Fossil fuel projects require money — and that money is coming from the world's top private banks, including many with net-zero climate pledges. That's according to a new report from the Rainforest Action Network, which looked at the major financial institutions funding oil and gas infrastructure since the 2015 Paris Agreement.

"Banks and financial institutions need to be held accountable for their role in financing false solutions that cause serious life-threatening intensity and threats to Indigenous peoples worldwide," said Tom B.K. Goldtooth, executive director of the Indigenous Environmental Network, in a press release.

According to the report, fossil fuel companies reaped $4 trillion in profits in 2022, with 60 of the world's top banks providing $673 billion in financing. The top fossil fuel-lending bank of 2022 was Royal Bank of Canada, or RBC, which allegedly spent over $42 billion dollars funding fossil fuel projects. These included $4.8 billion related to tar sands and $7.4 billion connected to fracking. Also in 2022, RBC released a statement in which it promised to "align our lending activities with net-zero by 2050," and "help our clients transition to net-zero."

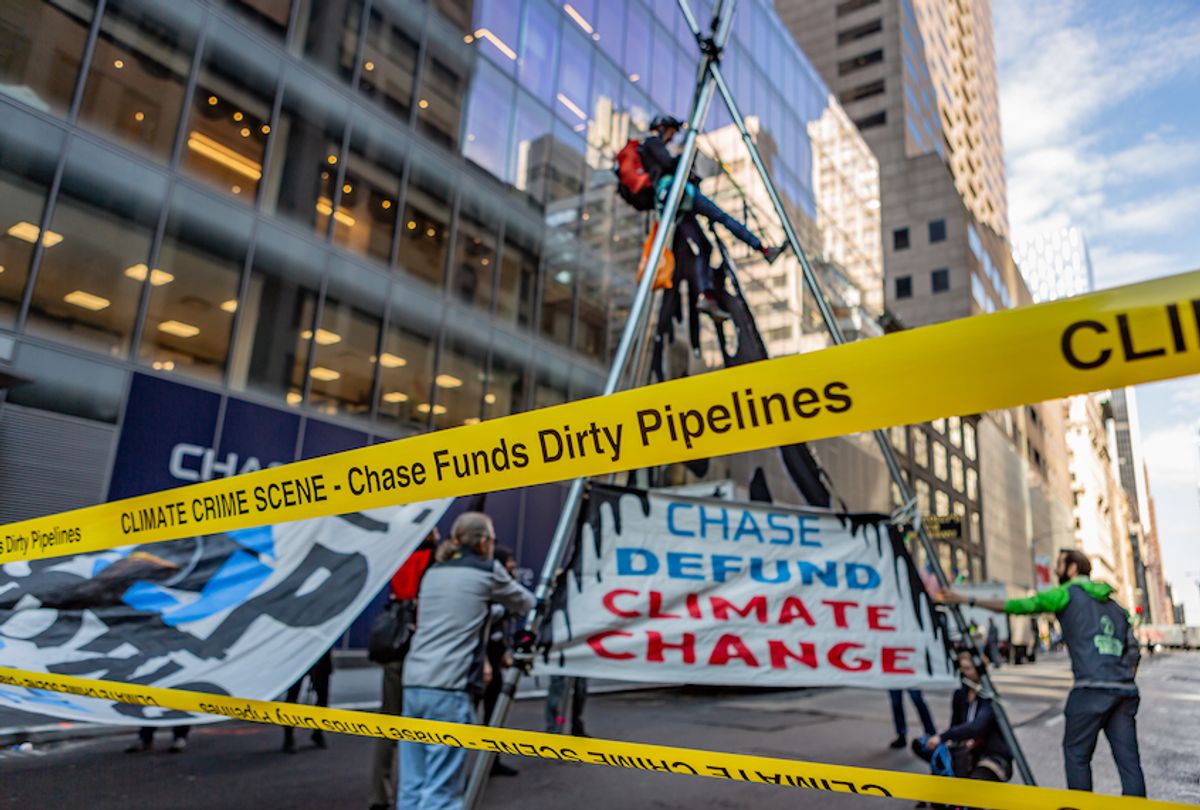

RBC was not the only major financial institution to make climate promises while still lending billions to fossil fuel companies. According to the report, 49 of the 60 banks — including JPMorgan Chase, Citigroup, Wells Fargo, Bank of America, Morgan Stanley, and Goldman Sachs — had net-zero commitments. JPMorgan Chase remains the world's top funder of fossil fuel projects since the Paris Agreement, followed by Citi, Wells Fargo and Bank of America.

In response to the report, JPMorgan Chase told the Financial Times that it provided financing "across the energy sector," including "energy security."

Gerry Arances, executive director at the Center for Energy, Ecology, and Development, told the Rainforest Action Network that banks funding fossil fuel projects are putting vulnerable habitats at risk, both as a result of increased carbon emissions and hazards associated with oil and gas infrastructure. "It's a stark reminder of the destruction that coal, gas, oil, and all other fossil fuels are capable of wreaking upon the environment and people," he said, "and banks like JPMorgan Chase and investors like BlackRock are bankrolling that destruction."

The report also listed out which banks were connected to specific fossil fuel projects, such as the Coastal GasLink fracked gas pipeline. The project, which is being built in Wet'suwet'en territory in British Columbia, is just one of many funded by RBC that advocates say jeopardize Indigenous health and sovereignty.

"Publicly, RBC spends millions on greenwashed advertising, claiming support for Indigenous rights," said Richard Brooks, climate finance director at Stand.earth told the Rainforest Action Network. "In reality, the bank is polluting our communities, bankrolling climate chaos and Indigenous rights violations to the tune of billions."

Even if these banks were able to meet their net-zero pledges, activists like Goldtooth say it wouldn't be enough: True climate action requires keeping fossil fuels in the ground, not offsetting them. "As Indigenous peoples, we are on the front lines of climate change and continue to be targeted by carbon brokers who want to enclose Indigenous lands and territories and justify more finance to the fossil fuel industries," he said.

This article originally appeared in Grist at https://grist.org/energy/banks-with-net-zero-pledges-are-among-the-top-funders-of-fossil-fuels/.

Grist is a nonprofit, independent media organization dedicated to telling stories of climate solutions and a just future. Learn more at Grist.org

Shares