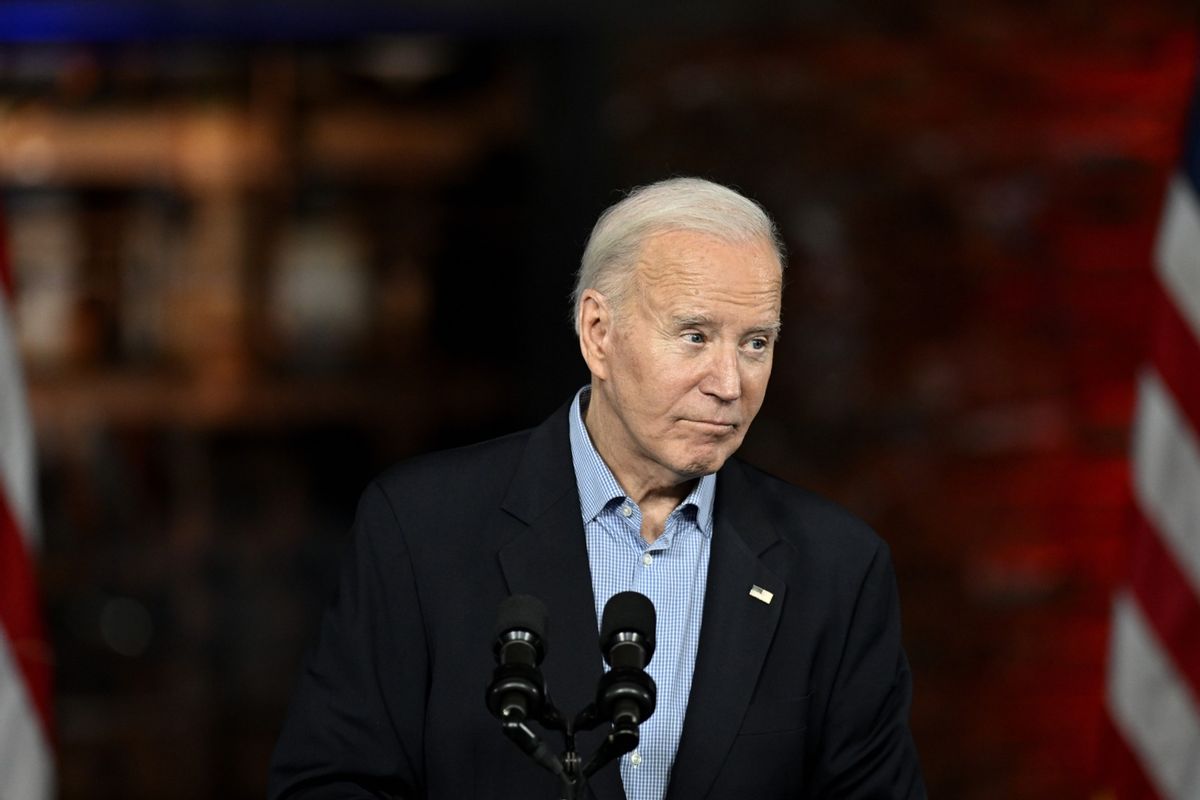

By some accounts, President Joe Biden has already missed the deadline to close a regulatory loophole — blamed for inflation and identified as a systemic risk to the global economy — without fear that Pres. Donald Trump can blast it back open.

Any time a presidency may be nearing its end, regulators scramble to finalize rules early enough that they’re not easy to undo if the other party takes control. Federal law says regulations passed near the end of the congressional session can be undone with just majority votes in the next Congress — and the signature of the next president.

Some estimates pegged yesterday, May 22, as the deadline to lock in new regulations safe from the next Congress. But the deadline also might be as late as September, because the timeline is determined, according to the Congressional Review Act (CRA), by the number of days Congress is in session, which we won’t know until the session is done.

Last month, the American Prospect took a look at the regulatory race now under way. But there’s one regulation no one’s mentioned so far that could not only curb inflation, but possibly prevent a global economic meltdown.

And the warning lights have been flashing red for more than two years.

My source for this claim is Michael Greenberger. He’s now stepping down from running the University of Maryland Center for Health and Homeland Security that he founded and led, but remains on the university’s law school faculty. I got in touch with him two years ago because of his previous job as director of the Division of Trading and Markets at the Commodity Futures Trading Commission (CFTC).

I called him after Russia’s invasion of Ukraine triggered a spike in oil prices. I wanted to know whether the spike was consistent with supply-and-demand issues.

I asked Greenberger specifically because he had raised this flag before, identifying the Enron Loophole for deregulating oil futures trading, causing oil to hit record prices back in 2008. I reported on this at the time for Countdown with Keith Olbermann. Both presidential candidates, Senators John McCain (R-AZ) and Barack Obama (D-IL), pledged to close the loophole. Obama did, and prices came down.

Was something similar happening now, in 2022?

Greenberger had said no a month before I called him, when a Senate staffer asked him the same thing. But now, by the time I came along, his answer had changed.

In fact, I was late to the game. On March 24, 2022, Public Citizen Energy Program Director Tyson Slocum had warned of “evidence of excessive [Wall Street] speculation” after two years of “an extraordinary surge in commodities market volatility.”

On April 28, 2022, The Guardian’s Antonia Juhasz wrote that once-minor blips in oil supplies were now causing outsized reactions. She quoted an industry analyst who said supply-and-demand “fundamentals have been rendered almost irrelevant.”

When I spoke with Greenberger for my report the following month, he identified one, single regulatory loophole — based on Footnote 563 of a CFTC policy statement — as the culprit. It turned out that Greenberger had already written a substantial paper on the dangers that Footnote 563 posed to the global economy.

