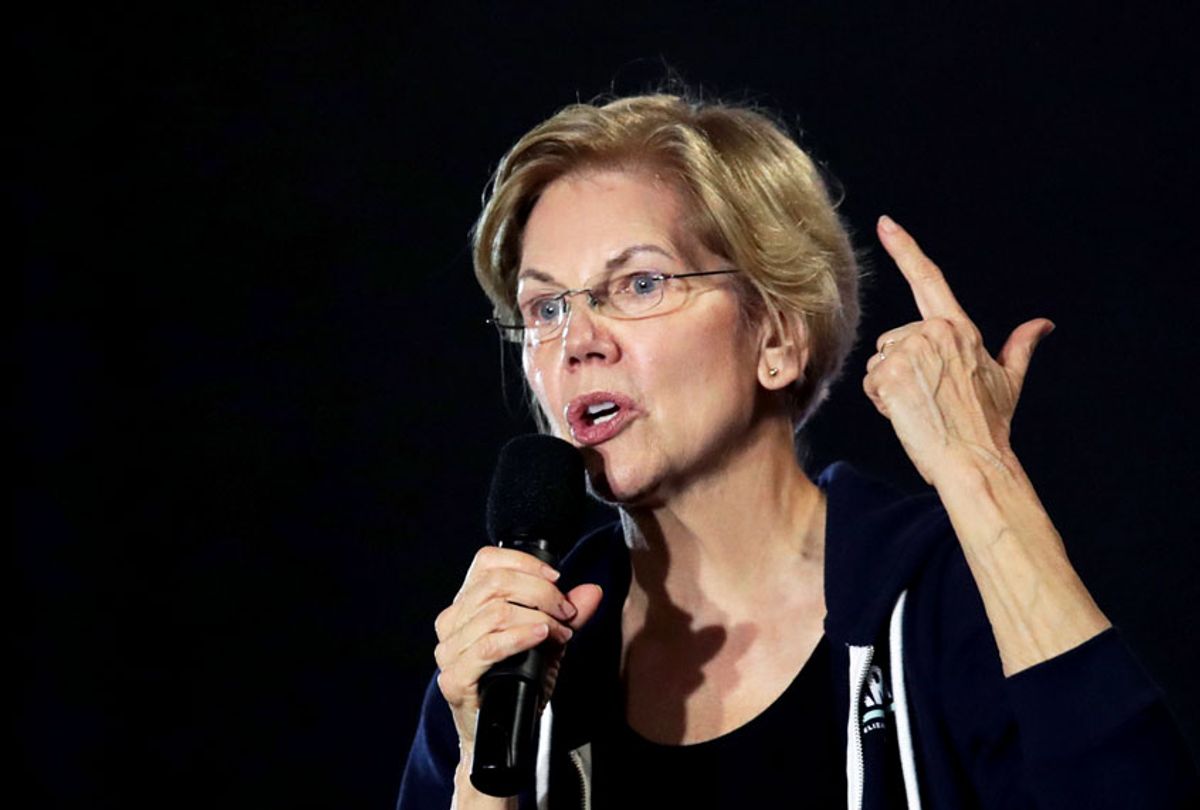

The 2020 Democratic primary elevated the student debt debate to the national stage and has sparked discussion at dinner tables and workplaces across the country. Americans are asking themselves and the candidates: how much student debt should we cancel, and how shall we cancel it? Sen. Bernie Sanders wants to cancel it all — and has introduced legislation to do so. Sen. Elizabeth Warren wants to cancel up to $50,000 in debt for households making less than $250,000 on Day 1 of the next administration. Warren recently updated her plan to clarify that she will use executive authority to cancel student debt, without needing to wait for Congress to act.

This debate — over how the government should cancel student debts — is not without precedent. The fight by former students of for-profit colleges to secure the debt cancellation they are owed by law provides a key example of why past administrations' approaches to debt cancellation fell short. Their fight teaches us how to make sure students don't get left behind in the future.

Beginning in 2014, lawmakers, law enforcement, advocates and students alike urged the Department of Education to do one thing: cancel the debts of former students of a predatory for-profit college en masse. Corinthian Colleges, Inc. was a massive for-profit college chain that collapsed into bankruptcy in 2015. The school was investigated by law enforcement and sued by the Consumer Financial Protection Bureau for predatory student loans. (The Bureau won the lawsuit in a default judgement.) This is significant because when a school breaks the law a borrower is entitled to have their federal student debt cancelled according to a 1990s regulation called "Borrower Defense."

Armed with that knowledge, former students of Corinthian organized with a group called The Debt Collective — and went on strike against their loans. The Debt Collective built a web application that allowed tens of thousands of former borrowers to apply for cancellation with the Department. Students and advocates alike thought the government should cancel the debt of all former Corinthian students. After all, both then-California Attorney General Kamala Harris and the U.S. Department of Education itself had found the school broke the law. And these students had faced years without job prospects (since the education they received was largely worthless), debts they could not repay, ruined credit, reduced earnings and lost precious time they could not get back.

In 2015, the National Consumer Law Center led an effort to create a petition outlining the many avenues of legal authority available to the Department to cancel the debts of Corinthian students in bulk. Student organizers with the Debt Collective traveled to D.C. to meet with Department officials and ask them to cancel all outstanding Corinthian debt — but the Obama administration declined to do so.

