President Donald Trump has issued an executive order and a slew of appointments to govern digital assets, signaling his further alliance with an industry he and his family are invested in.

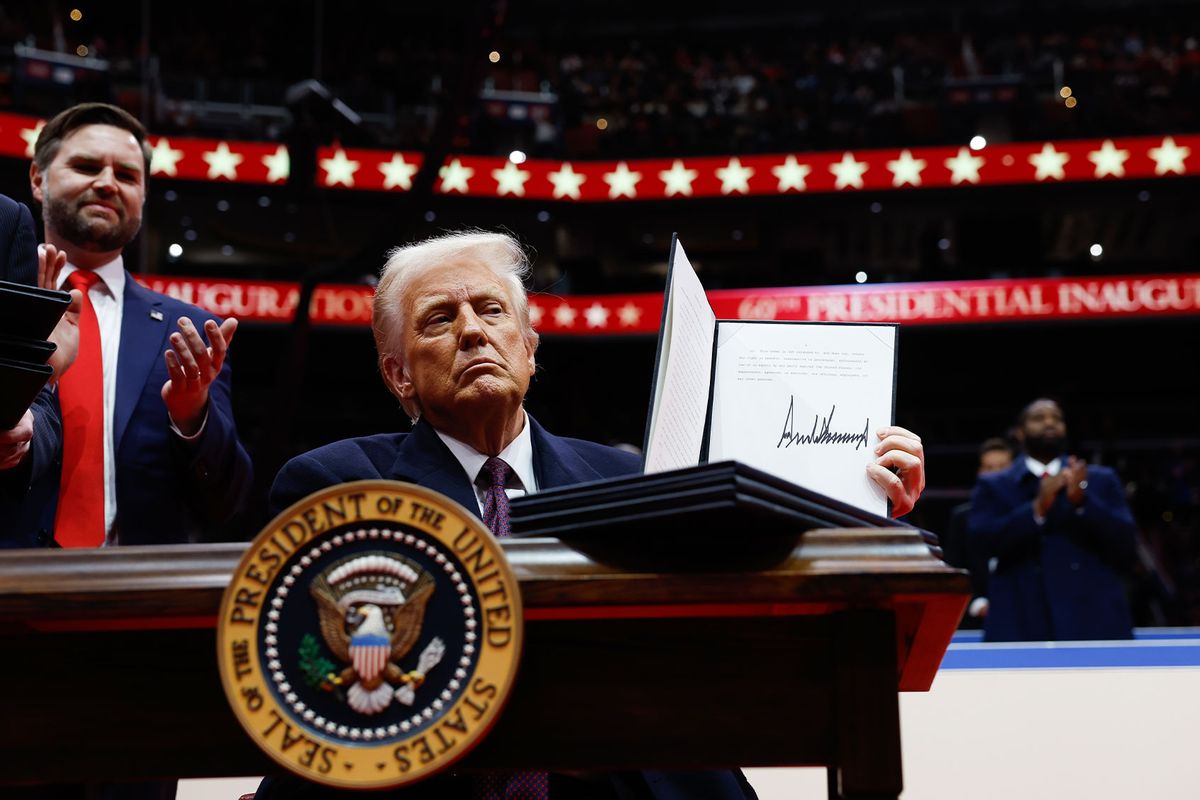

On Thursday, he signed an executive order that contained few details but was an apparent attempt to boost the development of cryptocurrencies. Crypto "might not be exciting, but it’s going to make a lot of money for the country," Trump told reporters.

The order creates a working group to establish a regulatory framework for crypto and possibly a national crypto stockpile controlled by the government. It revokes an order from President Joe Biden in March 2022 that primarily addressed national security concerns related to digital assets.

Trump's measure says the industry "plays a crucial role in innovation and economic development in the United States, as well as our nation's international leadership. It is therefore the police of my administration to support the responsible growth and use of digital assets."

It pledges "fair and open access to banking services," a reference to the industry's criticism of banks denying accounts.

Critics noted the order focuses more on issuers’ ability to introduce new digital assets, rather than protecting investors.

Alex Thorn of Galaxy Research, an analytics firm that sponsored a "Crypto Ball" to celebrate Trump's inauguration, said the measure "doesn’t accomplish everything, and is not as durable as formal rulemaking or legislation." The order does not direct federal agencies to drop lawsuits against crypto companies, or instruct the government to start buying bitcoin.

But "it nonetheless signals that President Trump was serious about moving the U.S. into a digital golden era," Thorn said in a research note.

Investments raise ethics concerns

Trump, who said in his first administration that crypto's "value is highly volatile and based on thin air," reversed course last year as he courted the crypto vote. The industry poured more than $130 million into pro-crypto candidates' campaigns, The New York Times reported.

Trump sold a series of digital trading cards, and along with his sons launched a crypto trading platform with Steve Witkoff, a co-chair of his inaugural committee and Middle East envoy. The Trumps are not owners or employees of the business, World Liberty Financial, but promote it and can receive a cut of the sales of its cryptocurrency.

In mid-November, the Financial Times reported Trump Media was in talks to buy Bakkt, a crypto trading firm previously led by Kelly Loeffler, another co-chair of his inaugural committee.

Days before his inauguration, Trump and his wife Melania began selling memecoins, a volatile cryptocurrency inspired by internet jokes or cultural trends.

A flurry of crypto appointments

Trump's agency appointments suggest the crypto industry will not face the crackdown it did under the Biden administration.

On Tuesday, Trump appointed Mark Uyeda acting chairman of the Securities and Exchange Commission, the agency that regulates crypto. Uyeda announced the creation of a crypto task force "dedicated to developing a comprehensive and clear regulatory framework for crypto assets." He will lead the SEC until Paul Atkins, a crypto advocate appointed by Trump as chair of the agency, is confirmed by the U.S. Senate.

Trump has tapped David Sacks, a venture capitalist and crypto fan, to oversee his administration's policies on AI and crypto. “The war on crypto is over,” Sacks told the crowd at the Crypto Ball, as reported by CNBC. “This is just the beginning of America reclaiming its position as the world’s innovation leader.”

Trump named Travis Hill acting chairman of the Federal Deposit Insurance Corporation. Hill immediately pledged a "a more open-minded approach to innovation and technology adoption, including a more transparent approach to fintech partnerships and to digital assets and tokenization."

Trump appointed Caroline Pham, who has been critical of the SEC’s aggressive approach to crypto, as acting chair of the Commodities Futures Trading Commission.

“We must also refocus and change direction with new leadership to fulfill our statutory mandate to promote responsible innovation and fair competition in our markets that have continually evolved over the decades,” Pham said in a statement. “It’s time for the CFTC to get back to the basics.”

Trump fulfilled a campaign promise by pardoning Ross Ulbricht, the founder of Silk Road, who had been serving a life sentence since 2015 for operating an illicit online marketplace that facilitated over $200 million in bitcoin-based transactions, Reuters reported.

On Thursday, Senate Banking Committee Chair Tim Scott (R-South Carolina) named U.S. Sen. Cynthia Lummis (R-Wyoming) the “first-ever chair of the new Senate panel devoted to digital assets.”

Read more

about personal finance

Shares