By making hundreds of billions of dollars in bets on commodity prices invisible, Wall Street had effectively recreated a dynamic in which yet again the markets were sufficiently opaque that one shaky domino could send the rest tumbling down. Again.

Greenberger’s warning about this scenario had been endorsed by no less august a figure than former Federal Reserve Chair Paul Volcker.

With gas prices rising, Greenberger now believed that the volume of Wall Street bets was so high, those bets weren’t just threatening the future of the economy, they were already driving prices. The few traders who actually sold or bought actual, physical oil — instead of just betting on it — were so outnumbered it didn’t matter what price they set; their price would disappear along with their tiny drop of oil into the vast virtual casino without a ripple.

And it wasn’t just oil. It was everything. Agricultural products. Meat. Fruit. Grain. Minerals.

I reported all this for The Young Turks on May 11, 2022. Neither the White House nor the CFTC responded.

Others did. As I reported the following month, Rep. Ro Khanna (D-CA) and other congressional Democrats were joining various watchdog groups raising flags around Footnote 563 and its role in rising prices. Greenberger had privately advised some of the groups that gas prices could come down as much as 25% with just a few choice words from Biden to scare off the Wall Street traders.

Still, nothing happened.

Biden said he had tasked his entire administration with finding levers to pull and knobs to twiddle that might reduce inflation. Senate Majority Leader Chuck Schumer (D-NY) said in early 2022 that because of rising gas prices, Democrats were “picking up the hood and shining a spotlight on how these corporations price and function.” But “these corporations” were oil companies, not the Wall Street firms who were Schumer’s constituents. Democrats were looking under the wrong hood.

They still are. On Tuesday, the White House announced it will release a million gallons of gas from a federal reserve to ease prices as summer travel season starts. That move, however, presumes prices follow supply — at a time when the U.S is producing more gasoline than any country in history.

For example, back in October 2022, OPEC announced production cuts to drive prices higher. It would have worked if supply and demand were holding the tiller. But prices went down, just as Greenberger predicted.

Even before prices started sliding, he told me that jacking prices up too high, even with the alibi of production cuts, wasn’t in Wall Street’s interests. If the markets went totally haywire, someone would catch on and shut the party down.

When the gas companies reported record profits, I asked Greenberger whether those profits were driven by Wall Street’s use of Footnote 563 — rather than by a sudden onset of Big Oil greed, as Democrats said. “Yes,” Greenberger said.

But Greenberger was virtually the only voice blaming Wall Street, and The Young Turks was the only outlet reporting it.

Nothing happened.

One irony here is that Democrats almost killed Footnote 563 once before, under similar circumstances. It was in the fall of 2016. The CFTC thought they could finish their work during the first term of President Hillary Clinton. No one thought Trump would win.

He did, taking control of regulatory agencies after promising in his campaign to undo the Dodd Frank Wall Street reforms. Trump ordered two regulations killed for every new one enacted. Treasury Secretary Steven Mnuchin signaled that he wanted the CFTC to keep Footnote 563’s loophole right where it was.

In 2019, Trump appointee Heath Tarbert took the reins at the CFTC. A former law clerk for Supreme Court Justice Clarence Thomas and former undersecretary for Mnuchin, Tarbert did what Mnuchin wanted.

By the end of 2019, Tarbert cemented Footnote 563 in place by killing the plan to close it: “The Commission is today withdrawing the 2016 Proposal.”

Biden has had three-plus years to close Footnote 563, but he was late off the mark. He took a long time getting his CFTC nominees to the Senate Agriculture Committee, which took a long time to confirm them.

In 2022, I asked Slocum, of Public Citizen, about the prospects for killing Footnote 563. Slocum told me, “We’ll see what [CFTC Chair Rostin] Behnam is able to do.”

Slocum served — and still does — on two CFTC advisory councils. But even his pleas went unheeded.

When I spoke with him again in October 2022, five months later, Slocum told me, “We continue to have radio silence from Chairman Behnam.”

The country’s entire financial regulatory regime had found itself distracted by the shiny new object known as crypto-currencies.

So yesterday, in light of the coming regulatory deadline, I checked in with Slocum yet again: “No action by the CFTC.”

I also asked Greenberger, referring specifically to the deadline that Biden and the CFTC may now have missed to undo Footnote 563 without having to fear the Congressional Review Act (CRA) next year. Here’s what Greenberger told me yesterday:

“The Trump campaign has made it clear — and especially clear for purposes of raising campaign funds — that it wants to attract campaign funds by promising to loosen greatly financial regulations designed to lessen financial collapse or inflation. The CRA would thus become a weapon to destabilize the U.S. and world economy by giving [the] biggest banks and biggest hedge funds whatever they want to the utter hindrance of anti-inflation and systemic risk controls.”

Of course, there’s an environmental cost to lower gas prices: People will burn more fossil fuels. Biden could address that more vigorously than he has — while still lowering prices on other commodities.

And there’s still time for Biden to act. He or his regulators could do something simple by merely addressing Footnote 563 publicly. That alone would cool Wall Street’s gambling streak.

In fact, lots of Democrats could do this, with similar effect. Committee chairs. State attorneys general could contemplate investigations or lawsuits. There are many levers and knobs to pull when it comes to Wall Street’s role.

Even if a new regulation isn’t set in stone in time, putting it on the books in time would at least attach a political cost to killing it. Closing Footnote 563, however late in the game, would still force Republicans in a second Trump presidency to vote publicly on whether to let Wall Street continue driving inflation.

The final irony, of course, is that acting now on Wall Street-driven inflation might boost Biden politically enough that there won’t be a second Trump presidency.

Shares