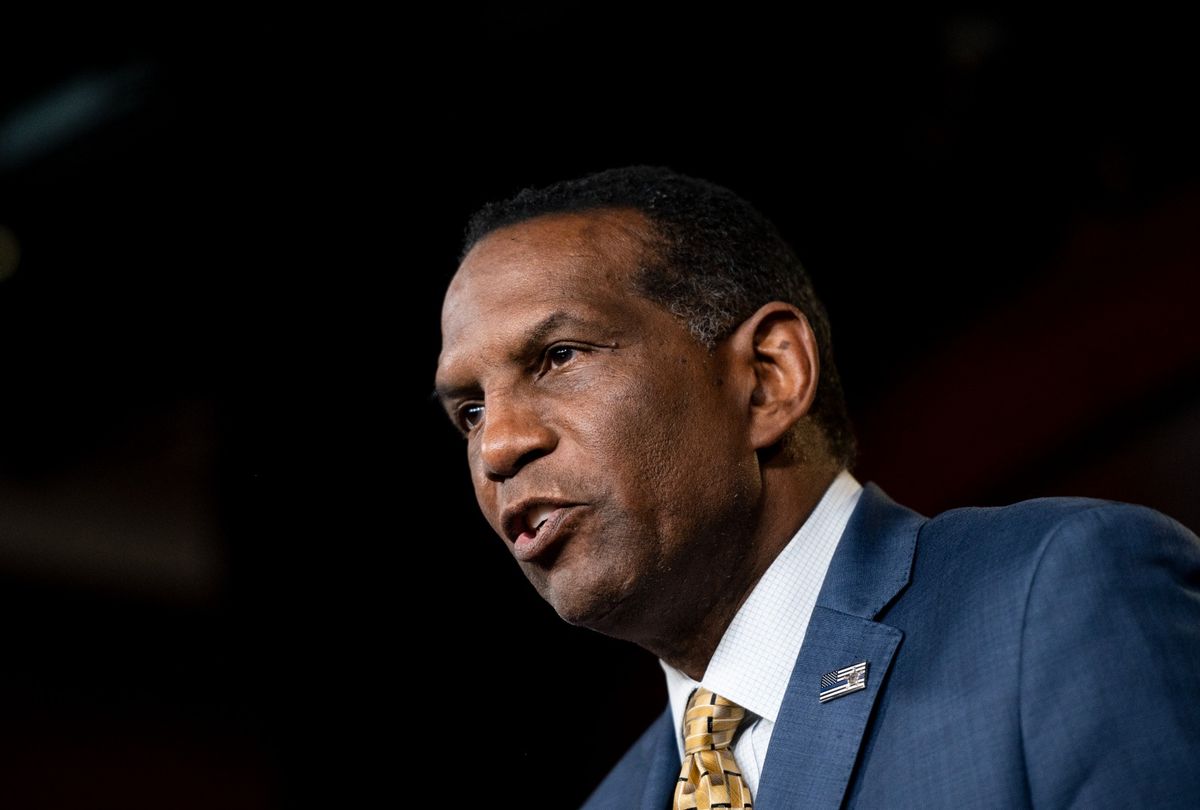

On Thursday, Rep. Burgess Owens, R-Utah, who has declared personal bankruptcy five times and had $1.5 million of his debt discharged, held a hearing aimed at attacking President Joe Biden's student debt forgiveness plan to forgive up to $20,000 of debt for borrowers.

In the hearing by the House Subcommittee on Higher Education and Workforce Development, Owens railed against the concept of student debt forgiveness, saying that it was unfair for those who pursued higher education to seek forgiveness and place the burden of their loans on the public — an argument that debt forgiveness activists have long disputed.

"Many people in this room probably have student loans. However, the blanket bailout that turns loans into target grants and saddles future generations with someone else's debt is not a solution," Owens said in his opening statement.

He railed against individuals for taking on loans that created "short-sighted, self-centered and intergenerational debt," and complained that the education that borrowers received is "low quality," perpetuating a thread of right-wingers attacking higher education for spurious reasons while disregarding the fact that the vast majority of jobs now require a college degree.

However, debt activists are pointing out that Owens is a raging hypocrite. During his first campaign for office in 2020, it was revealed that Owens filed for personal bankruptcy five times between the 1990s and 2000s. Records show he filed twice under Chapter 7 and three times under Chapter 13.

Under Chapter 13, a debtor creates a plan to repay debts between three to five years, after which point some debtors get their remaining debts discharged. Creditors then can't come after the bankruptcy filer — unlike for student debtors, who are ruthlessly hounded by creditors even when it would be nearly impossible to pay off the debt in full.

Under Chapter 7, debtors don't create a plan to repay debts but rather have non-necessary assets sold to pay off creditors. The rest of the debt is discharged, which happens to the vast majority of people who successfully apply for Chapter 7.

There aren't court records available for Owens's Chapter 7 filing in New York from 1991. However, as The Salt Lake Tribune uncovered, records show that Owens filed for Chapter 7 in 2005 for $1.7 million in debt. $200,000 of the debt was paid, and the rest, along with his three Chapter 13 bankruptcies, were dismissed — meaning, essentially, that Owens had $1.5 million in debts discharged by courts, per the Salt Lake Tribune.

Student debt is one of the types of debt that is almost explicitly carved out of Chapters 7 and 13. Some student debtors have been successful at using these methods to have their debts discharged, but it is extraordinarily difficult, and judges have even condemned people who think that it's possible; student debt used to be fully dischargeable under bankruptcy, but lawmakers changed that under Ronald Reagan in the late 1970s. (Still, debt activists encourage people to try, especially if they are facing loans that they will never be able to pay off.)

The bankruptcies weren't Owens's only financial trouble during his campaign. During his campaign, it was found that Owens had accepted at least $135,500 in contributions that were over legal limits, which amounted to about 40 percent of the funding that his campaign had on hand during the last stretch of the contested run. Later, he was handed a fee by the Federal Election Commission for failing to report $34,000 in contributions to his campaign.

Debt activists also pointed out the hypocrisy of other Republicans on the subcommittee. As the Debt Collective pointed out in a fact sheet, tuition at the University of Miami, which Owens attended on a football scholarship between 1968 and 1972, is now three times as expensive as it was when Owens graduated. The federal minimum wage then was higher than it is now, adjusted for inflation.

For Rep. Virginia Foxx (R-North Carolina), the chair of the House Education and Workforce Committee, tuition at University of North Carolina, Chapel Hill, was $310 when she graduated in 1968, or about $2,700 in today's dollars. Now, tuition there is about $7,000, or an effective increase of 258 percent. Minimum wage then was $14 in today's dollars — a large contrast to the current minimum wage of $7.25 federally and in North Carolina.

Shares