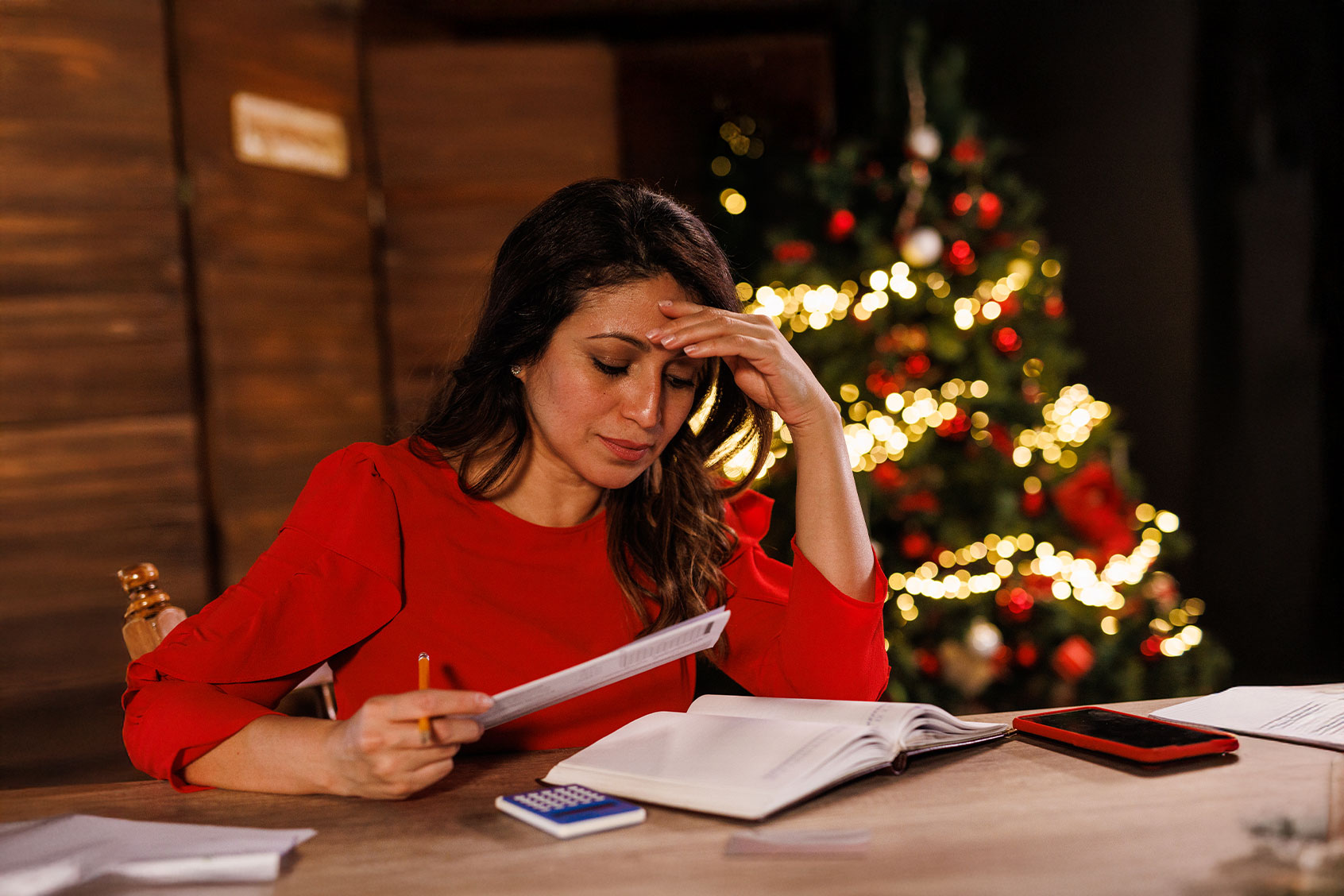

The holiday expenses of December and the fresh-start energy of January can combine to create a deep sense of financial guilt at the turn of a new year. You might be tempted to toggle from unfettered holiday spending to a restrictive mindset to punish or control yourself.

This splurge-and-restrict pattern in spending is similar to what we see with post-holiday dieting — and it’s not healthy or effective in either case.

Instead of responding to December’s extravagance with self-shaming and restriction, try these steps to recover from the holidays with a sense of peace and joy to carry you into the new year.

Reflect on your holiday spending

Start by thinking about how you used money this past holiday season. Don’t bring judgment to this reflection; just take note of where your money went.

Did you buy lots of presents or opt for a low or no-gift holiday? Did you DIY food and decor for holiday parties or order catering? Did you rack up travel costs or stay close to home?

Then note how you feel about the ways you spent (or saved) money. Does gift-giving feel like an undue burden that doesn’t give you any joy? Does opting for no gifts leave you feeling like you missed out on a vital tradition? Do you revel in the opportunity to get out of town, or is travel an expensive hassle for your family?

We need your help to stay independent

Noticing the impact of spending or not spending in certain ways can help you appreciate what money brings you instead of feeling guilty for the price tag. You can notice which kinds of spending didn’t serve you and adjust those for the future, but there’s no need to feel guilty now; this year’s experience gives you information to make more aligned decisions next year. This is how you learn!

Check in on your debt

One of the biggest impacts of holiday spending might be a big credit card bill that hits in January or February. This can derail your financial plans for months or more if you’re not expecting it.

So don’t ignore your debt — even if you’re worried about how you’ll handle it.

Before the surprise bill comes, log into your online credit card account(s) to check your balance. Note how much you owe in total on each, plus how much you’ll likely owe each month in minimum payments (which are typically around 2% of your total balance).

Just as with spending, don’t bring judgment to this task. Using debt and carrying a balance is a neutral financial choice, not a moral or ethical one. As much as our culture wants you to believe otherwise, your debt balance isn’t a reflection of your financial responsibility or your overall worthiness as a human being. Uncover your eyes, and take in this information without guilt.

Make a plan for your debt

Once you know where your debt stands, you can work through your options to deal with it.

Once you know where your debt stands, you can work through your options to deal with it

Maybe you don’t want that lingering burden and you have the resources to eliminate it — go ahead and pay off your balances in full before they start to accrue interest.

If that’s not an option, you’ll have to make a plan for how to deal with this debt in your life for the foreseeable future. Start by understanding the products you’re using.

What’s the interest rate on each of your credit cards? How close are you to reaching your credit limit? When are your payments due throughout the month? What is your minimum monthly payment? Under which circumstances will you be charged extra fees or penalties? Most of this information is required to be included on your monthly statement, per regulations from the Consumer Financial Protection Bureau.

When you have all of the information about the financial products you’re using, you understand the consequences of carrying debt. That lets you make an informed plan that’s not driven solely by fear or shame about carrying debt. You don’t have to strive to pay it off as quickly as possible if you don’t want to; you can make the debt fit into your life instead of the other way around.

Plan for next year —now

Now look ahead to the next holiday season. Based on your reflections this year, what do you want to keep, and what do you want to let go?

Are there pricy holiday traditions you’d like to eschew in the future? Start talking to your family and friends about those changes now. Plan ahead for new traditions.

Are there pricy holiday traditions you can’t imagine living without? Create a spending fund to set aside money over the next 12 months, so you have what you need by the next holiday season. Or start looking for cheaper alternatives.

Knowing what you want and planning ahead can stop you getting swept up in the waves of obligation that come with holidays. Letting go of that obligation can help you create the holiday experience you want to have — and it can help you avoid suffering financial stress over traditions you don’t even want in your life.

Read more

about personal finance