Instead of cancelling this debt in bulk, they took a slow, burdensome, bureaucratic path. They required students who were defrauded to apply, one by one, for debt cancellation. They created several formal processes for applying for Borrower Defense — the regulation that entitles a borrower whose school broke the law to pursue federal student loan cancellation. And they re-wrote the Borrower Defense regulation itself — making protections stronger in some places. But taking a more moderate, piecemeal approach instead of cancelling debts for large groups made these defrauded borrowers deeply vulnerable in the event that a more hostile administration took over.

By 2016, following over a year of advocacy and negative headlines for the Department of Education for its lack of action, former students of Corinthian began to receive debt cancellation, and finally had a chance to restart their lives. Tens of thousands more students were still awaiting decisions on their debt cancellation requests. Then, Trump won the 2016 election.

Since Betsy DeVos took over the Department of Education, she has utterly frozen even the moderate approach the Obama administration took to cancelling the debts of defrauded students. When she was forced by a court to formally execute 16,000 debt cancellations previously approved by the Obama administration, she took the time to write at the bottom of the authorization that she did so "with extreme displeasure." Since then, Betsy DeVos has stopped granting any new debt cancellations for those whose applications were still outstanding — except when lawsuits have forced her to do so. As of September 2019, 223,569 borrowers are waitingin limbo, their lives on hold as DeVos refuses to cancel their debts, even though Corinthian and ITT Tech (where the majority of the applicants went to school) have long since collapsed into bankruptcy.

DeVos hasn't stopped there: She gutted the Obama administration's update to the Borrower Defense rule and made it nearly impossible for anyone to utilize it. By the Department's own estimate, when their new rule goes into effect, even when a college breaks the law, only about 3 cents of every dollar borrowed will be forgiven after the DeVos revisions to the borrower defense rule. DeVos's actions led to numerous legal challenges. In one lawsuit, Calvillo Manriquez v. DeVos, DeVos was directed to stop collecting on the debts of former Corinthian students. But the Department kept collecting anyway — violating the court order a staggering 16,000 times. As a result, DeVos was held in contempt of courtand fined $100,000. Astonishingly, after this ruling, the Department announced it found yet another 17,258 borrowers who'd been illegally collected on.

The DeVos Department of Education is a case study in how vulnerable scammed borrowers are to political changes when administrations don't take decisive action to protect them. If the Obama administration had heeded the call of activists and advocates in 2015 and cancelled the debts of scammed students of now-bankrupt for-profit colleges as a group, far more students would have seen relief. Instead, hundreds of thousands wait in debt purgatory.

It is against this backdrop that we must look at Senator Warren's plan to cancel student debt on day one using executive authority. Back in 2014, Warren wrote a letter with 12 other senators calling on the Department of Education to cancel Corinthian students' debt. The letter noted the explicit authority Congress gave the Education Department to cancel student debt, and that "these legal tools … are of little value" unless the regulators "actually use them."

The years since have shown how the failure of regulators to use these very tools has in turn failed tens of thousands of students. Warren appears to have learned the lesson of that era. She is pledging to use the same legal authority that activists and advocates called on the Obama administration to use for Corinthian borrowers. That authority, which is part of the Higher Education Act, gives the education secretary the ability to "compromise, waive, or release" any student loans held by the Department.

The Project on Predatory Student Lending at Harvard Law School detailed this authority in a letter to Senator Warren. The letter argues that Congress has given the Education Secretary a "specific and unrestricted authority to create and to cancel or modify" federal student loans. Sanders and Warren both have debt cancellation plans — but so far only Warren has committed to using immediate executive action to bring student debt relief.

Sanders hasn't weighed in on if or when he would use executive action — if he opts to go through Congress, the likely makeup of the 2021 Senate means debt cancellation may never happen through legislation.

Meanwhile, possible stumbling blocks to Warren's plan to use executive action could come in the form of congressional attempts to block or obstruct her efforts. For example, a Republican-majority Senate could try to block her chosen secretary of education — putting her in the awkward position of relying on an acting secretary to accomplish such a major executive action, something she and others have expressed concern about under Trump. Even so, the use of executive action seems more certain to deliver immediate results without requiring buy-in from the Senate.

For this reason, the rest of the 2020 field would do well to join Warren in a commitment to Day 1 executive action on student debt. It would bring immediate relief to the 5.2 million borrowers in default on their student loans. It would help the debtors putting off having families or delaying buying a home due to excess student debt. But it would also boost the economy for everyone. Moody's Investor Service found that cancelling student debt would have a "tax-cut like boost to the economy." And a Levy Institute report found that wide–scale student debt cancellationcould boost GDP by up to $108 billion per year, and add up to 1.5 million jobs per year, both over a 10-year period.

This issue is as urgent as ever. Once the Senate impeachment trial is over, we will likely see a vote on a resolution that would reverse the damage DeVos did to the Borrower Defense rule. This is crucially important for defrauded students, and senators of both parties will face a choice of standing up for students or siding with DeVos and predatory for-profit colleges. But this is just one small fight in a larger battle. Lawmakers and the next administration will have to decide if they are going to take an incrementalist or transformational approach to the crisis of student lending. All of the candidates should commit to using all tools at their disposal to bring immediate relief to student borrowers — including executive action.

Copyright © Truthout. Reprinted with permission.

Shares