In January 2021, the biblical tale of David and Goliath became a reality of sorts in the high-stakes world of Wall Street.

In this modern rendition, Goliath was Wall Street hedge funds short sellers, while the underdog David was the retail investors seeking revenge on the aforementioned bullies. The tale's conclusion ends on a triumphant note — or a tragic one, depending on how you choose to interpret it — with a short squeeze of the stock of GameStop, the once-failing video game and consumer electronics retailer.

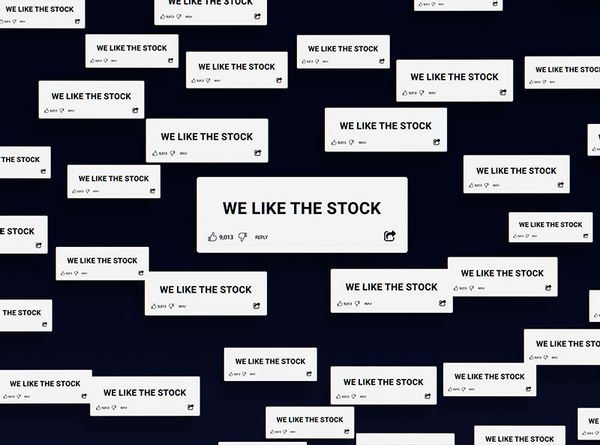

The short squeeze — where investors bet against a particular stock that rapidly increases in price — was fueled by a Reddit forum called r/wallstreetbets. Collectively, the group used a series of app-based brokerage services, most commonly Robinhood, to purchase an influx of shares to cover for the nearly 140% of GameStop's public float — the portion of outstanding stock that is available for trading by public investors — that had been sold short. Their initiatives were in full swing by August 2020 and later, reached its peak in January 2021 after countless business hot shots joined their efforts.

The rare occurrence, now known officially as the GameStop short squeeze, is narrated in Netflix's latest docuseries, "Eat the Rich: The GameStop Saga." Over the course of three episodes, the series spotlights a few Redditors who took part in the epic showdown along with hedge fund managers, finance experts and the journalists who covered the dramatic news.

Here are six of the wildest revelations from the recent series:

Alvan Chow from "Eat the Rich: The GameStop Saga." (Netflix)

Alvan Chow from "Eat the Rich: The GameStop Saga." (Netflix)Many members of WallStreetBets disagreed with Chow. But a handful of individuals also supported his manifesto, especially after they came across a man named Keith Gill — also known as Roaring Kitty on YouTube and u/DeepFuckingValue on Reddit — whose online analyses of the GameStop stock played a large role in the short squeeze.

Joe Fonicello from "Eat the Rich: The GameStop Saga." (Netflix)

Joe Fonicello from "Eat the Rich: The GameStop Saga." (Netflix) Andrew Left from "Eat the Rich: The GameStop Saga." (Netflix)

Andrew Left from "Eat the Rich: The GameStop Saga." (Netflix) Eat the Rich: The GameStop Saga (Netflix)

Eat the Rich: The GameStop Saga (Netflix)In addition to garnering attention on Reddit, the GameStop hoopla became popular on Instagram, YouTube and TikTok. Per Taylor Lorenz, The Washington Post's technology and online culture reporter, the short squeeze was "completely driven by influencer culture."

One such influencer was Matt Kohrs, a retail investor and YouTube "finfluencer" who gained millions of views after he posted livestreams on GameStop's stock. The short squeeze also caught the attention of prominent figures in the business world, including Chamath Palihapitiya, the founder & CEO of Social Capital, who had a reputation of sticking up for retail investors.

"Tell me what to buy tomorrow and if you convince me I'll throw a few 100k's at it to start," he tweeted on January 26, 2021. "Ride or die."

Similarly, Bitcoin investor Cameron Winklevoss also tweeted, "Thinking about going long GameStop $GME. Thoughts?"

The hype was further fueled by Elon Musk, who took to Twitter to simply write, "Gamestonk!!" More people, primarily Musk's fans and followers, began investing in GameStop's stocks.

"I got involved in GameStop straight-up because of Elon, dude," said Chris "Krispy" Ream in the documentary. "Elon posted 'Gamestonk!!.' I was reading all this stuff. I was like, 'Well, Elon's a genius. Gotta jump into this, right?'"

He continued, "My whole plan is to make a TikTok house. I just want to do TikToks all day in a big mansion with pretty girls. That's it."

Even the state of Alaska and The Church of Jesus Christ of Latter-day Saints invested in GameStop shares.

Eat the Rich: The GameStop Saga (Netflix)

Eat the Rich: The GameStop Saga (Netflix) Gunjan Benerji from "Eat the Rich: The GameStop Saga." (Netflix)

Gunjan Benerji from "Eat the Rich: The GameStop Saga." (Netflix)On Jan. 28, Robinhood prohibited users from purchasing GameStop shares, thus causing a frenzy. According to a 2021 CNBC report, following the controversial move, "shares of GameStop initially reversed their gains, sliding quickly into negative territory. The stock, which traded about $500 at one point in premarket trading, closed down 44%."

Retail investors, politicians and finance experts accused Robinhood of market manipulation and claimed that the investing app was wrongfully making money off of people's addiction to trading.

"They have designed their user interface in a way that taps into some of these psychological blind spots to make people trade more," said Dr. Vicki Bogan, professor of economics at Cornell University. "The research indicates that even if you're aware of a blind spot, it doesn't necessarily eliminate its effect on your behavior."

Per Scott Galloway, a podcast host and New York University professor, "Robinhood is similar to a lot of other big tech companies and that is it's based on the attention economy. And that is the more it can get you to trade, the more time it can get you to spend on the app, the more money it makes.

"Robinhood's incentives are not for you to learn, not for you to generate wealth, but for you to engage in a trading activity that historically has resulted in less wealth and less economic security, and that is day-trading."

Many Redditors and conspiracy theorists on Twitter also speculated that Robinhood had made a shady deal with Citadel Securities, a market making firm that was Robinhood's primary customer, and Melvin Capital Management. To add to the mess, Citadel LLC, which is the sister company of Citadel Securities, invested $2.75 billion into Melvin Capital in January 2021.

As a result, a slew of class action lawsuits were filed against Robinhood. But despite the allegations, executives for Robinhood denied claims that Citadel had pressured them into limiting the trading of GameStop. In June 2022, however, the House Committee investigating the GameStop debacle concluded that Robinhood and Citadel Securities were indeed in communication with each other.

"There is a power shift and I think it's important to acknowledge that literally Tiktok and Twitter and Reddit, they've become forums for information and they clearly can move markets," claimed Banerji.

"Eat the Rich: The GameStop Saga" is now available for streaming on Netflix. Watch the trailer below, via YouTube:

Shares